A significant feature of the Inflation Reduction Act is the tax credit for used electric vehicles. The credit, which has a maximum value of $4,000, is available for used EVs, PHEVs, and FCEVs sold for less than $25,000 on the market. However, there was an issue- The Internal Revenue Service’s (IRS) list of acceptable vehicles never included used Teslas.

CleanTechnica’s Paul Fosse found in a study that used Teslas would not qualify for the tax credit because the automaker had “forgotten” to complete the necessary paperwork to allow used examples to qualify.

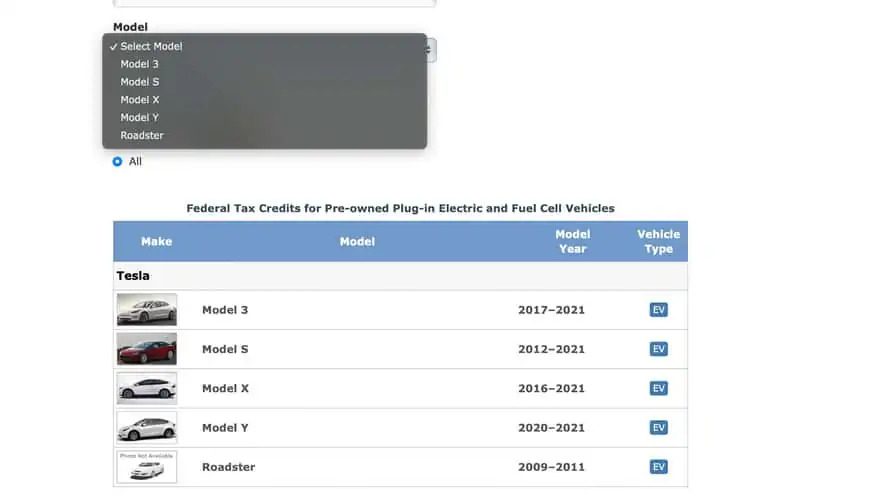

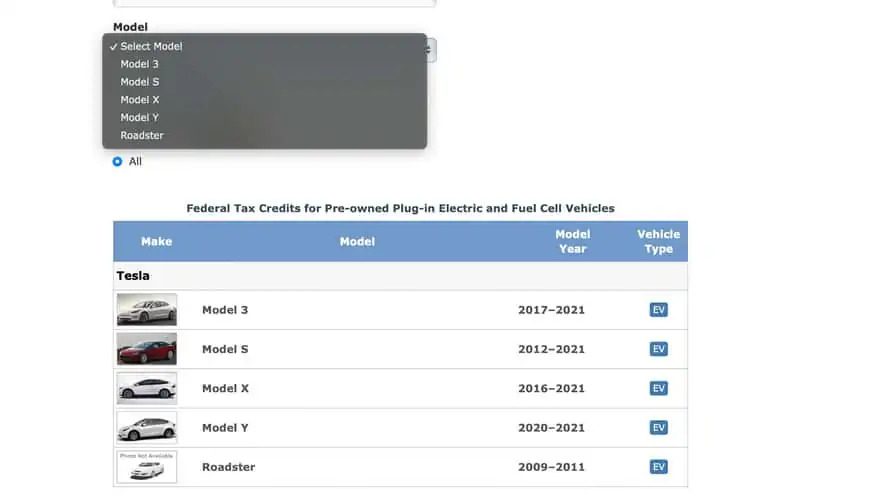

Recent developments suggest that used Teslas are now eligible for the $4,000 used EV tax credit. On August 3, 2023, the IRS modified its website, replacing the qualified manufacturers list with a link to the EPA’s website, which lists all Tesla models eligible for the used EV tax credit.

The image confirms that all used Teslas do qualify for a tax credit.

Although it isn’t stated explicitly that Tesla qualifies, we’ll have to wait until more details are made available by Tesla and the IRS. Nevertheless, a large number of early Model S sedans will be eligible, while a small number of Model 3s priced under $25,000 are eligible.

Please refer to the list below to determine the qualification status for other makes and models:

- Individuals must make less than $75,000 to be eligible for the credit. Joint filers may make up to $150,000, and the head of household may make up to $112,500.

- The vehicle must be purchased through a dealership, and the purchase price cannot exceed $25,000.

- It must be at least a two-year-old vehicle.

- The car can be a plug-in hybrid, but the battery must be at least 7kWh. For example, the Mercedes C350e, Toyota Prius Plug-in (not Prime), and Honda Accord Plug-in Hybrid do not qualify.

- The tax credit only covers 30% of the cost of the vehicle if it costs $13,333 or less.

- A prior owner cannot claim the used EV tax credit on the vehicle.