This past year was met with a lot twisting turns when it came to auto sales and trends. However, in the end, many were wondering how 2018 would eventually shape up, and December’s sales results held the final piece of the puzzle. Estimates given by leading analysts from Cox Automotive and Edmunds have revealed that December is on track to show some of the most robust results of the past year.

According to Edmunds, December is expected to be the second-best auto sales month of 2018. Both firms forecasted December sales to hit a seasonally adjusted rate (SAAR) of over 17 million. Cox Automotive has an estimated SAAR of 17.2 million while Edmunds forecast approaches 17.4 million. This past year will likely be the fourth year in a row that auto sales will be above 17 million. Cox Automotive and Edmund’s numbers reveal a healthy auto industry that rose above expectations to put many automakers in a decent position for 2019. What possibly led to this uptick, and is the outlook as optimistic for 2019? Read on for our takeaways from December’s auto sales results.

A Healthy Economy Put 2018 on the Map

One of the main reasons 2018 turned into a positive year for auto sales was this past year’s strong economic showing. Low unemployment, favorable gas prices, and a large number of credit options made it possible for consumers to purchase new vehicles at rates that were on par with the past four years. The favorable economy also increased consumer confidence to allow car buyers to feel as if they were in a stable position to take on more substantial loan payments and monthly car notes. These factors contributed to high retail demand in the latter part of 2018 that helped to raise the final count over 17 million.

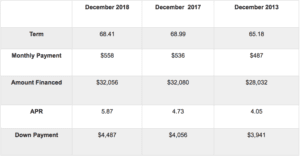

New-Car Finance Data

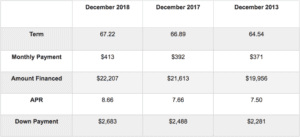

Used-Car Finance Data

A Mixed Bag of Results for Automakers

While the year ended on a positive note overall, many automakers experienced volatile results in the final month of 2018. Cox Automotive and Edmunds projected year-over-year declines under 10 percent for General Motors, Ford, Toyota, Honda, Nissan, and Volkswagen. On the positive side, Hyundai Kia and Subaru are expected to see increases under 10 percent. However, the winner of December 2018, as well as the overall victor of the year, is Fiat Chrysler. According to projections from Cox Automotive, Fiat Chrysler is set to see an increase of 11 percent in December. Increasing consumer desires for SUVs and the popularity of the Jeep is set to put Fiat in the top spot for automaker year-over-year sales increases in December.

Fleet Sales, “Buy-Now” Sentiments, and End-of-Year Incentives

While consumer sales played a significant role in this year’s results, much of the auto industry’s sales in 2018 can be attributed to commercial fleet sales. Corporate tax reform left more money in the pocket of many businesses. As a result, many of these companies decided to update their car fleets. According to Cox Automotive, rental fleet volume was up by 100,000 units when compared to 2017.

Concerning consumer sales, many of the purchases were made out of urgency. Research by some of Cox Automotive analysts revealed that increasing vehicle tariffs and discount rates created a “buy now” attitude among consumers and dealers alike. Car buyers wanted to get the best rate they could by buying “early.” This sentiment contributed to the sales hike throughout 2018 and specifically in December. Sales incentives also didn’t hurt. Edmunds analysts found that increased fleet deliveries (approximately 16.1 percent of total sales for the year) and attractive (but also unsustainable) incentives encouraged high auto sales in the last month of the year.

Looking Ahead to 2019

While 2018 defied expectations and brought higher levels of consumer confidence and optimism throughout the year, the Q4 2018 Cox Automotive Dealer Sentiment Index revealed that auto dealers became more negative than positive moving into the last quarter of the year. Tariffs, higher interest rates, and higher prices as a result of making room for the tariffs impacted the outlook of auto dealers all across the country. Many are afraid that price changes and gradual increases in interest rates will eventually turn off car buyers altogether. It is everyone’s hope that the relative success of December will also move into 2019. However, the first quarter of 2019 will be the initial test of how an evolving economic landscape will shape 2019.