For battery minerals, the U.S. and Japan have reached trade agreements. The agreement may increase Japanese EVs’ eligibility for U.S. EV tax credits under the Inflation Reduction Act (IRA).

The IRA, which was passed in August 2022, modifies the federal EV tax credit program in the U.S. One of the requirements limits credit eligibility to vehicles made in North America. Whereas additional requirements are based on the sources of essential minerals and battery components.

The legislation mandates that “critical minerals” used in an EV battery be harvested or processed in the U.S. or in a nation with whom the US has a free trade agreement. It also mandates that a minimum percentage of EV battery components be manufactured in North America. Every year, this minimal percentage will rise.

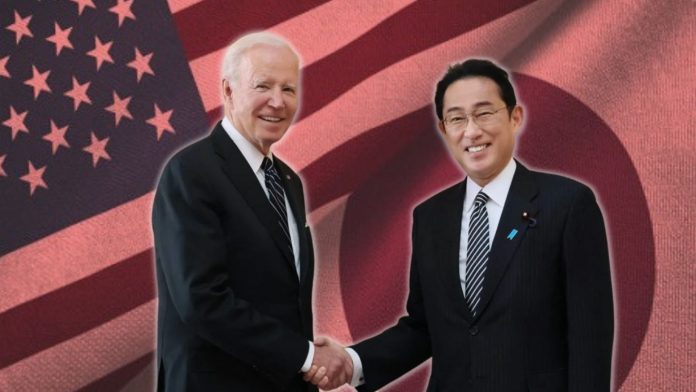

By establishing a limited free trade agreement with the US that covers only the essential minerals for batteries, it appears that Japan has now discovered a different way to get past these requirements, or at least one of them. Katherine Tai, a US trade official, and Koji Tomita, the Japanese ambassador to the US, signed the agreement.

Therefore, the deal reached today may allow Japan to join the group of free trade nations that may extract or refine the essential minerals used in EV batteries.

A comparable agreement is currently being negotiated independently by the US and the EU, but so far, little progress has been made. As the Treasury’s decision-making deadline approaches, we might learn more about it in the upcoming days or weeks.

All of these agreements are subject to the Treasury’s interpretation of the legislation, nevertheless. Any country with which the United States has an active free trade agreement is defined in the bill’s actual text.

Therefore, it is now up to the Treasury to determine whether this new arrangement qualifies as a “free trade agreement” in accordance with its definition.