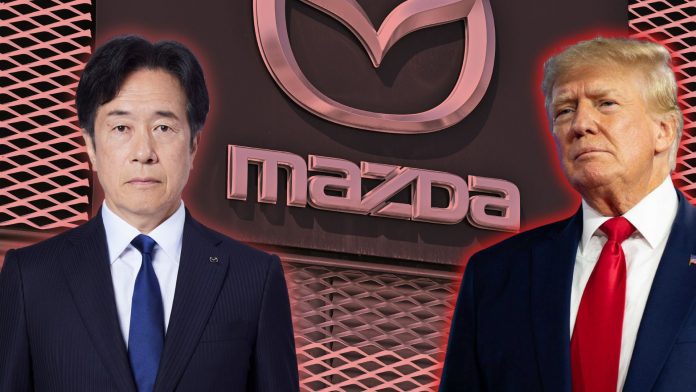

The U.S. market accounts for a third of Mazda’s global sales, driving record-breaking performance for the automaker. Yet, the anticipated shift in political policies has introduced a wave of uncertainty.

The results of the U.S. election could slow the momentum of electric vehicle (EV) adoption, providing Mazda with more time to revamp its lineup. However, this potential reprieve comes with a catch: the looming threat of tariff expansion, which could significantly disrupt the automaker’s finely tuned business strategy.

Mazda’s vulnerability to trade policy changes stems from its heavy reliance on imported vehicles, with 88% of its U.S. sales sourced from factories outside the country. While the Huntsville, Alabama, assembly plant—jointly operated with Toyota—offers some domestic production, its output is limited to the CX-50 crossover. As a result, Mazda must navigate a precarious path, balancing potential tariff expansion with operational adjustments.

Higher tariffs could force Mazda into an impossible position. On one hand, maintaining current prices would erode profits; on the other, raising prices to offset costs might demand increased incentives to sustain sales. Either approach risks cutting deeply into Mazda’s profit margins. With U.S. operations serving as a crucial profit center, any significant disruption could ripple across the company’s global financial stability.

Mazda’s initial goal of a 6% operating profit margin by the fiscal year ending March 2026 now seems optimistic. Faced with economic pressures, the automaker has revised its projection to 4%, reflecting the challenges ahead. Still, the company remains determined, leveraging a temporary spike in incentives to sustain sales through 2024 while preparing for a strong push with new models, including the highly anticipated CX-50 Hybrid.

As Mazda braces for these headwinds, its phased approach to innovation and cautious EV rollout could be key assets. By focusing on hybrid and internal combustion technologies alongside EVs, the company is positioning itself to remain flexible amid economic uncertainties while pursuing long-term growth.