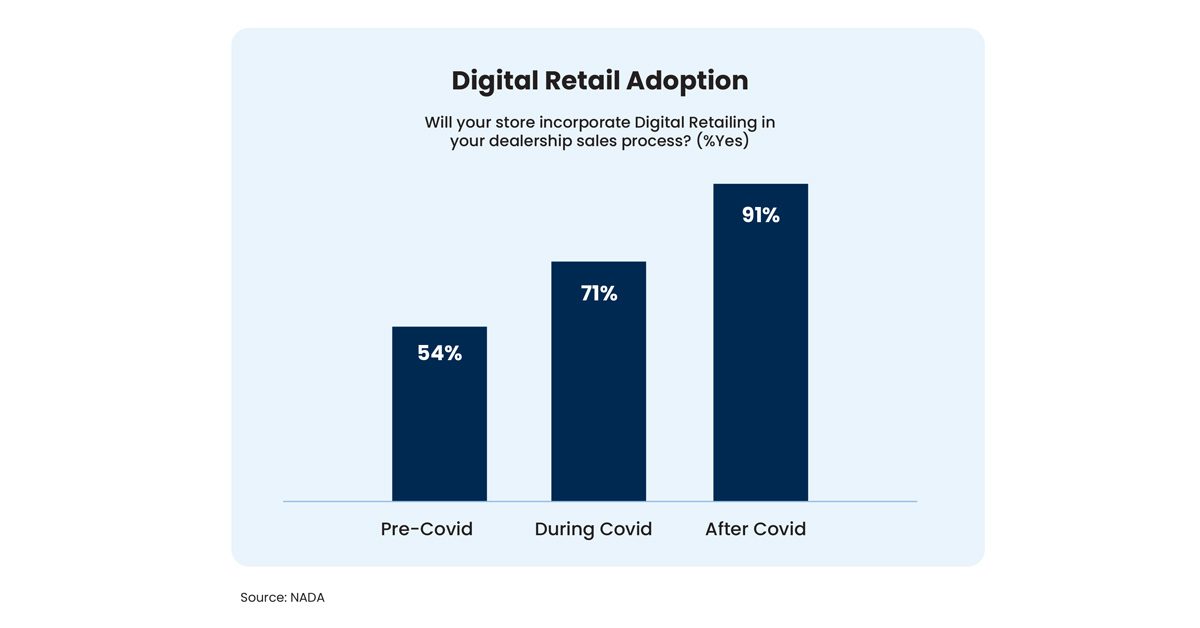

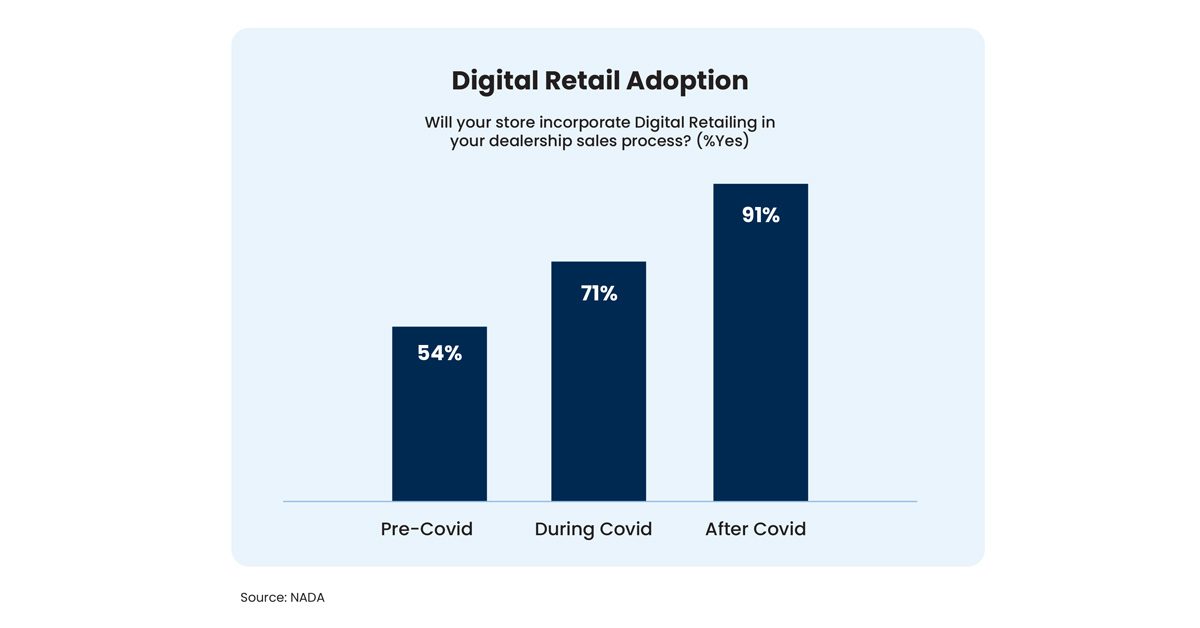

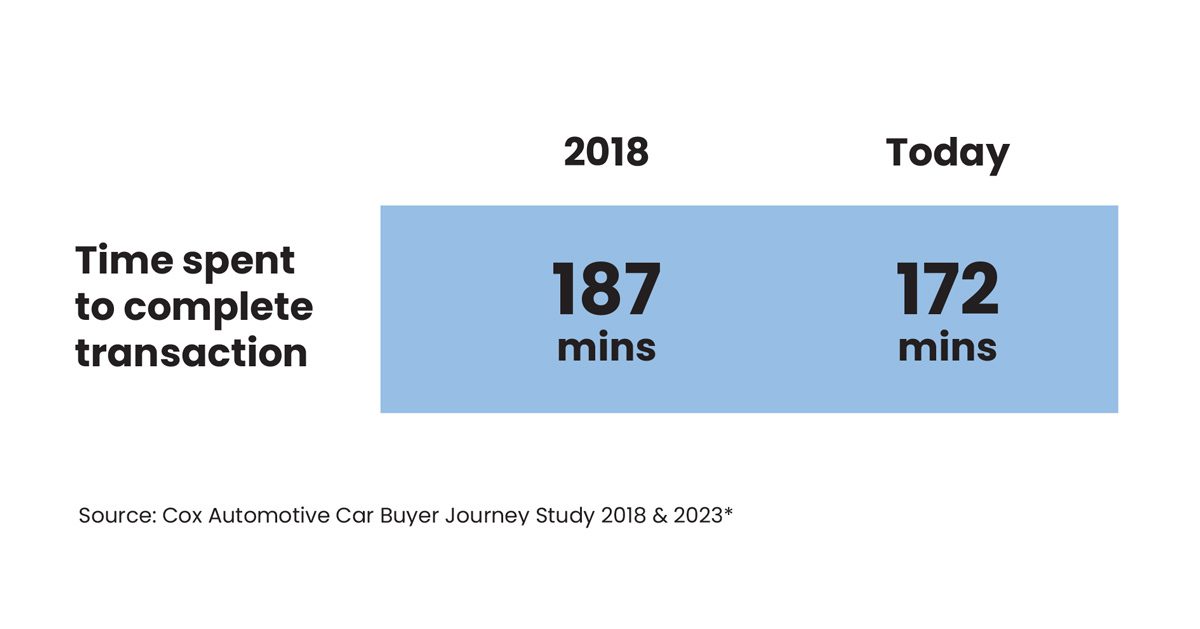

Over the past decade, dealers have invested significantly in technology to support and strengthen their sales process. Digital retailing in particular has grown in popularity. According to a Dealer survey, only 54% of dealers used digital retailing solutions prior to COVID. But 90% of dealers incorporate digital retailing in their shopping experience post-COVID.

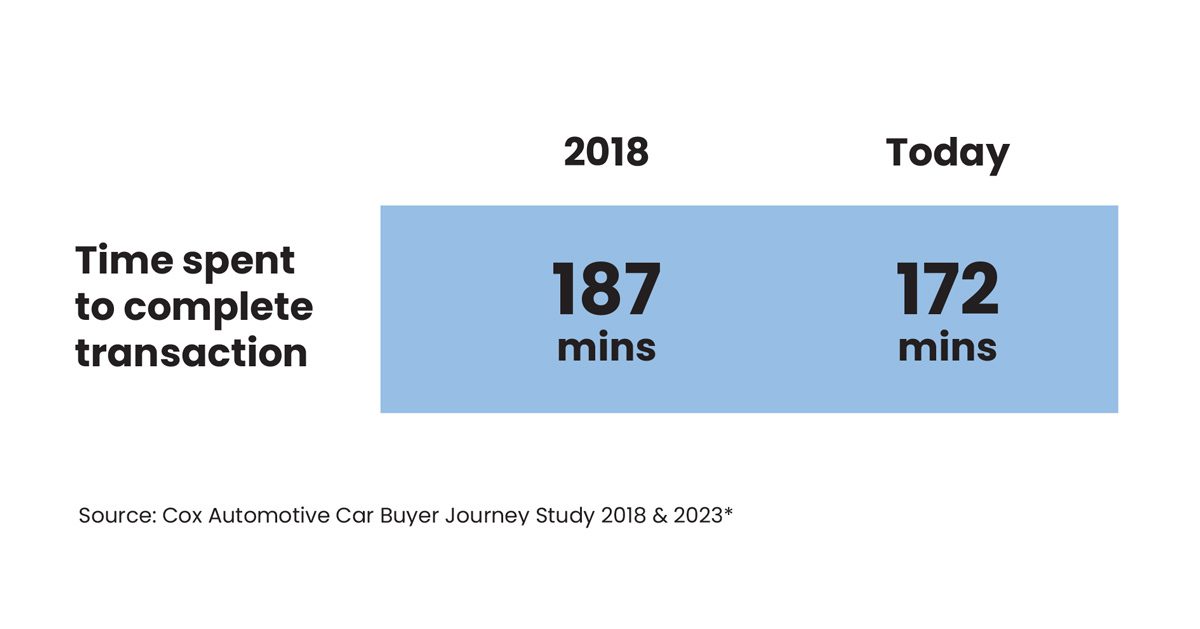

Despite mass adoption of digital retailing and other technology by dealers, the car buying process is still time-consuming and inefficient. A recent survey showed it still takes nearly 3 hours to buy a car, a 15 min improvement in 5 years. And the average salesperson sells only 9 new vehicles per month, which has remained unchanged over the years.

Why does this matter? According to a January 2025 study from McKinsey, for the average US dealership, every 1 percent rise in sales productivity is worth about $500,000 in revenue.

The promise of technology as a way to add efficiency to the process has yet to be realized. In part, because our focus has been largely on putting a widget on the dealer’s website, instead of using technology to power our people and process in the showroom. In working with dealers nationwide, we found that there are long-standing problems that still plague the sales process. This includes:

A chaotic negotiation

On a busy Saturday, it takes over 15+ minutes to get a first pencil out to a customer. And most salespeople don’t have the autonomy to work the deal, so they go back and forth to the desk throughout the process. This back and forth causes customers to psychologically talk themselves out of the deal. And puts our salespeople in a desperate mode to save them.

The trust gap persists

The trust gap between customers and dealerships still remains. Customers come in skeptical, with a chip on their shoulder from their previous experiences. And the perceived games and lack of transparency in the buying experience only widen the trust gap.

A new generation of salespeople (and customers)

The sales process has not evolved for the next generation. Gen Z salespeople are digital natives and we are sending them into the negotiation with outdated processes foreign to them, or the Gen Z customer for that matter.

Lender approval is more challenging than ever

Getting challenged customers approved is increasingly complicated. Higher interest rates, plus stricter and ever-changing lender policies make it difficult for managers to efficiently choose the right lenders that maximize approval and profit. In fact, turn downs have increased by 19% over the last 5 years.

The Solution: A Technology Guided Sales Experience

Top dealers lean in on technology to offer a guided sales process (online and in the showroom) that builds trust with customers, adds consistency to the sales process, and fast-tracks the deal to F&I.

4 opportunities to use technology to strengthen the sales process

Tackle affordability and land the customer on the right Deal

One of the most common delays in the process is a mismatch between customer expectations and what can get approved. If customers aren’t aware of their financing options or realistic monthly payments, the negotiation can turn into a battle. To avoid this, top dealers tackle affordability earlier in the process. This includes enabling customers to pre-qualify through a soft pull which helps the customer to understand their budget and interest rate.

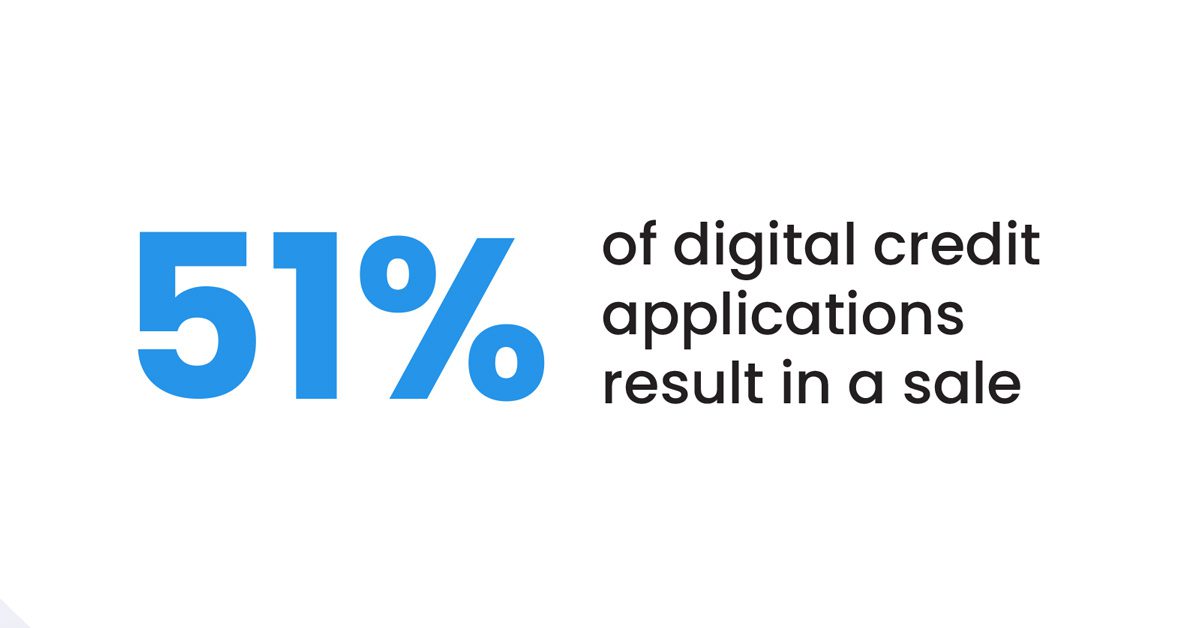

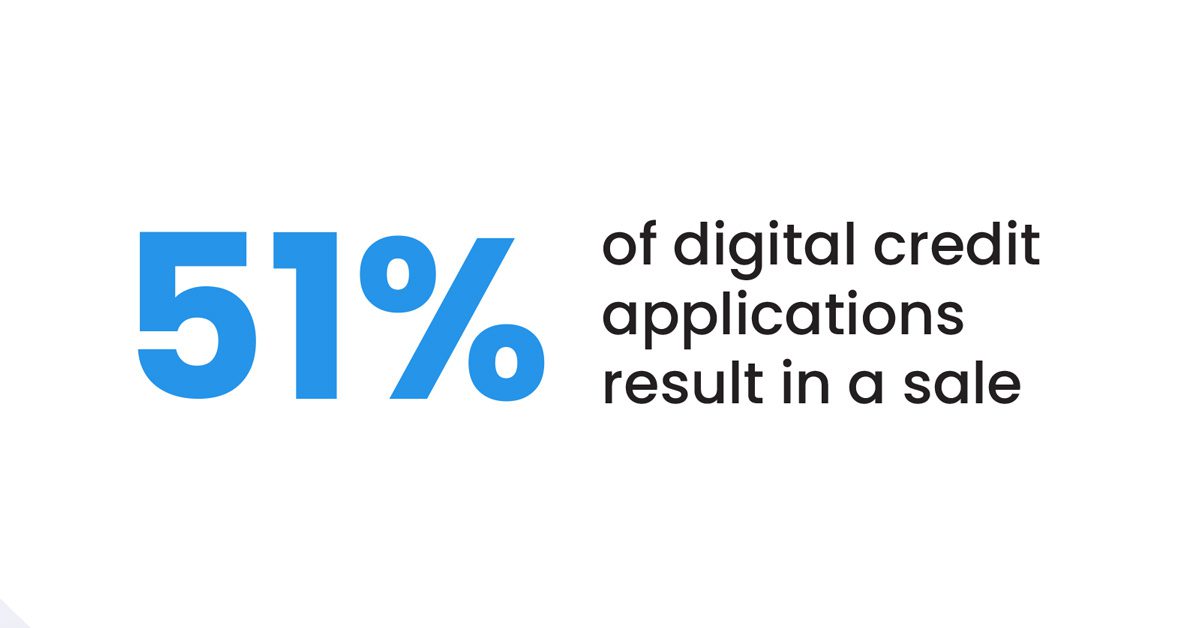

Another opportunity is to encourage customers to get approved by filling out a credit app online or earlier in the sales process with their salesperson. Lender approval is often the equivalent to buying the car for many customers, particularly with affordability being a major detractor. In fact, 51% of customers who fill out a credit app go on to purchase a vehicle.

Empower your team to fast-track the deal to F&I

Top dealers arm their salespeople with technology to streamline the negotiation. That includes presenting numbers in a collaborative experience with the customer, without the back and forth to the desk. It also offers management the guardrails and alerts that enable them to monitor and intervene when necessary. Alternatively, online customers can experience a self-guided shopping experience on the dealer’s website that enables them to shop on their terms, with dealer controls over pricing and markups.

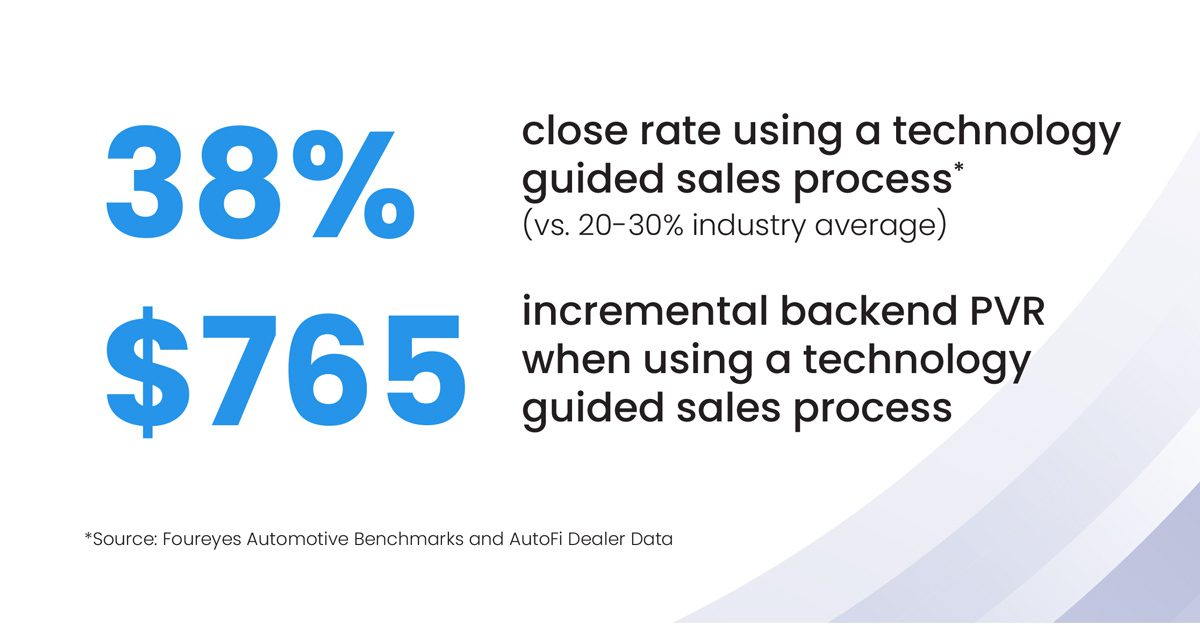

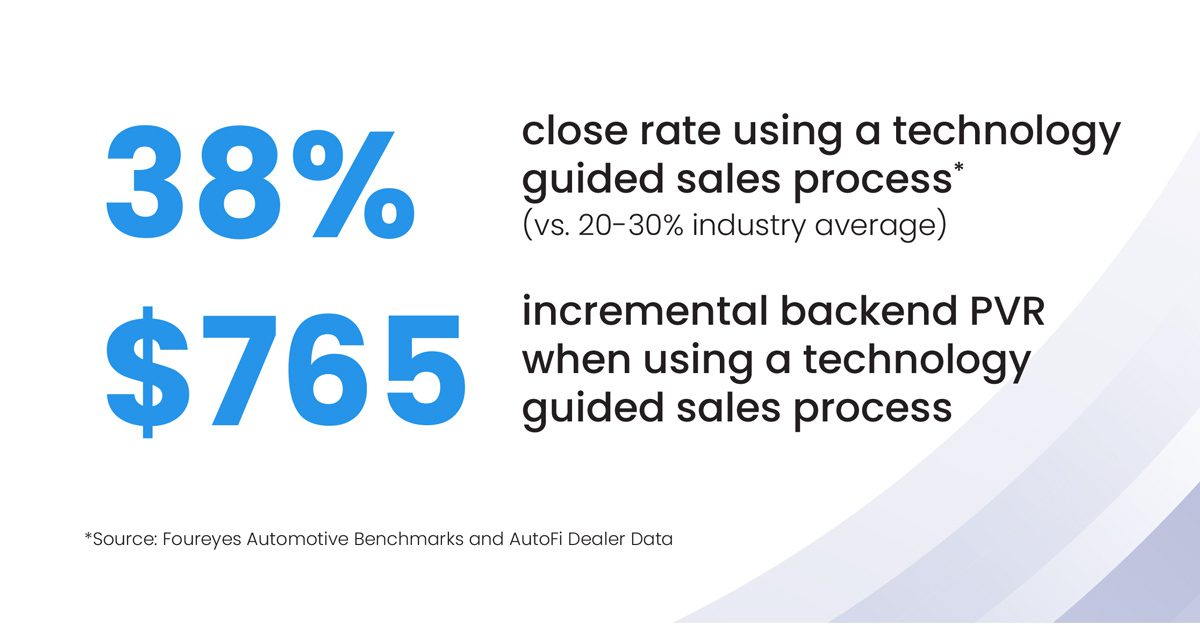

Technology puts the customer at ease and makes them more likely to say YES quickly with less negotiation. Dealers that embrace this see close rates that are 1.5 to 2X higher than average, deals locked in an average of 34 mins (first pencil to lender approval), and $765 incremental back-end PVR per deal.

Level up the new generation

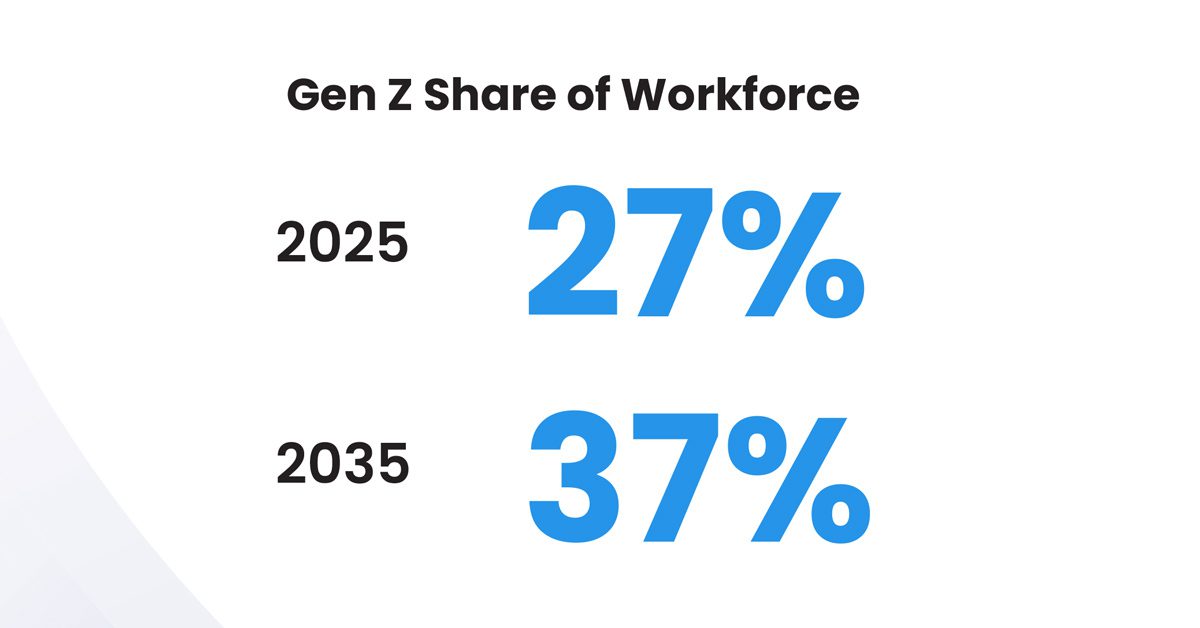

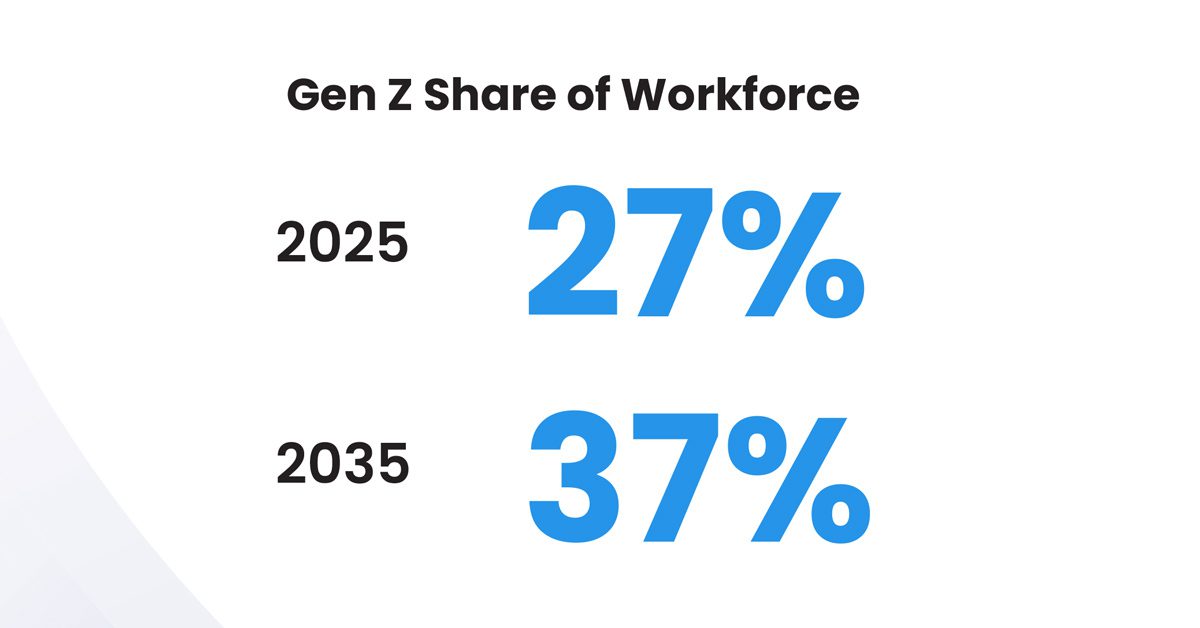

Gen Z is here and the sales process must evolve to adapt to them. They are digital natives and by the end of 2025 will be 27% of the workforce and 37% by 2035. The slow, antiquated sales processes at many dealerships are foreign to this younger generation.

Technology allows dealers to empower them to sell more effectively through a guided sales process. We see that top dealers that incorporate this can not only ramp up Gen Z and green pea salespeople faster but cast a wider net on the talent they can recruit and improve employee retention.

Optimize Lender Decisions to get more approvals

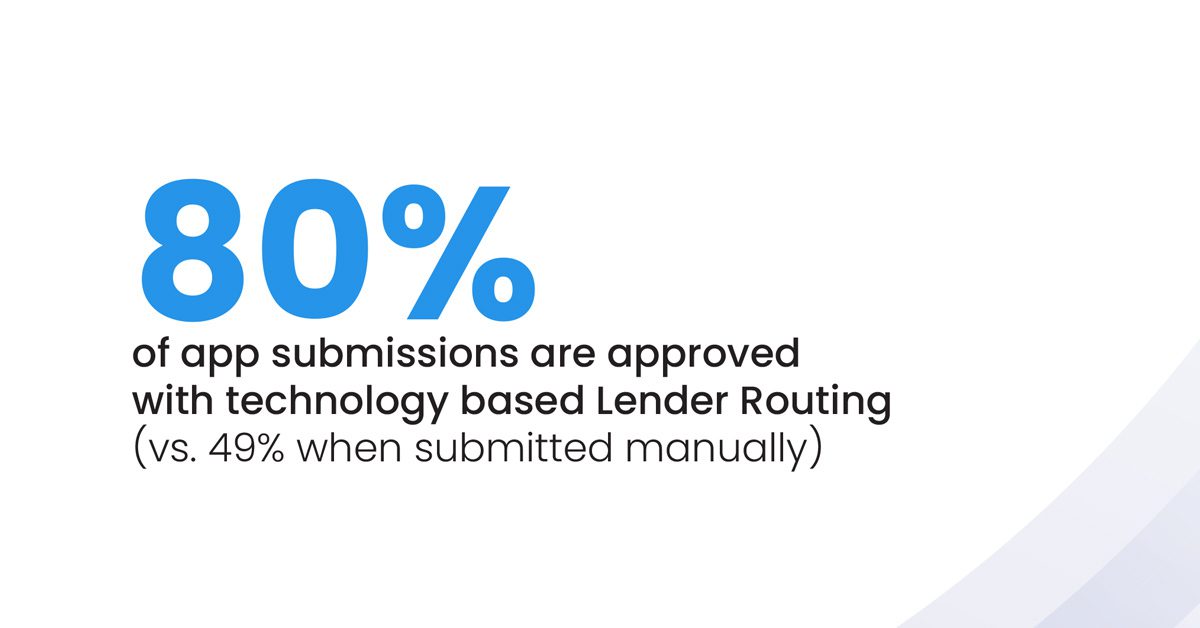

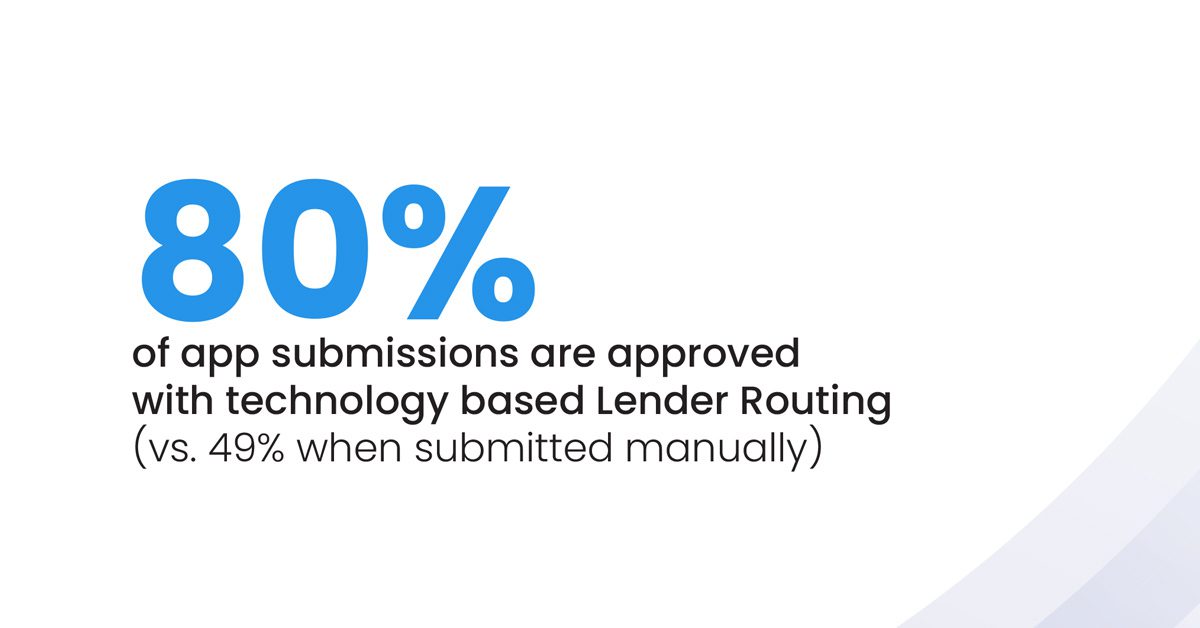

Sales Managers make countless decisions throughout the day, including lender selection. Technology removes guesswork by automating and optimizing this process—just as Google Maps helps drivers navigate without replacing them.

Instead of relying on intuition, technology factors in real-time lender policies, approval trends, and dealer preferences to suggest the best lenders. The result? Higher approval rates—80% with intelligent, tech, and data-driven lender routing vs. 49% with manual submissions. Technology doesn’t replace managers; it empowers them to work smarter.

The next frontier is here

Whether interacting with website shoppers or showroom ups, dealers that lean into technology to offer a guided sales experience (or self-guided experience) are going to be the winners in this competitive landscape.

Learn more at www.AutoFi.com