In early March, the U.S. auto market showed signs of optimism despite ongoing consumer concerns. Sales of new vehicles surged, buoyed by the influx of tax refunds and annual bonuses, while rising inventory levels provided consumers with ample choices. This combination of factors, however, comes against a backdrop of falling consumer confidence due to economic uncertainty.

As of February 21, 28% of tax refunds had been issued, totaling $102.25 billion, marking a 10% increase from the previous year. The average refund amount rose by 7% year-over-year to $3,453, giving consumers a significant cash boost. In addition, annual bonuses also contributed to a higher purchasing power for new-vehicle buyers. However, despite these financial boosts, consumer confidence dipped in February. This drop was primarily due to political tensions, looming tariffs, and rising prices, which pushed vehicle purchase plans to their lowest point since the same period last year.

Despite these challenges, February turned out to be a strong month for new-vehicle sales. According to vAuto Live Market View data, the 30-day sales pace for new vehicles rose by 13.6% compared to January and saw a 5.9% year-over-year increase. At the beginning of March, the U.S. had 2.99 million unsold new vehicles available, reflecting a 2.2% increase from February and a 12.8% rise from the previous year. This increase in inventory helped dealers maintain market confidence and provided consumers with more options in the showroom.

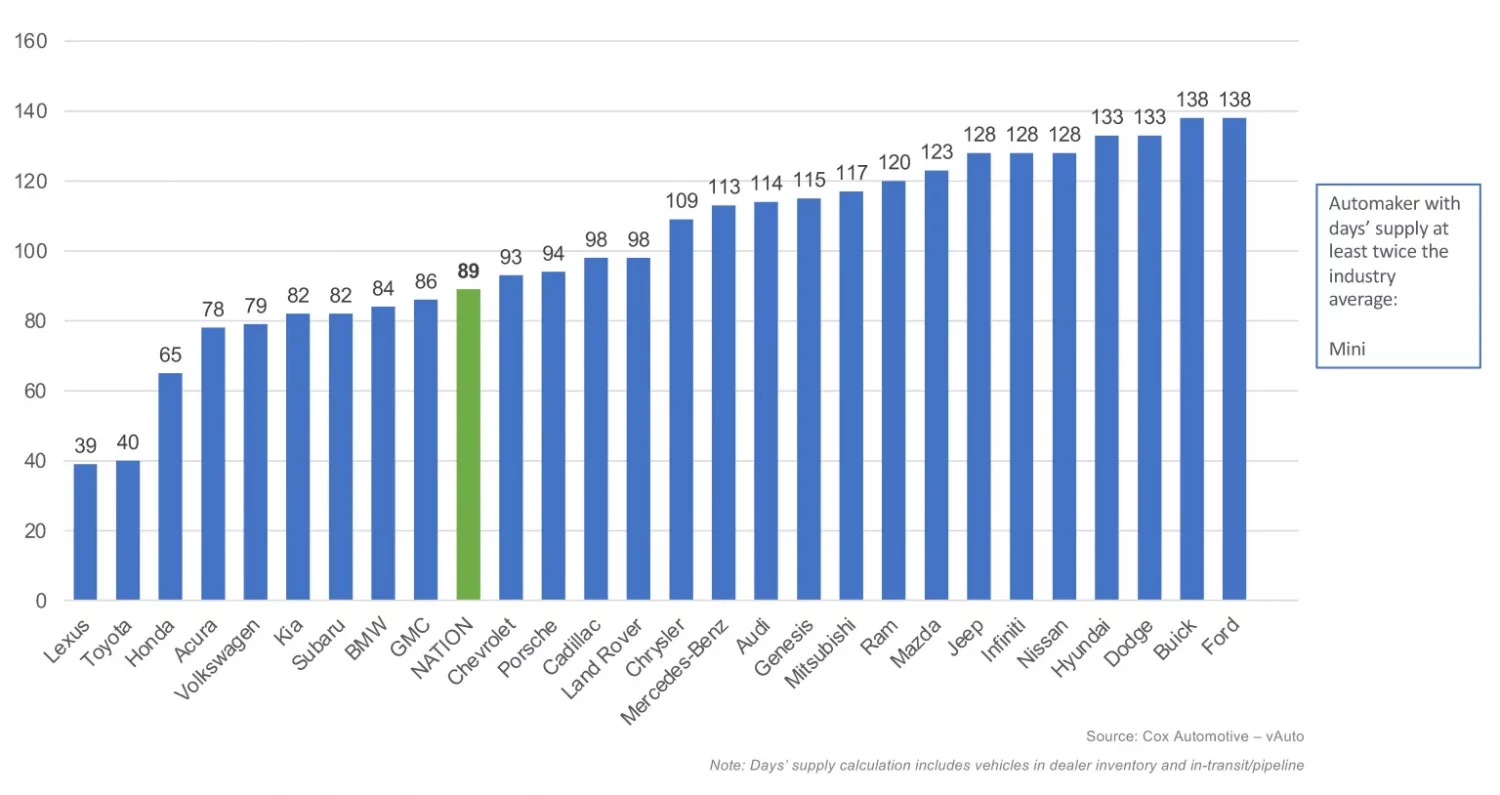

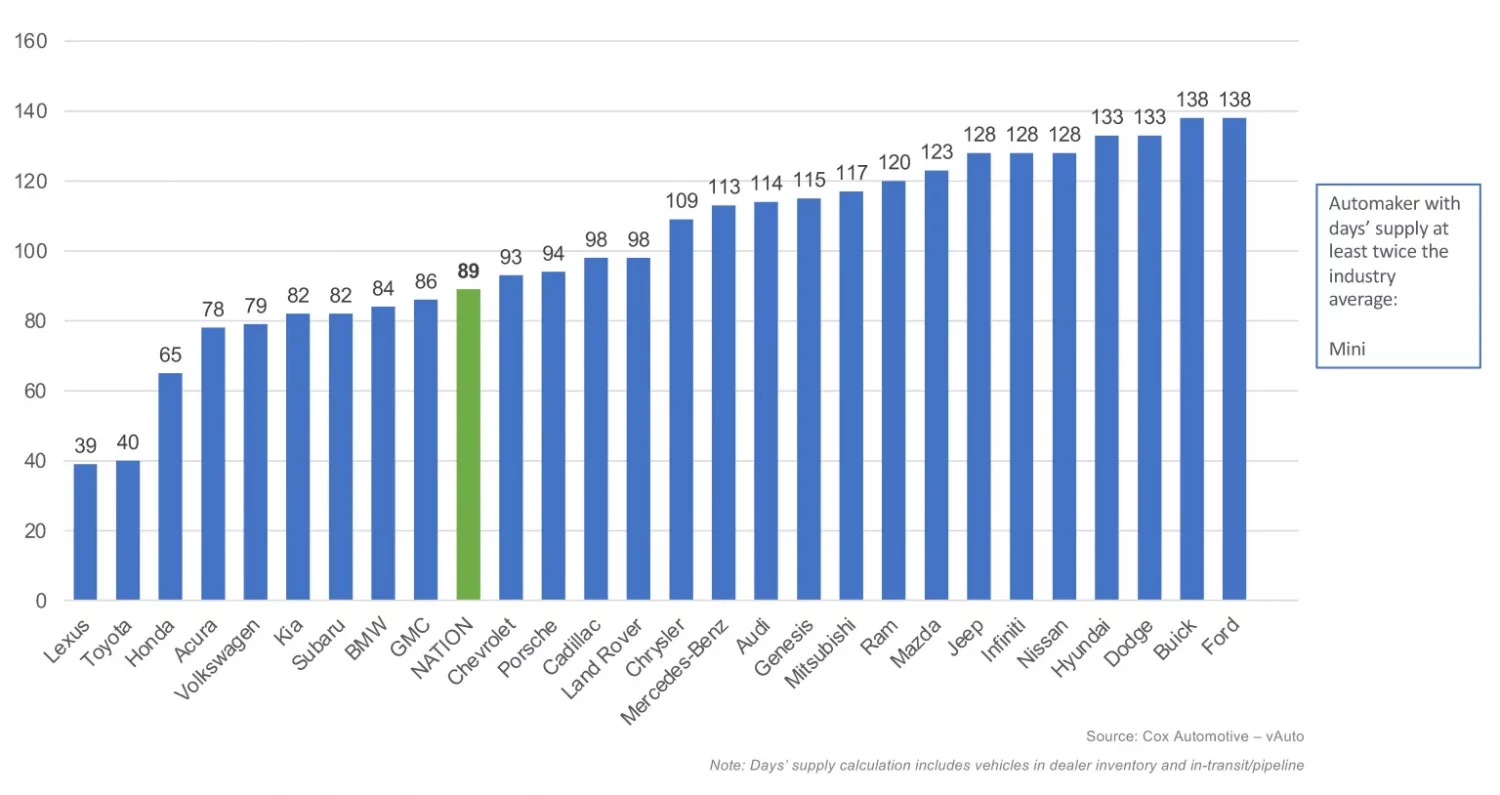

With the boost in sales pace, new-vehicle days’ supply fell by 10% from February, dropping to 89 days. This decrease in supply was expected as more vehicles moved off the lots, signaling that dealers were adjusting to a changing market. However, uncertainties surrounding policy changes and tariff discussions have left automakers in a holding pattern. Despite these concerns, Hyundai saw the most significant increase in days’ supply, gaining 38 days year over year, while brands like Jeep and Ram experienced the steepest declines, down to 54 and 56 days.

Source: Cox Automotive

Top-selling brands in February included Toyota, Ford, Chevrolet, Honda, Hyundai, and Kia, which together accounted for 58% of all sales and 53% of all available inventory. The average listing price for a new vehicle was $48,316, slightly down by 0.6% from January but up 2.6% compared to the previous year. These six leading manufacturers offered a wide range of models below the average listing price, making their vehicles more affordable as interest rates continue to rise and challenge affordability for many buyers.

The inventory of vehicles priced at or below $20,000 declined by 17% from January, while vehicles priced above $80,000 rose by 9%. This shift towards high-end models reflects the growing reliance on higher-income households to drive the new-vehicle market. More than 75,000 new vehicles were priced over $100,000 at the beginning of March, a sharp increase from fewer than 50,000 a year ago. Among the highest price category, 41% of inventory was priced at $100,000 and above.

In terms of pricing, the average listing price for a new vehicle was $48,316, down 0.6% from January but still 2.6% higher compared to the previous year. Although prices are generally rising, there are still over 80 models listed under $40,000, with several priced below $30,000.