The electric vehicle (EV) maker, Rivian, reported robust fourth-quarter results, surpassing Wall Street earnings expectations and achieving its first-ever gross quarterly profit of $170 million. However, the EV maker anticipates lower sales for 2025, forecasting deliveries between 46,000 to 51,000 units. This move would be a decrease from the previous 51,779 units delivered in 2024.

In addition, the EV maker expects to narrow its adjusted losses to between $1.7 billion and $1.9 billion for 2025, down from a $2.69 billion loss in the previous quarter.

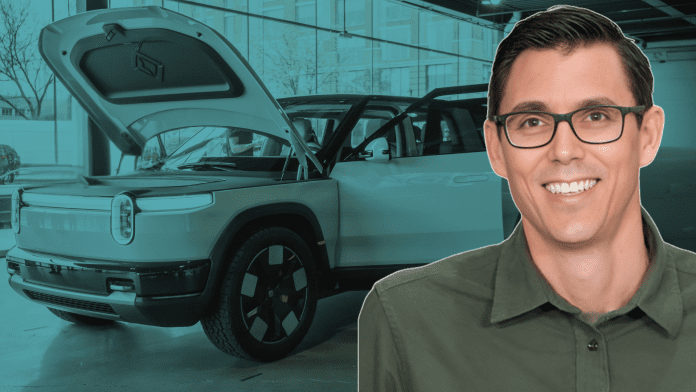

Although the EV maker posted positive earnings, Rivian’s stock closed lower, down 2.3% after-hours, following the company’s earnings call. CEO RJ Scaringe cited uncertainty in the automotive market, particularly the potential removal of federal incentives for EVs and tariff policies, as factors that could impact future performance.

Looking ahead, Rivian plans to increase its capital expenditures from $1.6 billion to $1.7 billion in 2025 as it prepares to launch its new “R2” midsize vehicles in 2026. The company expects its Normal, Illinois plant to be idled for retooling during the second half of the year.

In the fourth quarter, Rivian’s revenue reached $1.73 billion, surpassing expectations of $1.4 billion. This was partially due to $299 million from regulatory credits and $214 million in software and services revenue. Rivian’s net loss for the quarter was $743 million (or 70 cents per share), a significant improvement from the $1.52 billion loss in the same period the previous year.

For the full year, Rivian posted a $4.75 billion loss, with revenue of $4.97 billion, reflecting a 12% increase.