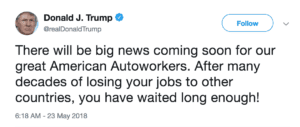

By now, most have heard something about the Trump Administration’s planned auto tariffs. The president campaigned under promises to help a flagging auto industry through a 25% tariff on auto parts, including tires and steel. Back in May, Trump reiterated his commitment to the industry, tweeting, “There will be big news coming soon for our great American Autoworkers. After many decades of losing your jobs to other countries, you have waited long enough!”

However, those closely following developments don’t quite share the Commander in Cheif’s enthusiasm. Earlier this month, Binyamin Applebaum of the New York Times published an article pointing out that tariffs aren’t necessarily bringing jobs home; rather, overseas companies are moving their factories to places not affected by the tariffs. Workarounds like these could mean American auto workers will continue to lose out.

Now, a study by the Center for Automotive Research (CAR), commissioned by the National Automobile Dealers Association (NADA) brings more troubling news. The results of the study predict steep price increases throughout the industry, negatively impacting both dealerships and consumers.

To start with, depending on the origin of the car and the quotas and tariffs attached to its various stages of assembly, consumers could see new car prices rise anywhere from $455 to $6,875. The result? ”Higher new car prices will drive some consumers into the used vehicle market,” the CAR predicts, “where prices will also be higher due to heightened demand and constricted supply – producers cannot make more used vehicles.”

New and used car purchases won’t be the only auto expense to soar once if the tariffs go through. Existing car owners should prepare for increased maintenance and repair prices as tariffs on car parts translate to the consumer. Dealership employees will also feel the  pinch: the CAR study shows the 25% tariff leading to lower wages and layoffs. Looking specifically at the 17,000 new US dealerships, “CAR estimates that new vehicle dealership employment declines would range from 28,800 to 117,500 and total dealer revenues could decline between $16.3 billion and $66.5 billion as a result of automobile and automotive parts tariffs and quotas.”

pinch: the CAR study shows the 25% tariff leading to lower wages and layoffs. Looking specifically at the 17,000 new US dealerships, “CAR estimates that new vehicle dealership employment declines would range from 28,800 to 117,500 and total dealer revenues could decline between $16.3 billion and $66.5 billion as a result of automobile and automotive parts tariffs and quotas.”

Looking generally at the automotive industry, the study sees anywhere between 82,000 and 750,000 jobs being lost, and the country’s GDP taking a hit somewhere between $6.4 and $62.2 billion.

Overall, this latest addition to a growing body of work looking at the future of cars in America should the tariffs pass as they currently are, is bleak. Hopefully, though, the data will convince lawmakers to think twice before making changes.

To quote NADA’s President Peter K. Welch’s testimony to the US Department of Commerce, “As a nation, we can and should work together to address genuine trade concerns, without hurting American consumers and small businesses.”