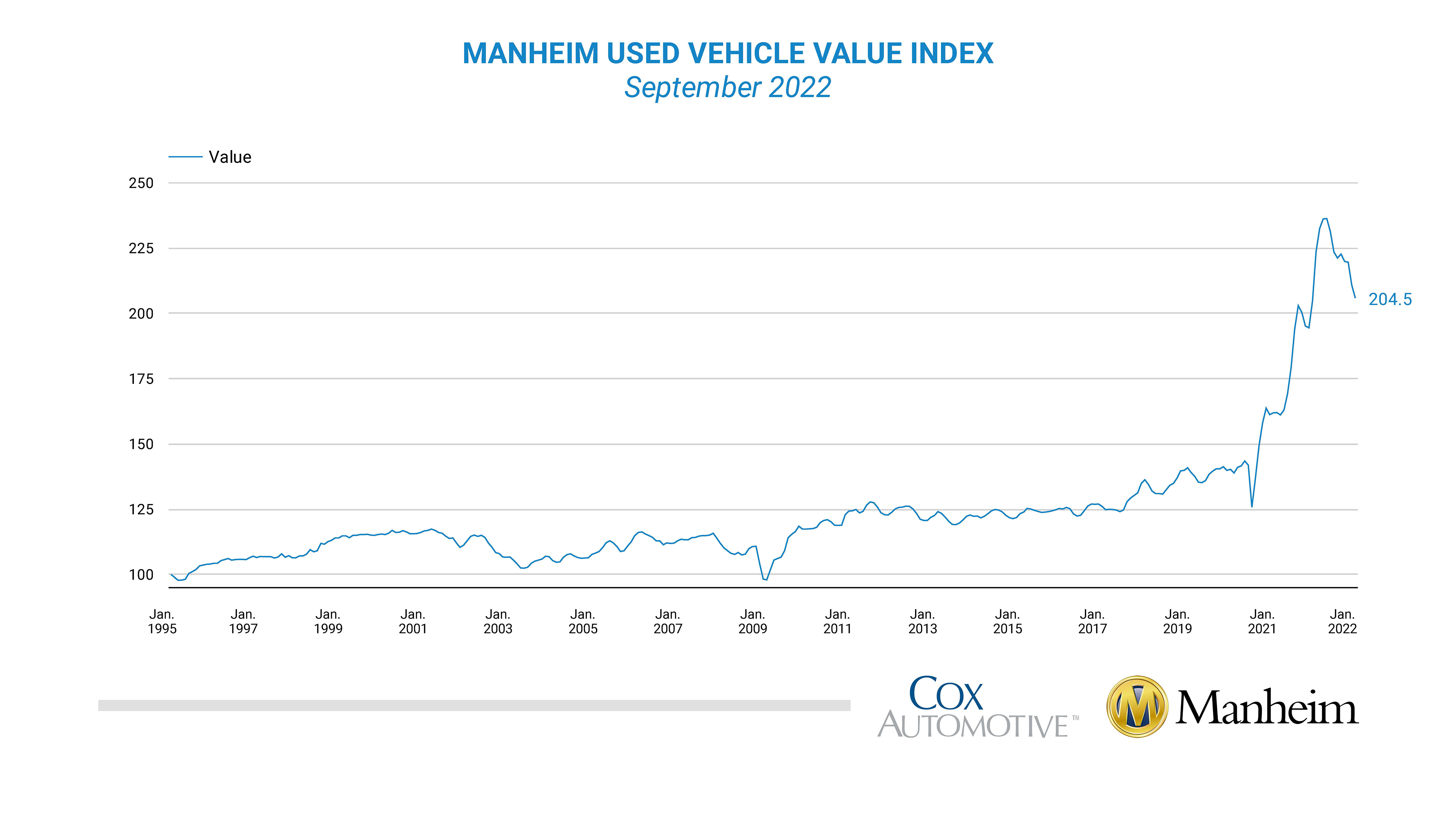

Both the Manheim Used Vehicle Value Index and non-seasonally adjusted prices showed a steep decline year-over-year for the month of September.

Wholesale used-vehicle prices decreased by 3.0% from August to September, bringing the Used Vehicle Value Index to 204.5, a 0.1% decline from last year. The non-adjusted price change declined 2.1% for the month, totaling a 2.3% decrease from a year ago. That makes September the first month since May 2020 that wholesale values declined year-over-year.

“2022 has been the year of giving back some of the big 2021 increases when it comes to wholesale used-vehicle values,” said Cox Automotive Chief Economist Jonathan Smoke.

“2022 has been the year of giving back some of the big 2021 increases when it comes to wholesale used-vehicle values,” said Cox Automotive Chief Economist Jonathan Smoke.

“Vehicles are once again depreciating assets. As we look at the cumulative declines this year, we are down significantly and now expect to finish the year down nearly 14% in December. We haven’t seen declines like this since the onset of the pandemic and the beginning of the Great Recession,” he added.

September saw Manheim Market Report (MMR) values decline at larger-than-normal rates, totaling a 2.5% drop for the month. The daily MMR Retention, which is the average difference in price relative to the current MMR, averaged 98.4%, meaning market prices fell below MMR values.

Only three major market segments saw increases in seasonally adjusted prices year-over-year for September; compact cars, vans, and pickups. Every other segment saw prices well below the industry average. Compared to August, all eight major segments were down.

Chris Frey, Cox Automotive’s Senior Manager of Economic and Industry Insights, said that despite the significant September decreases, he is not expecting any “major declines.”

“Our expectation is that depreciation over the next three months will be slower and lower than what we’ve just seen this past quarter,” said Frey.

The full-year Manheim Used Vehicle Value Index forecast is now likely to finish nearly 14% down year-over-year. The second quarter’s revised forecast showed a potential 6% decline, but a third quarter that showed the largest declines of the year and further forecasted decreases for the remainder of the year prompted the change.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.