Welcome back to the latest episode of The Future of Automotive on CBT News, where we put recent automotive and mobility news into the context of the broader themes impacting the industry.

I’m Steve Greenfield from Automotive Ventures, and I’m glad that you could join us.

This week, a lot of news around the early-stage EV-only automakers.

In the electric vehicle race, it’s increasingly clear that not every competitor will make it to the finish line.

Companies like Rivian, Lucid and Fisker are burning through their cash reserves as they spend heavily on expanding factory production and sales—all while losing money on every vehicle they sell.

For consumers, the increased competition translates into steep discounts on some of the sexiest electric-powered vehicles. But for EV automakers, a slowdown in demand starts the clock that might determine how long they can keep the lights on.

These young companies went public at stratospheric valuations, even though many had no revenue and little experience building a car. Investors, analysts and ordinary shoppers believed EV makers could emulate Tesla’s success in disrupting the traditional car market. Rivian’s market value briefly surged higher than that of Ford and General Motors

Now, these companies are fighting to stay afloat amid stiff competition. Sales of battery-powered cars and trucks have been weaker than expected in the U.S., leading companies from Ford to Tesla to slash prices in an attempt to jump-start demand. Too few buyers have been willing to make the switch to fully electric vehicles, worried about the relatively high sticker prices, immature charging infrastructure and the long-term reliability of EVs.

This week negotiations between Fisker and a large automaker — reported to be Nissan — over a potential investment and collaboration were terminated, a development that puts a separate near-term rescue funding effort in danger.

Needless to say, Fisker’s stock price plunged on the news. The New York Stock Exchange said it would immediately suspend trading shares and is moving to take the company off its stock exchange.

On the other end of the spectrum, Lucid got a massive and well-needed lifeline this week, raising another $1 billion from its biggest financial backer, Saudi Arabia, as it looks to blunt the high costs associated with building and selling its luxury electric sedan.

Ayar Third Investment, an affiliate of Saudi Arabia’s Public Investment Fund, agreed to purchase $1 billion worth of Lucid’s stock, which will means the Kingdom now owns about 60% of the company.

The fresh funding comes just a few weeks after Lucid told investors that it only plans to build around 9,000 of its Air EV this year, a slight increase over last year’s output. It lost $2.8 billion in 2023, which equated to over $300,000 per unit sold, and finished the year with just under $1.4 billion in cash. So this latest injection couldn’t have come at a better time.

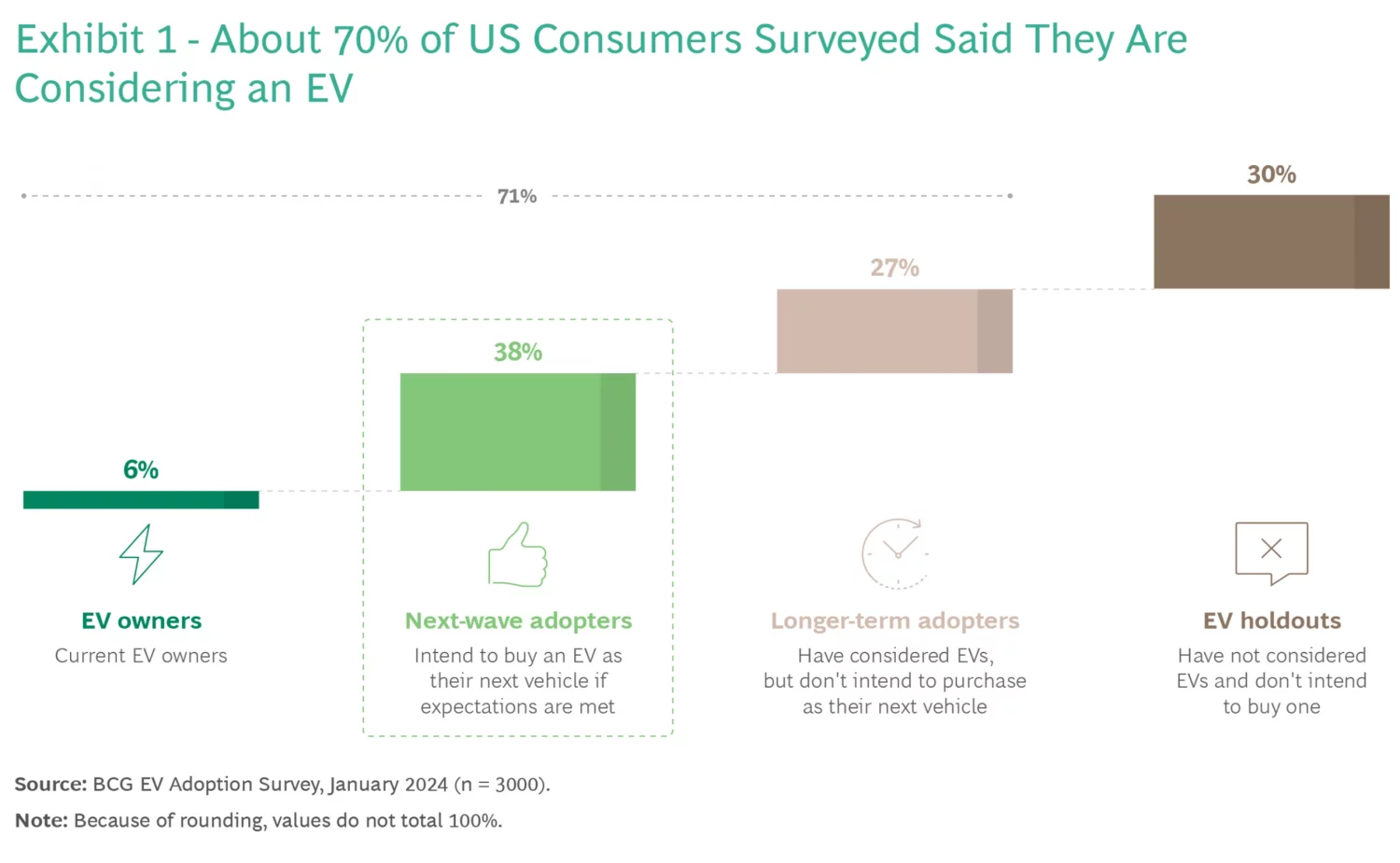

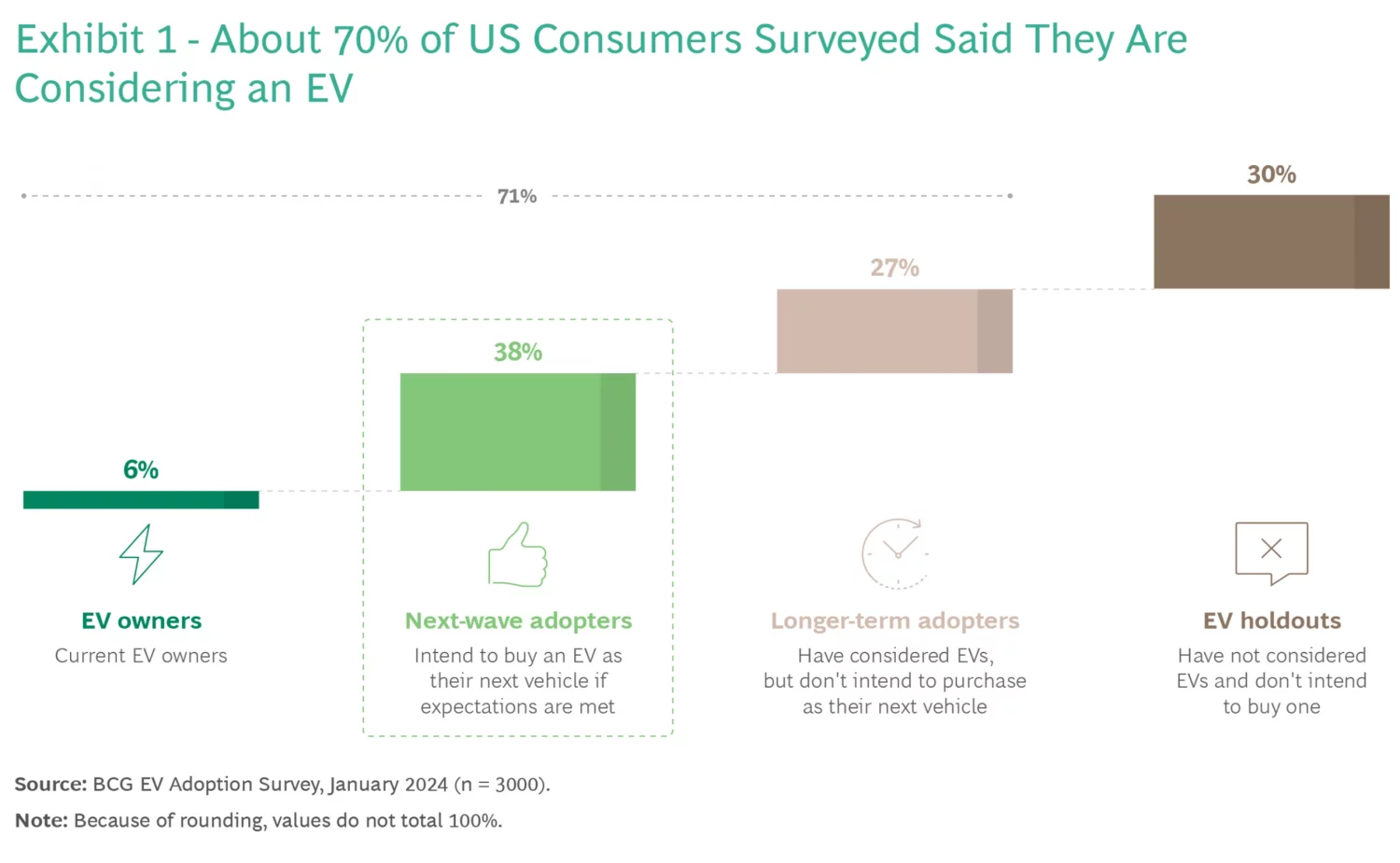

A recent Boston Consulting Group study illuminated that U.S. consumer acceptance of EVs hinges on automakers delivering four things:

1. 20-minute charging times.

2. 30 minutes maximum to find and wait for access to a fast-charging station.

3. 350 miles or more of driving range per charge.

4. A price of $50,000 or less.

So we just have more road to travel, before the average U.S. consumer is ready to embrace having an EV in their driveway. Especially a brand who might not survive over the next 12 or 18 months.

Companies to Watch

Every week we highlight interesting companies in the automotive technology space to keep an eye on. If you read my weekly Intel Report, we showcase a company to watch, and take the opportunity here to share that company with you.

Azumo

Azumo, the leader in low-power displays, believes that with automobiles, light is the new chrome.

Trends in electric and autonomous vehicles demand new surface illumination requirements both inside and outside the vehicle. Automotive designers have been wrestling with the limitations of current lighting options including microLED which have challenges in bulk, power, reliability, and rigidity constraints.

Azumo enables multiple surface illumination applications across mobility.

Azumo’s lightguide film is ultra-flexible and provides high-resolution imaging from a single LED through super thin automotive-grade material. Their Nano-TFI product has crossed a key threshold for invisibility and directionality to provide beautiful, efficient illumination for a variety of smart surface applications.

If you’d like to learn more about Azumo, you can check them out at www.azumotech.com.

So that’s it for this week’s Future of Automotive segment.

If you’re an AutoTech entrepreneur working on a solution that helps car dealerships, we want to hear from you. We are actively investing out of our new DealerFund.

If you’re interested in joining our Investment Club to make direct investments into AutoTech and Mobility startups, please join. There is no obligation to start seeing our deal flow, and we continue to have attractive investment deals available to our members.

Don’t forget to check out my book, The Future of Automotive Retail, which is available on Amazon.com. And keep an eye out for my new book, “The Future of Mobility”, which is almost done, and will be out early this year.

Thanks (as always) for your ongoing support and for tuning into CBT News for this week’s Future of Automotive segment. We’ll see you next week!