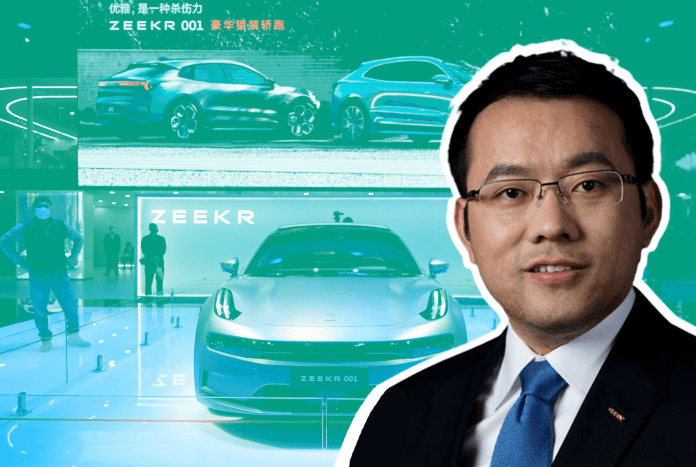

China’s Geely Automobile Holdings has confidently filled for a U.S. initial public offering. The electric car brand, Zeekr, would be the first major Chinese listing in the country in nearly two years.

As reported by Reuters, Zeekr submitted a document to American regulators outlining its intentions to raise more than $1 billion in its U.S. IPO and aims for a value of more than $10 billion. Additionally, the plans call for a New York IPO to happen as early as the second quarter of 2023.

In October, Geely announced its intention to spin off the company, which covers Zeekr’s listing venue, offering size, and price point. In addition to having a more predictable listing speed, a Zeekr offering would pave the way for more Chinese share sales in the United States- which is said to hold the world’s largest pool of money.

On the other hand, only five Chinese firms have successfully executed U.S. IPOs this year, raising a total of $162.5 million. The largest offering came from hotel company Atour Lifestyle Holdings in November, raising $52.25 million. In comparison to the $12.8 billion that was raised last year.

Zeekr received $500 million in its initial external fundraising in August of 2021 from investors including Intel Capital, battery manufacturer CATL, and internet video provider Bilibili.

The starting price of the 001 model in China is 299,000 yuan ($43,000), which is just a little bit higher than the recently reduced price of 288,000 yuan for Tesla’s Model Y. But, Zeekr has not disclosed any overseas market prices yet.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.