Subprime loans for autos have sprung back to nearly pre-pandemic levels, and fewer borrowers are defaulting on their payments. That’s according to TransUnion’s Q3 2021 Quarterly Credit Industry Insights Report (CIIR) issued on November 3. At the same time, the average car loan balance and monthly payment have increased.

TransUnion’s quarterly report identifies credit industry data across multiple sectors including mortgages, credit cards, personal loans, and auto loans. Of particular interest to dealers, is the auto lending data that indicates a very healthy return to more normal borrowing behavior across virtually all credit levels.

Satyan Merchant is the senior vice president and automotive business leader at TransUnion. He said in a statement, “So far in 2021 we have seen growth in the auto industry across both originations and balances and at the same time, serious delinquency rates have declined. While origination growth rebounded to a healthy level this past quarter, external factors such as the uncertainty surrounding semiconductor chip shortages and supply chain issues will continue to have an impact on new vehicle inventory and drive up vehicle prices. We anticipate this will impact vehicle sales through the remainder of the year and possibly into 2022 despite growing consumer demand.”

More Subprime originations

Auto loan originations remained relatively stable and experienced growth in Prime, Prime Plus, and Super Prime credit levels. These are borrowers who are largely unaffected by the financial challenges during the pandemic. But Near Prime borrower originations declined by 11.5% in Q3 2020, 1.7% in Q4 2020, and 4.7% in Q1 2021 before springing back by more than 14% in Q2.

A disparity is painfully evident when looking at Subprime borrowers, however. Deep double-digit declines of 25.5%, 19.1%, and 21.9% over the same time periods show how profoundly impacted this segment was during the pandemic. Slight growth was seen in Q2, up 5.9% for the quarter.

In Q3 2021, though, Subprime vaulted back to levels near those seen pre-pandemic, with a stellar 32.8% increase in loan originations was seen in subprime. Similar growth was seen in all credit profiles aside from Super Prime, where 16.7% more originations were seen.

Fewer delinquencies

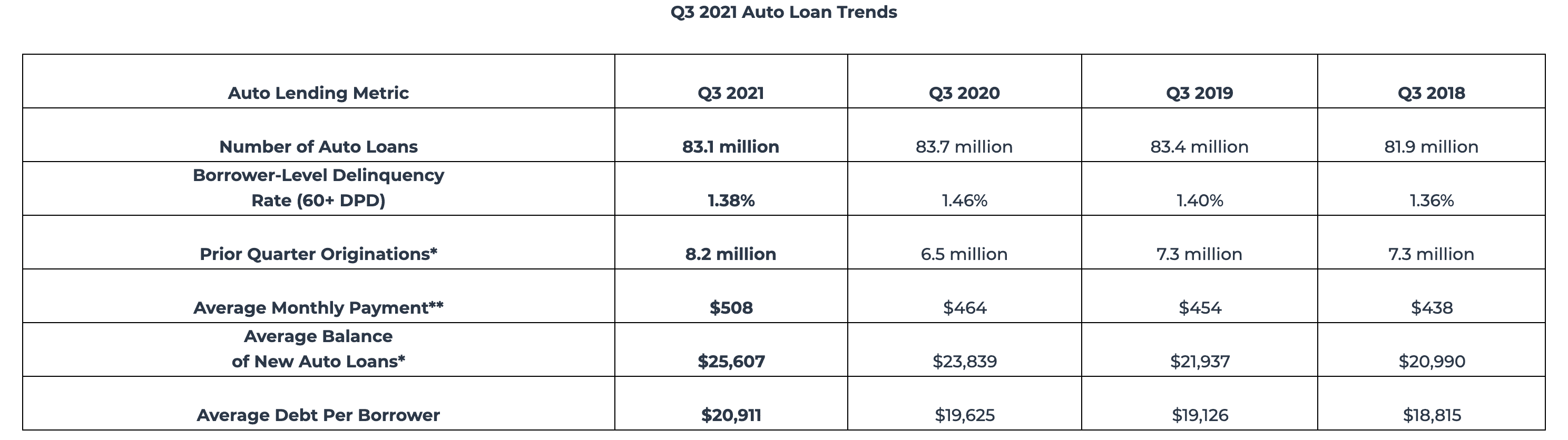

Over the course of the quarter, the delinquency rate of 60-plus days past due dropped to 1.38%. That’s lower than the 1.40% seen in 2019 before the pandemic shook the economy. It’s unusual to see higher rates of subprime loans coincide with lower instances of default, to be sure.

The clients securing subprime loans today may not be the same as those before the economy took a hit, though. Some financially responsible individuals who are now recovering from pandemic-related issues may represent the increase in subprime originations and their steadfast repayments are reflected in lower delinquency rates.

It is certainly intriguing that delinquencies have been diminishing in the face of higher auto loan balances – now averaging $25,607 across all credit profiles according to TransUnion – and average monthly payments have now reached $508 per month.

Subprime an area to focus again

Credit facilities tightened for lesser-qualified borrowers during the depths of the pandemic, but lenders have been opening back up to subprime in greater numbers. That’s great news for dealerships, especially those in cities and neighborhoods with higher instances of subprime applicants.

It comes at a time when used vehicles are more prevalent on dealer lots as well. As dealers wait for new car inventories to return, serving the well-qualified borrower, there’s an opportunity to focus on selling quality used cars for subprime clients with the vehicles currently in stock.

Did you enjoy this article from Jason Unrau? Read other articles on CBT News here. Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch-up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.