In a strange catch-22, chipmakers are running out of the chips needed for their chipmaking machines. And it’s going to affect everyone unless priorities are changed.

Audi, Kia, Toyota, Hyundai, and the entire auto industry continue to struggle with the effect that chip shortages are causing. For example, Audi of America posted a 35% sales drop for the first quarter of 2022.

However, aren’t we supposed to be coming out of the shortage issue soon? According to Tom Caulfield, Chief Executive of contract chip manufacturer GlobalFoundries Inc. the answer is not to hold your breath. In a recent Wall Street Journal article, Caulfield says, “There’s this wishful thinking that by the end of 2022, supply will be balanced with demand. I just don’t see it.” Other chip execs say the shortage will persist through 2024 or even longer, given some of the global problems we’re experiencing.

No chips for the chipmaker

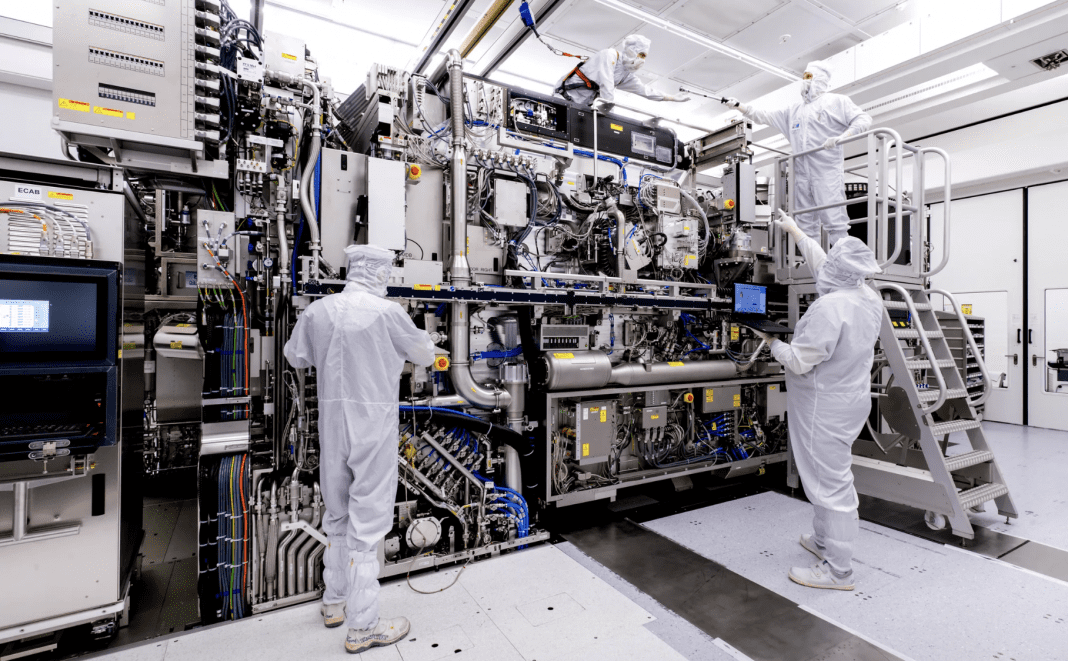

Since the automotive industry continues its hunger for chips, this is causing another more significant problem – there aren’t chips to supply the machines that make the chips. So, in what seems to be a cruel comedy routine, the chip shortage is pressuring chipmakers to build more chips. However, more chipmaking machines require more chips.

In the WSJ article, Advantest America Chief Executive Doug Lefever says, “typical lead times on his company’s [chipmaking] machines, which test whether newly made chips function correctly, have doubled or more. ‘I think we’re in it for quite a while before we get completely back to standard times.'”

Lessons from the pandemic

With most companies hoping to learn from government and business mistakes over the last three years, they’re also learning from the positives. For example, while the healthcare industry experienced problems with supplies of various items at the beginning of the COVID panic, manufacturers were hyper-focused on producing what was essential and needed in the short term.

This prioritization is taking shape in the chipmaking industry and could be helpful for the automotive segment, with Apple and Intel putting their weight behind the move.

Companies like Microchip Technology Inc., a maker of microcontroller chips that process data in electronic devices, including chipmaking equipment, are changing priorities. Ganesh Moorthy, the CEO, said his company “is treating chip-equipment suppliers as priority customers, not unlike the way it treated medical-device manufacturers at the onset of the pandemic.”

Other chipmakers are following suit. In a Bloomberg report, chipmaker TSMC said, “in end-March that it will rearrange production priorities to deal with a shift in demand caused by Covid restrictions ins Shanghai and Shenzhen. TSMC wasn’t planning to revise down its sales and capital spending forecasts for 2022.”

Changing priorities delaying EVs?

9to5mac recently reported that roadblocks remain in four component categories:

- Display Drivers

- Memory

- Processors

- WIFI Chips

Demand is exceeding supply by over 30%. So how is this going to affect the auto industry’s transition into EVs? The average electric vehicle has around 2,000 chips, double the amount found in an ICE vehicle. So, automakers can’t sell EVs if they can’t produce them—even if there is a market clamoring to buy them.

Despite the 35% drop in Audi’s EV vehicle sales, the lone bright spot was the A3, with a 2.9% increase YoY. And since semiconductors are mainly made in China and Taiwan, we can expect more delays in EV rollouts, requiring dealerships to continue to push what’s available in used, preowned, and even sedans. It seems to be an excellent time to have a small car fleet.

Consumers will still need vehicles if we don’t have a significant economic crash. So, it’s time for dealers to stock up on the ICE vehicles you can get.

Did you enjoy this article from Steve Mitchell? Read other articles on CBT News here. Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.