October was a bit heavier on the tricks than treats when it came to auto sales. When compared to last year’s numbers, October is expected to see an approximate decline of 1.9 to 2.1 percent as projected by Cox Automotive and Edmunds respectively. Edmunds further estimates the sale of 1,322,340 new cars and trucks —a 6.7 percent decrease from September 2018— with a seasonally adjusted rate of 17.1 million. While car buyers did purchase fewer automobiles than the previous year, SUVs and rising wages are contributing to the softer decline. So, what defined October’s minimal decline in sales, and what could it mean for the rest of the year? Check out our takeaways.

SUVs Prevented a Sharp Decline

Despite the rising transaction price of today’s vehicles, consumers are still enamored with SUVs and pickup trucks. Most of the top U.S. automakers reported rises in sales of larger vehicles. Ford reported a 6.7 increase, while Fiat saw a staggering 16 percent rise in purchases for their Jeep and Ram vehicles. Toyota also saw a minimal surge because of its SUV sales with an increase of 1.4 percent, a result of interest in the Highlander and Tacoma SUVs. Again, even though transaction prices are continuing to creep up to record highs, buyers are willing to pay premium prices.

Who Won and Who is Playing Catch Up?

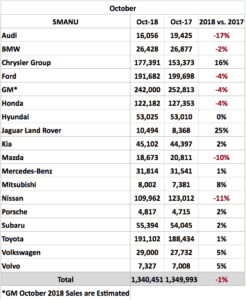

Since SUVs are still all the rage, it is no surprise that car manufacturers that chose to put SUVs front and center were successful this month. Fiat Chrysler, Toyota, Subaru, Volkswagen, and Kia saw sales increases of 15.7, 1.4, 2.5, 4.6, and 1.6 respectively. Subaru continues its record run of positive sales, while Fiat also maintains its gradual routine of growth. On the other end, Ford, Honda, and Nissan experienced declines of 3.9, 4.1, and 10.6 percent respectively. General Motors no longer posts monthly reports, but estimates have them between an 8.8 and 9.4 percent decline. While Toyota, Ford, and Honda have wavered throughout the past few months, Subaru, Fiat, and Volkswagen have managed to remain steady. As the end of the year continues to approach, it will be interesting to see if any of the financial issues within the industry has any impact on these seemingly unshakeable carmakers.

Interest Rates and Still on the Rise

According to Edmunds, the average annual percentage rate on new financed vehicles averaged 6.2 percent in October, a 1.3 percent increase when compared to 2017. These numbers are significantly impacting the scarcity of zero finance loans, as only 3.8 percent of buyers were able to attain them. If customers are looking for incentives, they will encounter a market where they will pay an average of $1,316 more in interest over their lifetime. Affordability for new cars is slipping. Data from J.D. Power and LMC Automotive found that average new-vehicle transaction prices were $32, 947, a 1.5 percent increase from the previous year. Car shoppers are starting to notice the trend, and some are avoiding the purchase of new vehicles. This is supported by the fact that Edmunds projected over 3.3 million used vehicles sold in October 2018, a vast difference from the 1.3 million estimated for new vehicles.

New-Car Finance Data

Used-Car Finance Data

What Could This Mean for the Future

October may be the turning point for many buyers. Consumers are still purchasing SUVs, and wages are high enough to handle the rising expenses. However, a hit to the economy could be devastating for the automotive industry. Jeremy Acevedo, Edmunds’ manager of industry analysis, brought insight into the potential consequences if the economy experiences a shake-up: “It’s getting harder and harder for shoppers to afford a new car, and if the economy starts to slip, we’re at a point now where we really could start to see some significant impacts in the auto market.” Eventually, it looks as if the average consumer will be “priced out” of vehicles they could once afford. Unfortunately, analysts are playing a “waiting game” as the only thing preventing a downward spiral are the steady uptick of buyer wages. `

Final Thoughts

On paper, October was not a defeat for many automakers and the industry as a whole. The sales are roughly only two percent lower than last year’s, and consumers are flocking to new SUVs. The real story about October is the continued gradual rise of interest rates and transaction prices, while incentives like zero down financing continue to fall. September and October have both signaled the decreasing affordability of new vehicles. If SUV prices rise a bit out of reach and wages experience stagnation, the beginning of next year may begin to tell a different and more worrisome story as 2019 unfolds.

More insight into recent auto industry trends can be found in the Edmunds Industry Center at https://www.edmunds.com/