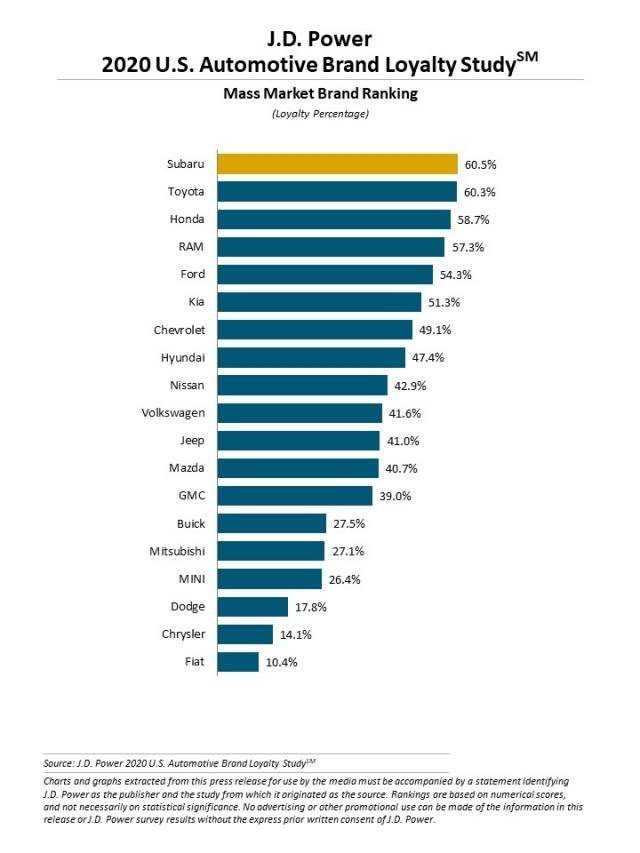

For the second year in a row, Subaru ranks highest in mainstream brand loyalty, according to J.D. Power’s 2020 U.S. Automotive Loyalty Study. Subaru owners who are trading in or purchasing a subsequent vehicle have a loyalty rate of 60.5 percent.

That rate narrowly beats out second-place Toyota with a loyalty rate of 60.3 percent as well as Honda at 58.7 percent, RAM at 57.3 percent, and Ford at 54.3 percent. Luxury brands rated lower overall with Lexus topping the list at 48.0 percent, then Mercedes-Benz at 47.8 percent, followed by BMW at 45.1 percent, Porsche at 44.9 percent, and Audi at 43.4 percent.

The study uses data compiled from the Power Information Network between June 2019 and May 2020. A car buyer is deemed loyal if the car brand they purchase is the same as the brand they are trading in or currently own.

Customer Retention Remains a Priority

Not surprisingly, one of the top goals for carmakers is customer retention. Customer acquisition costs per new vehicle sold was reported to be $633 per vehicle in 2016 – a number that’s sure to have climbed since then. Retained customers are about one-tenth of that cost, saving the dealership nearly $600 per sold vehicle in advertising, marketing, and other costs.

During the pandemic recovery, carmakers have clearly had retention at top of mind. Toyota and Kia offered loyalty cash on certain models, for example, while Honda offered rate reductions for eligible buyers who currently owned a Honda.

Tyson Jominy, vice president of data & analytics at J.D. Power, said, “Automakers are really focused on customer retention, as evidenced by the payment plans and incentives they’ve offered since the COVID-19 pandemic broke out. Many have gone above and beyond to offer customers financial assistance during a period of economic uncertainty, which does a lot to bolster consumer confidence in their chosen brand and repurchase it in the future.”

CX at Point of Purchase

Customer satisfaction with the purchasing experience is a major target for dealerships and carmakers alike. More than ever, reliability and initial quality are on par across the brands sold in North America and is less of a factor than in years past. The difference is now in how well customers feel they’ve been treated during the sales process.

Salespeople need to embrace the sentiment that they are selling the store to the shopper ahead of selling the car. Keeping every aspect of the dealership in a positive light – the service department, the F&I office, the collision repair shop – is imperative to presenting a cohesive and pleasing customer experience.

In-Vehicle Enjoyment

Of course, how well a vehicle engages with the shopper is a large part of the sale. In the 2018 Deloitte Global Automotive Consumer Study, 72 percent of shoppers agreed that they “have to test drive the vehicle to make sure it’s right for me.”

Feature-filled vehicles that are viewed as good value tend to command higher customer retention. That’s something Subaru has always kept as a focus for their vehicles and why they’ve taken the top rank for both of the J.D. Power Automotive Brand Loyalty studies.

Thomas J. Doll, President and CEO, Subaru of America, Inc. said, “We remain grateful for the dedication of our owners and we are proud to provide long-lasting value for our customers, as both an automaker and a brand that is more than a car company.”

Service Experience is Integral

However, retaining customers between purchases is as important as brand loyalty to a dealership. Brand loyalty does not equate to dealership loyalty – they could be purchasing at a competitor. The service experience can be the determining factor. Is the shopper purchasing because of the service experience or in spite of their experiences in the service department between purchases?

Dealers need a whole-store approach in building a standout customer experience. It seems the vehicles will sell themselves, but it’s incumbent on the dealer to give the customer a reason to buy from their store.

Did you enjoy this article from Jason Unrau? Read other articles from him here.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.