According to UBS, the largest vehicle manufacturers in the US are likely to face difficult times in the coming months, as consumers continue to face rising inflation and higher ticket prices.

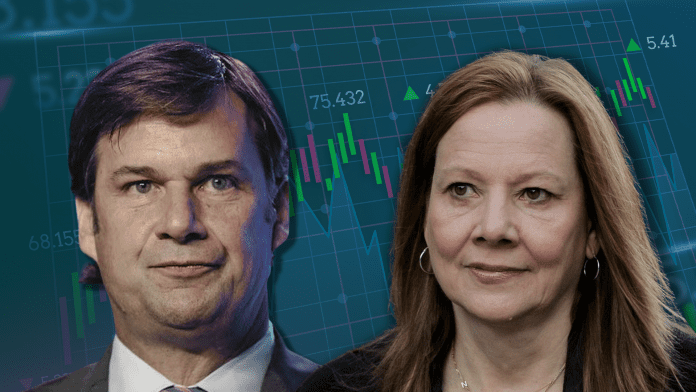

Analyst Patrick Hummel downgraded General Motors from buy to neutral and moved Ford from neutral to sell. Hummel said consumers are looking away from large purchases and the industry will likely face unprecedented oversupply in the next three to six months.

Hummel said manufacturers will lose the pricing power they had during the pandemic when customers were willing to pay above market value due to limited supply and implied this will halve earnings per share for most suppliers.

“We believe this will likely lead to a paradigm shift from under-to oversupply and consequently, a price & mix led drop in margins,” Hummel said of General Motors.

“Despite -40% negative share performance ytd, the rapidly deteriorating top-down picture makes it unlikely that GM’s strong EV story can drive shares higher with a 6-12m view,” Hummel wrote.

UBS cut Ford’s earnings per share estimate by more than half, at 61%, noting the automaker will get closer to just breaking even on free cash flow and earnings before interest and taxes than its competitors.

On a positive note, Hummel said the luxury segment is less likely to feel the effects of higher prices, and that the Inflation Reduction Act could lead to a “breakthrough” year for GM’s electric vehicle line-up, although the analyst noted it is unlikely to make up for shrinking demand elsewhere.

“The overall sector outlook for 2023 is deteriorating fast so that demand destruction seems inevitable at a time when supply is improving,” he said.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.