The latest Haig Report for Q3 2023 from buy/sell firm Haig Partners revealed a sustained high demand for car dealerships. The report indicates that 2023 is shaping up to be the third most active year in dealership acquisitions, trailing only 2021 and 2022, with at least 385 dealerships changing hands by the end of the third quarter.

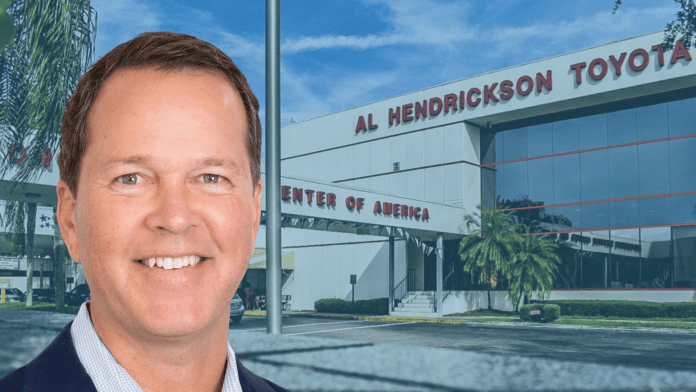

Despite a robust market, average blue sky values of publicly owned dealerships have seen a 12% decline from the end of 2022, averaging a little over a 1% drop per month. The downturn in values isn’t uniform across all franchises and regions. A notable exception is the recent sale of Al Hendrickson’s Toyota dealership in South Florida. Advised by Haig Partners, this sale set a new record for the highest price ever paid for a single dealership, marking a historic moment in the industry.

Al Hendrickson Toyota, based in Coconut Creek, Florida, stands out as the nation’s second busiest dealership, leading in passenger car sales among all franchises in 2022. The dealership was sold to Morgan Automotive Group, with Haig Partners as the exclusive sell-side advisor in this landmark transaction.

The demand for Toyota dealerships continues to be strong, with Haig Partners receiving attractive offers for several other Toyota stores they represent. Beyond Toyota, there’s a surge in interest for various other franchises, especially in fast-growing and business-friendly regions.

In a significant move, Dream Motor Group, co-owned by University of Alabama football coach Nick Saban, former Mercedes-Benz CEO Steve Cannon, and CEO Joe Agresti, expanded into Florida’s market. They acquired two Mercedes-Benz dealerships in Miami-Dade County for over $700 million, including real estate. These acquisitions, part of Dream Motor Group’s strategic expansion, involved the purchase of Mercedes-Benz of Cutler Bay and Mercedes-Benz of Coral Gables from Bill Ussery Motors.

The Haig Report also notes potential record-setting sales in other regions like Texas, the Southeast, the Mid-Atlantic, Mountain States, and the Southwest, indicating a flourishing market for dealership acquisitions across the United States.

In a press release, Alan Haig, president of Haig Partners stated, “The buy-sell market remains near record levels due to strong profits and significant demand from dealers who want to grow their companies. Declining profits continue to reduce blue sky values from the record highs we saw in 2022, but they remain 2.3x above pre-pandemic levels. We believe blue sky values will remain elevated since buyers believe profits will also remain elevated. There is pent-up demand for new units and service drives remain full.”