With interest rates continuing to stay high, the analysts at Edmunds.com conducted an in-depth review of transaction and finance data across all 50 states. On today’s show, CBT’s Jim Fitzpatrick speaks to Ivan Drury, Senior Manager, Strategic Analytics to get a sense of how consumers are adapting to this changing environment.

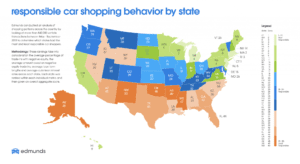

So, what exactly is car shopping responsibility? According to Edmunds.com, the transaction data that stood out was the rate of negative equity among consumers. The share of trade-ins that have negative equity needed to be segmented by state for analysis. The APRs that are being paid, indicate whether consumers have done their research and they got a good deal overall. All of this things together create an understanding of what a responsible car buying journey is.

The motivation for this study began by looking at where are people right now, and how their situation will change going forward? How will an entity like Edmunds.com advise people to make better deals in the future?

Well, it turns out that income and education levels were not nearly as important contributing factors when it comes to how well each state performed. It ultimately came down to shopper mentality during car shopping. The states that performed well, had a lot of research on financial calculators, whereas states that did not perform as well had all the flash and glamour, but not the financial substance.

With interests rates on the uptick and negative equity at record high levels, you don’t want consumers to be in a bad situation forever. You have to realize what your financial situation is and work within those means. Trade-in value might not be as high as what you think it is.

Extended terms last longer than the car ownership experience and it certainly plays into the cause of this negative equity. During the examination of all the different metrics for each state, the factors that comprise consumer responsibility were ranked, and a regional trend was not identified.