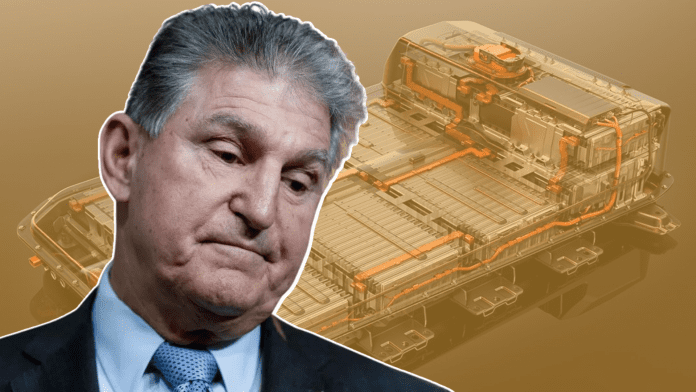

Senator Joe Manchin has threatened legal action over upcoming rule changes to electric vehicle tax credits.

In the coming weeks, the U.S. Treasury will announce guidance updates for EV battery and mineral sourcing requirements in the Inflation Reduction Act. The new rules will require 50% of the battery to be assembled in the U.S. and 40% of the materials to be procured domestically or in countries with whom the U.S. has a free trade agreement. Manchin criticized the anticipated revisions for allowing foreign manufacturers to profit from the bill. “I’m fine with the processing in those areas,” remarked the senator, “I’m just not fine with you all completing the project, and all we’re going to end up is assembling here.”

The domestic sourcing requirements in the IRA have also received criticism from lawmakers in allied countries, who feared the bill would impact local business. While the act does make exceptions for free trade partners, few nations have such an agreement with the U.S. However, the Biden Administration is currently in talks with the E.U. to create new free trade deals which would allow manufacturers in member states to circumvent such requirements. The Treasury has also signaled they will broadly accept the negotiated arrangements. Since full details for both the revisions and the agreements have yet to be made public, it may be some time before legal action can be taken. “I’m willing to go to court, I’m willing to stop it all,” said Manchin.