In my three recent articles, “From the Fax Machine, to the Future: Auto Finance Disruption Time is Here,” “Digital Finance: Consumer Expectations and Today’s Digital Retail Reality,” and “Automotive Finance: The Adverse Impact of Declining Transparency,” I leveraged data from recent surveys of auto lenders and dealers to discuss the barriers to achieving the next generation of automotive finance. This included how inaccurate online payment quotes are generating alarming disconnects between quotes and fundable contract terms, and the adverse impact of declining lender transparency on the car buying experience.

Today, I want to conclude the series by focusing on core causes of the disconnect between the sales and finance process. I will also discuss the role that new lender AI-based loan decisions play, and how to bridge the gap between dealer and lender technologies with an API roadmap. One that connects, rather than disconnects, the flow of information to the mutual benefit of the customer, the dealer and the lender.

The End of Rate-Sheet Pricing Bulletins

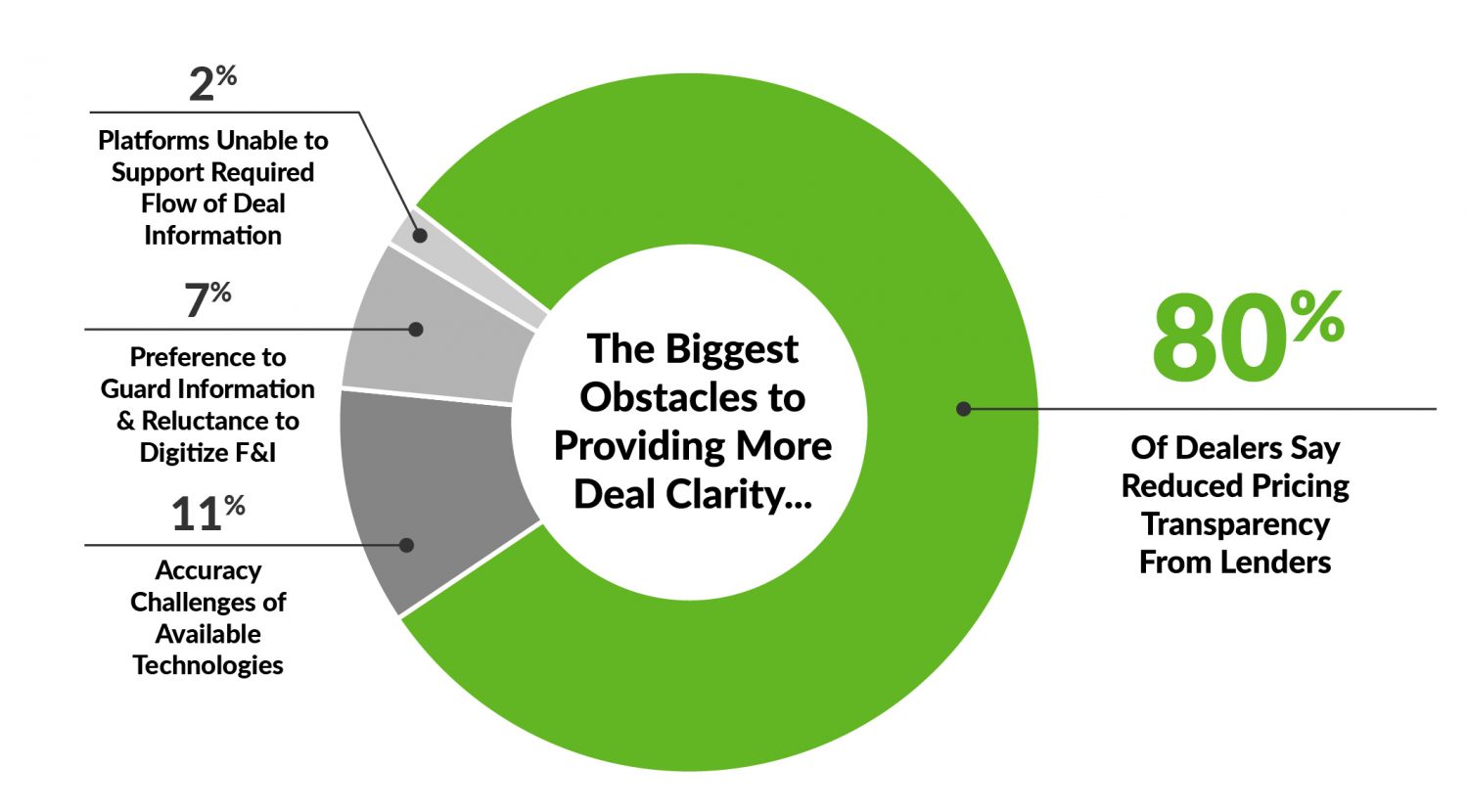

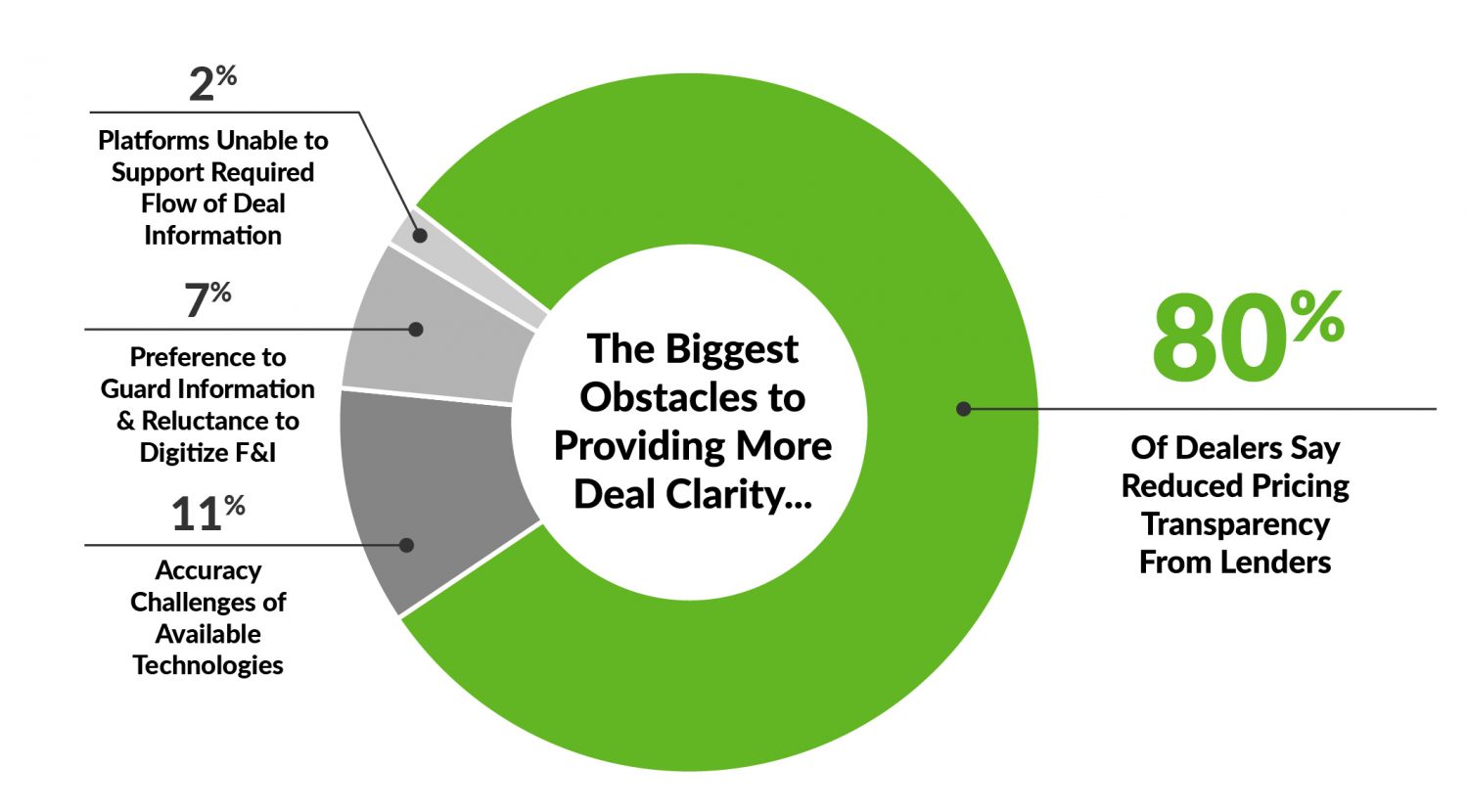

At the core of today’s auto finance disconnects and inaccurate payment quotes is a dramatic reduction in lender pricing transparency with 80% of dealers saying it is the biggest obstacle to providing more deal clarity. And this relates directly to a significant reduction in lenders providing standard rate-sheet pricing bulletins.

In fact, one of the most striking pieces of data from our dealer and lender survey was their near unanimous consensus – dealers ((89%)/lenders (83%) – about the decline in this much-needed information. Especially as it is the very thing that dealers rely on to estimate the customer’s payment. Why the reduction? Because most major auto lenders have moved away from publishing standard rate sheet bulletins that put consumers into credit tier buckets, and loan pricing, based solely on their credit scores. Lenders are now using AI-based dynamic pricing down to the individual customer qualifications level.

AI-based Pricing and Inaccurate Payment Quotes

AI-based loan decisioning is absent from, and therefore contributing to, inaccurate online payment quotes agree lenders (85%) and dealers (91%). This seems counter intuitive given the depth of information in AI-based pricing. As an example: AI-based loan pricing might be driven by a combination of attributes such as credit score plus length of credit history, high credit, % of revolving utilization, debt and payment to-income ratios, stability factors etc. with AI-based lender underwriting guidelines possibly adjusting loan pricing based on year of vehicle, term, front and back -end advance, loan to value, mileage plus a limitless number of attributes in their proprietary AI-based black box loan decision engines.

While these AI algorithms optimize portfolio performance for lenders, they miss a key factor in the car sales/financing process: the important ‘on-the-ground’ information that results from front-end deal negotiation conversations between customer and dealer. And the timing is backwards: AI-based loan pre-qualification pricing needs to come into play at the front of the sales process with the price quote, not at the end, at which point the customer believes that shiny new car is his/hers to drive away. A deal rewrite will invariably result, ejecting that customer from that driver’s seat as suddenly, if far less glamorously, as James Bond from his Aston Martin.

Key to a Happy Auto Finance Marriage? Dealer and Lender Together at the Beginning

To prevent this indignity repeating over and over again, with severe impact to CSI and profitability, the dealer and lender must be together, hand in hand (along with that AI-based pricing), happily married, at the beginning of the sales process, rather than divorced at the end. And it can happen – through new APIs and integration that bring customer qualified payment terms forward.

And don’t just listen to me: the majority of dealers and lenders agree that pre-desking technology, integrated with lender proprietary credit scorecard models, would improve the car buying/selling experience for all parties.

Lenders realize that finance needs to move to the front of the sales process, and some are making moves in this direction on automotive portals. But, they are still working around the dealer, offering payment quotes that are essentially hypothetical, because they don’t take into account the on-the-ground information gathered from the customer/dealer sales negotiation process. Entities have tried many times to connect the customer and lender together without that information and have failed. There is no reason to believe it will work now!

A Solution

Let’s stop the madness and stop letting customers self-desk their own deals online. Instead, let’s create a buying experience and workflows that integrate the lenders’ proprietary AI-based pricing decisions into the front of the dealership’s vehicle sales process, and that include dealer/customer information.

The technology to facilitate this exists: new API’s between dealer and lender software systems, that function as middleware, and enable shoppers to be introduced to realistic lender qualified payment terms at the front of the sales process. This middleware comprises pre-desking solutions that tie the customer’s credit application, credit report data, vehicle of choice and deal structure to a waterfall of lender qualified payment terms through API’s. The end result: The right customer in the right vehicle with the right deal structure matched to lender fundable contract terms prior to the customer’s transition to F&I.

In conclusion, the time has come for our industry to come together to transform modern automotive finance into a digital end-to-end buying experience that bridges the gap between ‘shopping’ and ‘contracting,’ at last elevating digital retailing from a lead generation to deal generation model. Because who doesn’t want a better customer buying experiences, and more efficient sales and finance workflows that sell more cars in less time at higher profits?

This series of articles provides indisputable evidence, directly from dealer/lender survey data, that an auto finance revolution is on the cusp of happening. And it must. But it is going to take a big village to bust out of the status quo. Creating the “Next Generation of Auto Finance” will require collaboration amongst industry leaders in the sales and finance software eco-system.

Become a part of “The Next Generation of Auto Finance”.

Contact Pete MacInnis at pete@elendsolutions.com

Pete MacInnis, founder and CEO of eLEND Solutions

Pete brings 40+ years of experience in automotive finance and technology as Founder and CEO of eLEND Solutions™, an automotive FinTech company providing a middleware solution designed to power transactional buying experiences – online and in-store. The platform specializes in hybrid credit, identity verification, and ‘pre-desking’ solutions, accelerating end-to-end purchase experiences – helping dealers sell more cars! Faster!