The automotive industry is constantly evolving, influenced by market conditions, consumer preferences, and various economic factors. The current affordability crisis is no exception, as trends and data shaping vehicle ownership costs are heavily influenced by these factors. However, incentives, rebates, and payment analytics demonstrate unique opportunities to help make these vehicles more accessible.

Average Auto Payments Over Time

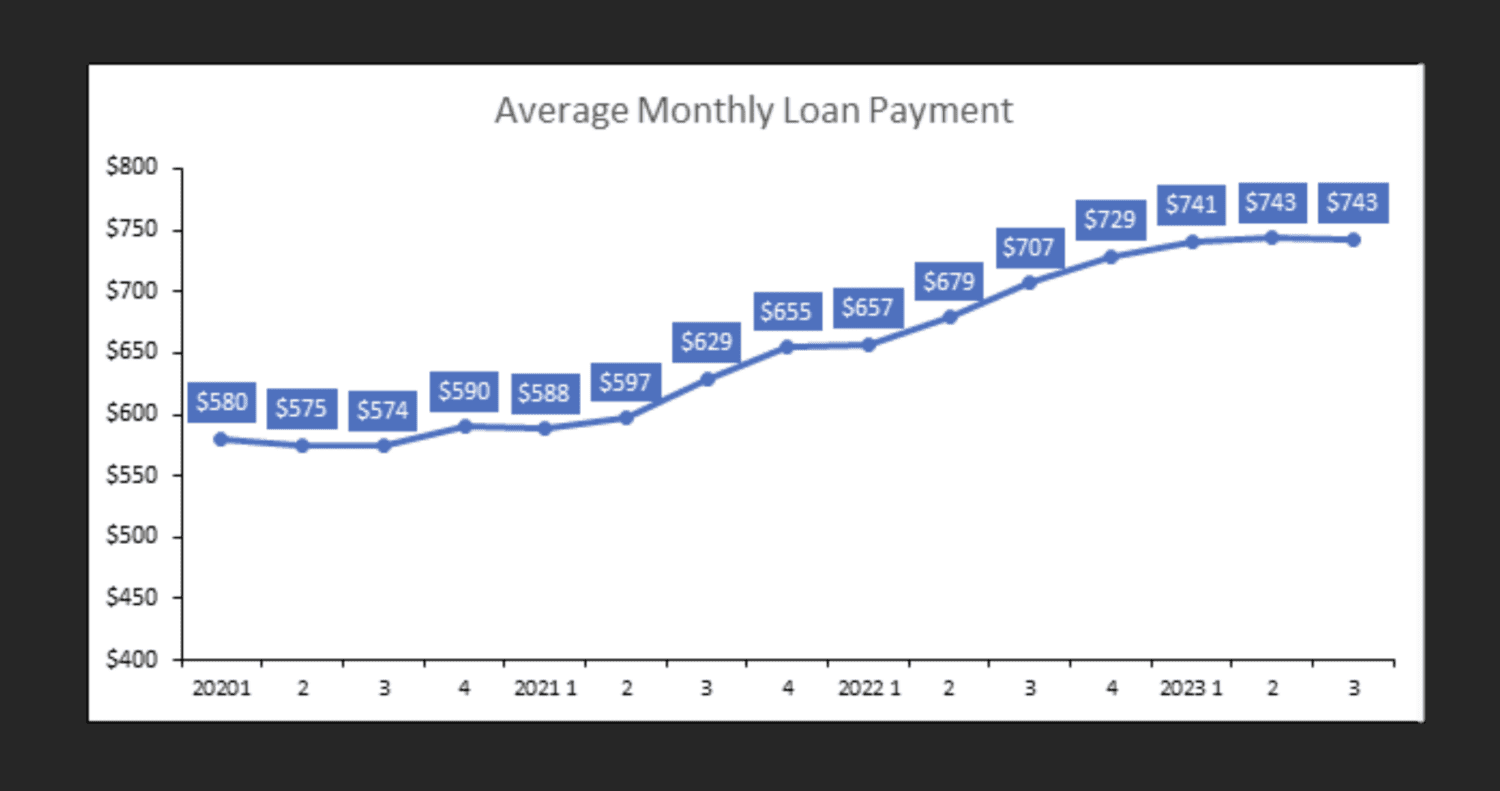

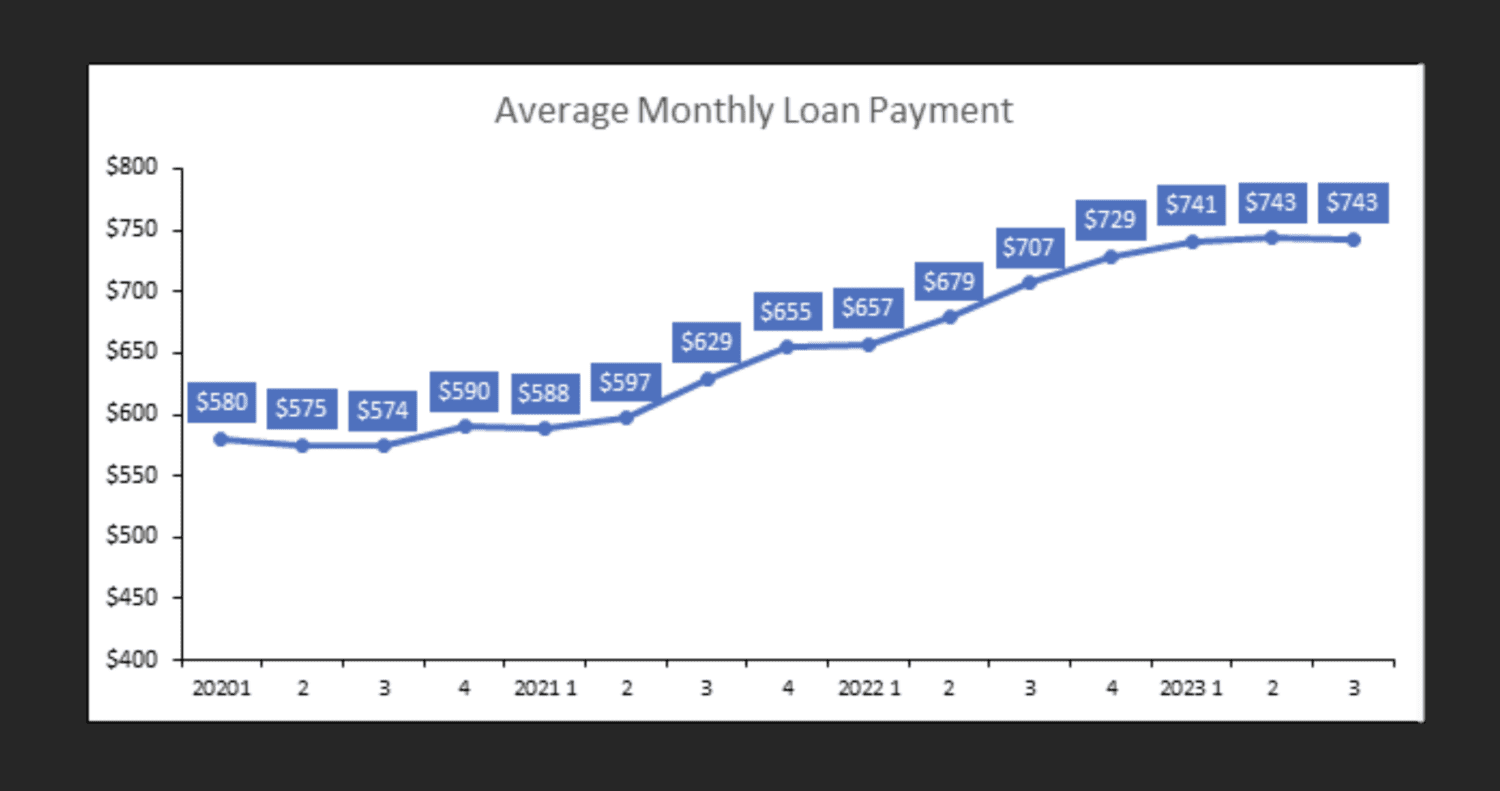

Looking at average auto payments over time, the cost of owning a vehicle has evolved substantially, with the average payment on a new vehicle loan increasing more than 28% from January 2020 through September 2023.

Source: S&P Global Mobility — AutoCreditInsight with TransUnion, based on US new retail light vehicle registrations Q1 2020-Q3 2023

Another critical aspect of vehicle ownership is the share of income allocated to vehicle expenses, which offers a holistic view of the financial responsibility of vehicle ownership. In 2023, the average monthly income in the US after taxes was $4,318. However, the average monthly car payment of $743 in Q3 2023 accounts for nearly 17% of the average monthly take-home pay. It’s worth noting that this figure doesn’t consider additional expenses like insurance, fuel, maintenance, tolls, and parking.

Incentives and rebates play a pivotal role in the journey to making vehicles more affordable. But how do they work? Incentives can take various forms, including cash rebates, special financing rates, or lease deals provided by manufacturers or dealerships. These incentives aim to reduce the overall cost of the vehicle for consumers, making it more attractive.

Understanding the intricacies of auto rebates is essential. Are auto rebates taxable? The tax implications of rebates can influence the overall financial picture for consumers. Exploring who offers automotive rebates and incentive solutions is crucial for both consumers and industry stakeholders.

An opportunity for maximizing sales lies in leveraging a relatively new tool in the proverbial toolbox, payment analytics solutions. Using these solutions, key stakeholders in the auto industry can gain a deeper understanding of consumer behavior, optimize pricing strategies in near real-time, and enhance the overall buying experience for consumers; this presents the right offer that consumers can afford, and in turn, helps retailers sell more vehicles.

This solution is readily available through Market Scan, part of S&P Global Mobility. Market Scan’s mScanAPI delivers unparalleled precision for dealers, lenders and OEMs, including vehicle payment calculations, ensuring that its solutions align precisely with clients’ needs. Market Scan’s accuracy, rapid incentive data integration, and partnership-driven expertise set it apart in the market.

The Market Scan offering includes:

- Unrivaled Accuracy in Vehicle Payment Calculations: Leveraging comprehensive, geo-specific data for precise payment calculations.

- Rapid Incentive Data Integration: Near real-time accuracy based on rapid data integration, usually within 24 hours.

- Commitment to Success: Offering a 90-day satisfaction guarantee, efficient migration, and implementation with a user-friendly approach.

- Partnership-Driven Expertise: Access to a team of automotive professionals skilled in discerning and fulfilling specific client needs.

As we navigate the automotive landscape in 2024, understanding the factors influencing new vehicle affordability is crucial. Incentives, rebates, and payment analytics are integral components shaping the industry. Market Scan’s innovative solutions provide accurate, real-time data that benefit consumers and industry stakeholders alike. As the journey toward more affordable and accessible vehicles continues, it’s important to consider the impact and role technology and data will play in driving positive change.