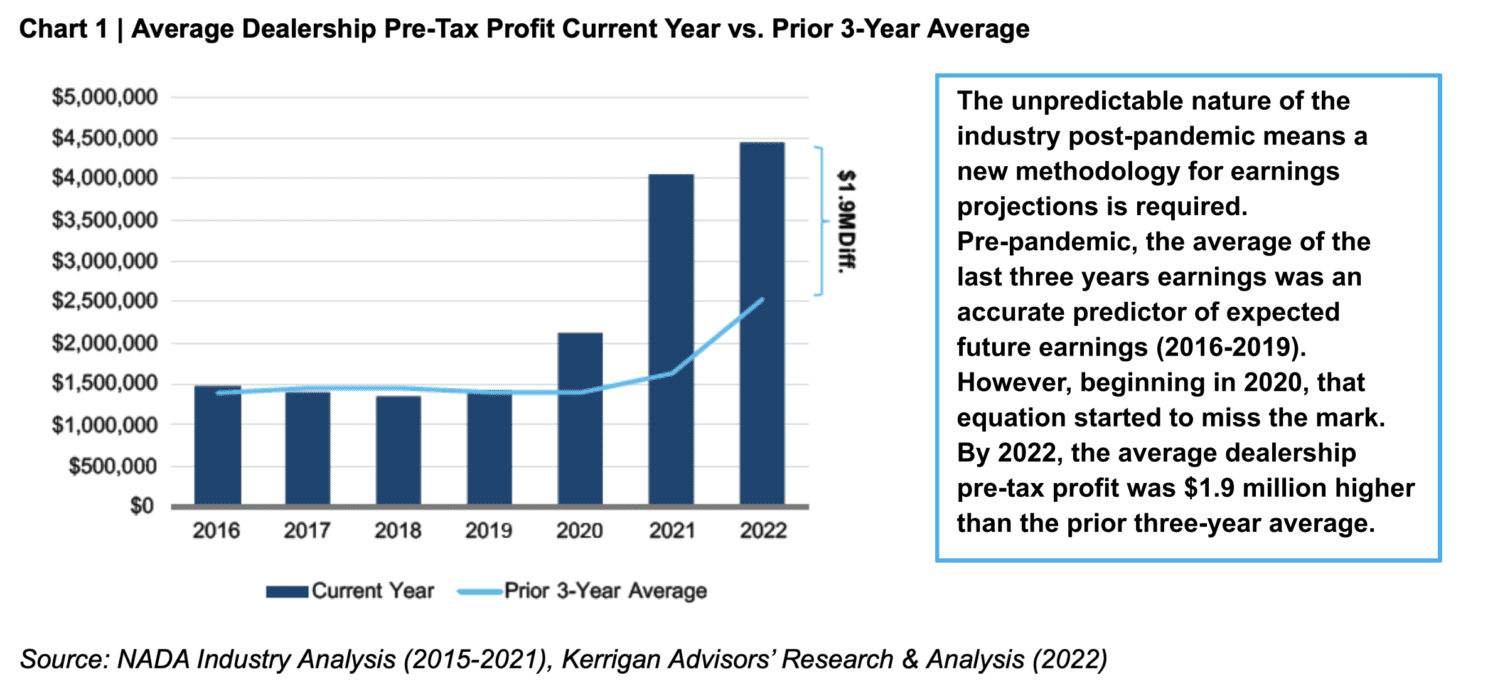

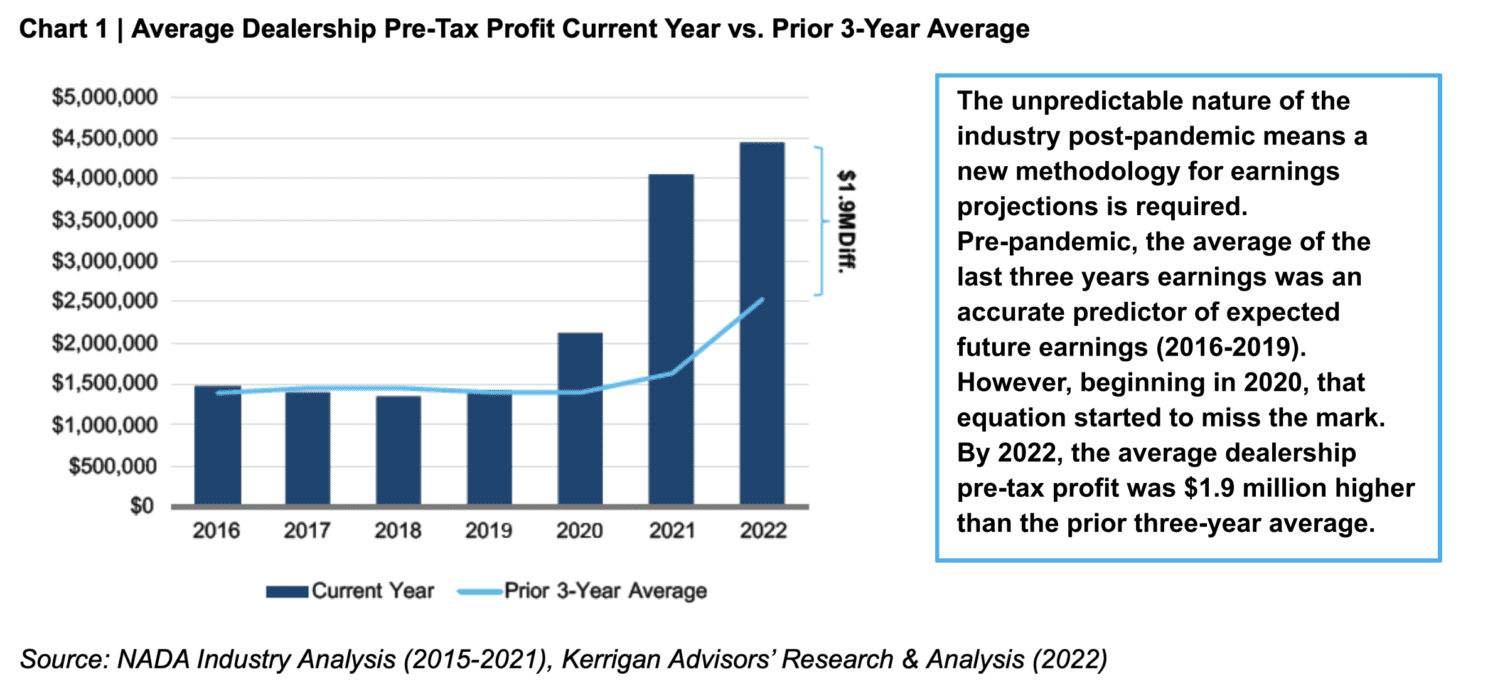

Auto retailers have commonly averaged the last three years of earnings to estimate expected future profitability. This methodology proved to be an effective predictor of future earnings for the years leading up to the pandemic (see Chart 1). However, beginning in 2020, when earnings commenced their hockey stick progression, the calculus for projecting future earnings based on the last three years of profits started to miss the mark. Buyers and sellers have since struggled to assess future earnings given the seemingly unpredictable nature of the industry post-pandemic. It appears that the past is no longer prologue, and a new methodology for earnings projections is required.

In response to the challenge of projecting future profits, some of the public buyers, particularly Lithia, began pricing blue sky based on a percentage of revenue, rather than a multiple of profits. By valuing franchises on revenue rather than earnings, buyers are effectively estimating their purchase price assuming their own projected profit margin on current revenue, rather than relying on the seller’s historical profit performance. This approach ignores the seller’s prior earnings and determines valuation based on a projected profit margin on acquired revenue.

“We continue to successfully target…investments of 15% to 30% of revenues.” - Bryan DeBoer, President & CEO, Lithia & Driveway, Second Quarter 2021 Earnings Call

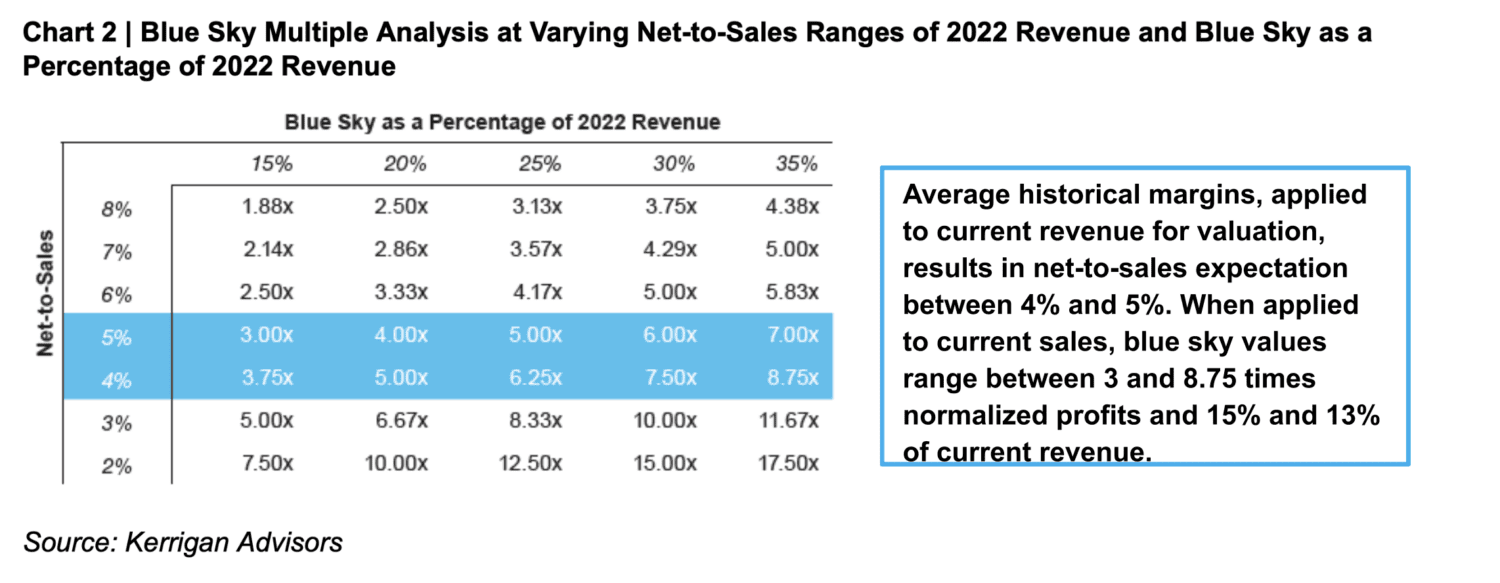

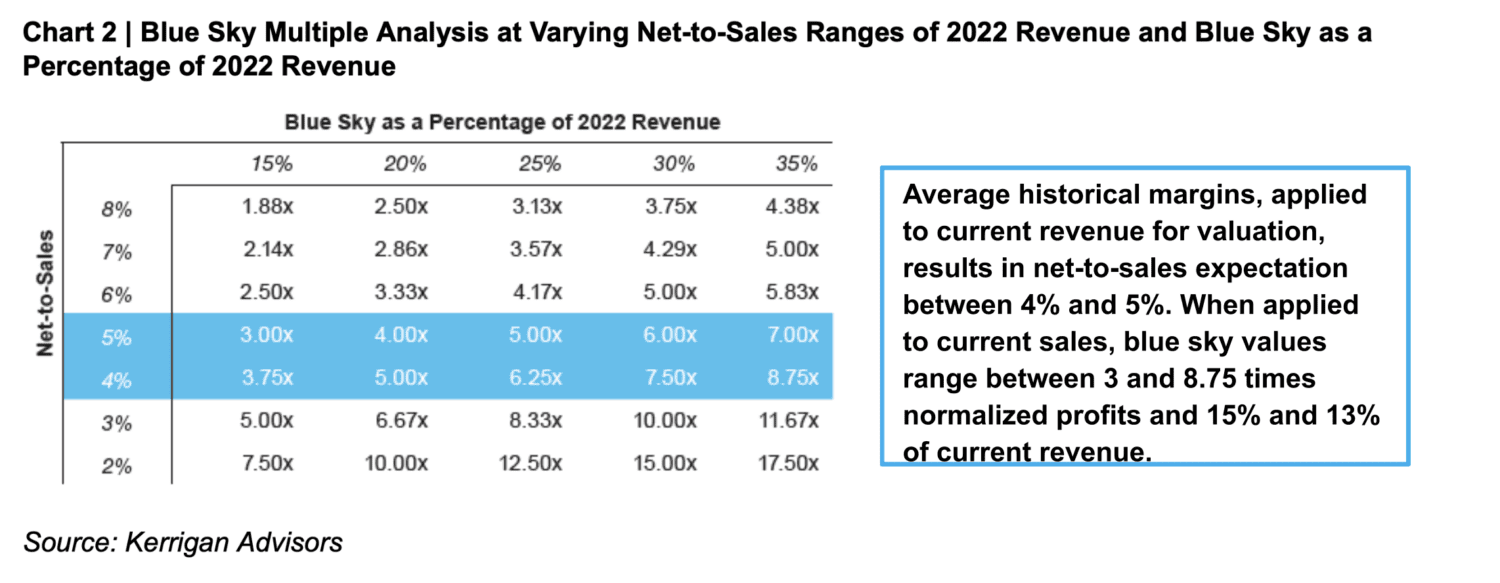

Today, Kerrigan Advisors finds most buyers are eschewing historical earnings in determining blue sky value. As an alternative, many are beginning to project future profits based on their expectations for future profit margins, assuming front-end gross margins normalize at levels higher than the pre-pandemic period but lower than the most recent years, while some operating efficiencies achieved over the last three years are retained. In so doing, these dealers are often averaging historical margins, rather than historical profits, and then applying that margin to current revenue to project normalized profits for valuation purposes. This methodology often results in a normalized net-to-sales expectation of between 4% and 5%. When applying those margins to current sales, blue sky values range between 3 and 8.75 times of normalized profits and between 15% and 35% of current revenue. These valuation metrics are consistent with the 2022 and 2023 transaction pricing Kerrigan Advisors has observed in the buy/sell marketplace (see Chart 2).

“Our patient, disciplined and consistent approach towards acquisitions continues to generate massive value by maintaining our multi-decade long valuation methodology of 3 times to 7 times normalized environment earnings levels.” - Bryan DeBoer, President & CEO, Lithia & Driveway. Fourth Quarter 2022 Earnings Call

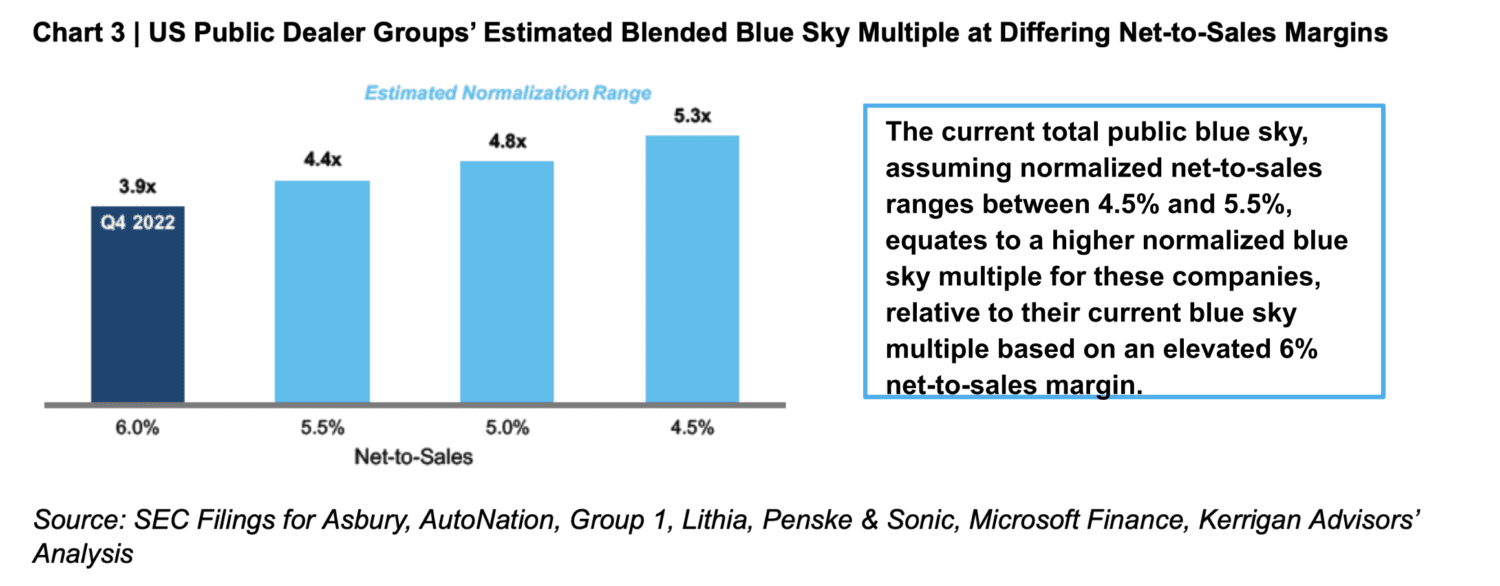

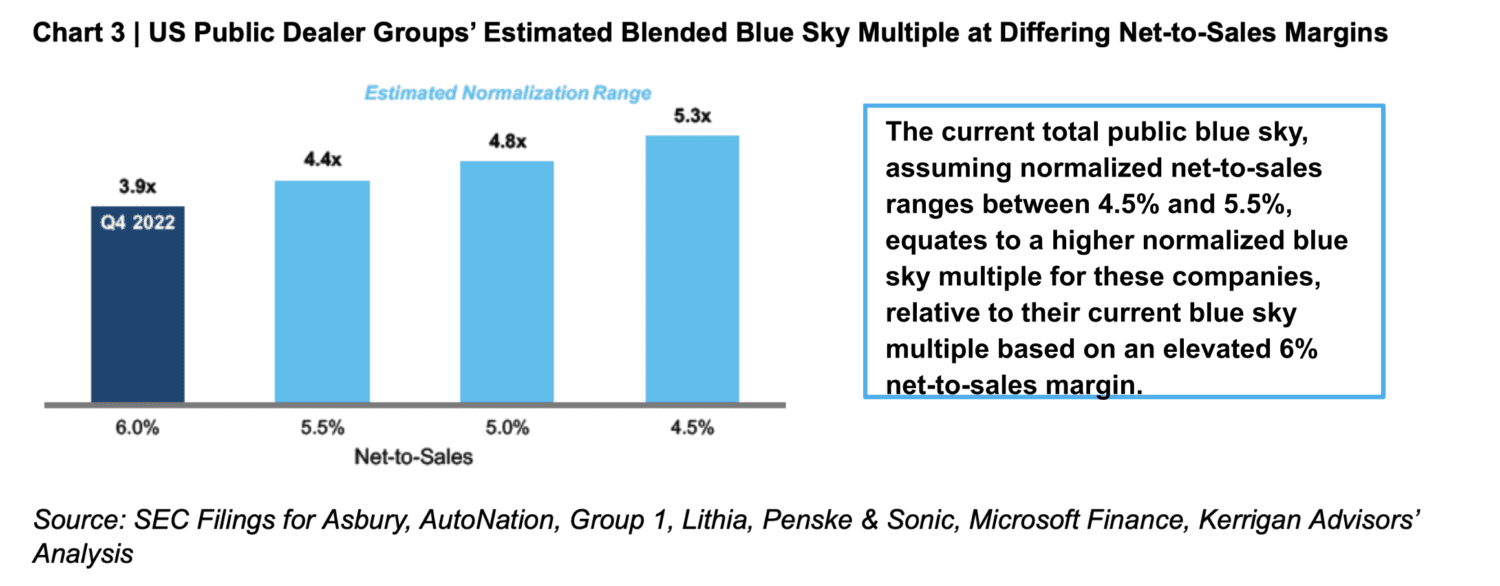

This approach of applying normalized profit margins to current revenue to determine expected future profits and ultimately blue sky is consistent with how Wall Street appears to be valuing the public companies (see Chart 3). Assuming lower net-to-sales levels of between 4.5% and 5.5% on current revenue, the publics are trading at blue sky multiples consistent with their historical blue sky multiple average.

As with everything since the pandemic, the valuation model for blue sky will continue to evolve as profits normalize at lower levels in the coming quarters. Kerrigan Advisors believes until the average of the last three years of earnings reflects the expectation for the next three years of profits, buyers will apply their own assumptions on normalized profit margins to expected future sales to determine the blue sky price they are willing to pay. How long this method lasts will be determined by how long it takes for earnings to become more consistent from year to year, whether that is on the way up or on the way down.