Stellantis announced a new investment into advanced materials company Lyten, which aims to develop an electric vehicle battery with twice the efficiency of current automotive technology.

The automaker’s offshoot venture capital fund, Stellantis Ventures, revealed the decision on Thursday, May 25. This subsidiary has purchased stakes in multiple automotive technology enterprises since its founding in 2022 and is part of its parent company’s electric-vehicle-focused Dare Forward 2030 strategy. The company did not disclose the size of its payment, although its latest investment into the startup is its 10th. The stock purchase is part of Lyten’s ongoing Series B funding round, which has reportedly raised more than the $210 million earned during Series A. Other shareholders include protective case developer Pelican Products, Italian race car manufacturer Dallara and the U.S. Department of Homeland Security.

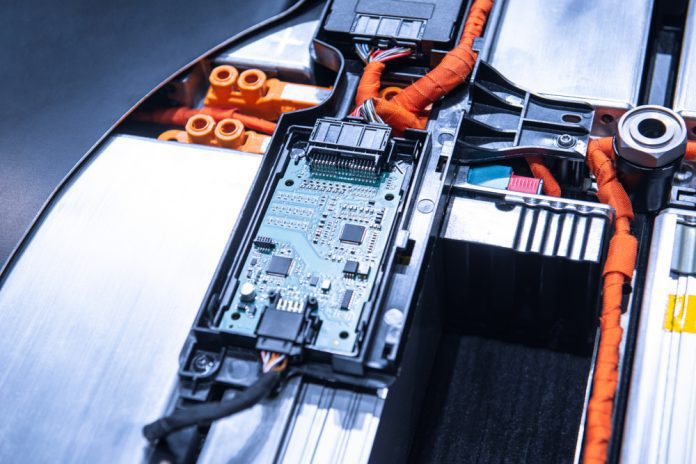

Lyten is primarily focused on the industrial application of graphene, a highly conductive supermaterial made from a single layer of atoms. Using the nanostructure in manufacturing “will decarbonize the hardest to abate sectors on the planet,” claimed CEO Dan Cook. The company claims its patented 3D Graphene has the potential to make cars lighter with double the efficiency that current automotive technology allows. Its carbon-neutral LytCell battery, currently under development for the electric vehicle market, is comprised of lithium and sulfur, a cheaper mineral than the nickel, cobalt and manganese chiefly used by the auto industry.

Stellantis aims to double its revenue by 2030 through greater operational efficiency, automotive technology breakthroughs and electric vehicle proliferation. Company chief Carlos Tavares has historically hesitated to show enthusiasm for the auto industry’s electrification push. But writing in a press release after the Lyten investment, the CEO wrote “Lyten’s Lithium-Sulfur battery has the potential to be a key ingredient in enabling mass-market EV adoption globally…” The car manufacturer recently exited the first quarter with higher year-over-year revenues, which it attributed to higher prices and stabilizing supply chains.