Ford announced that its third-quarter sales increased about 16% compared to the same period last year, even after a September sales decline. The company’s vehicle sales were down about 4% compared with the second quarter.

Ford said it sold 142,644 vehicles in September, representing an 8.9% decline from September 2021. The decline caused the company to miss quarterly sales expectations from Cox Automotive and Edmunds, which had forecast gains of 19% and 17.8%, respectively.

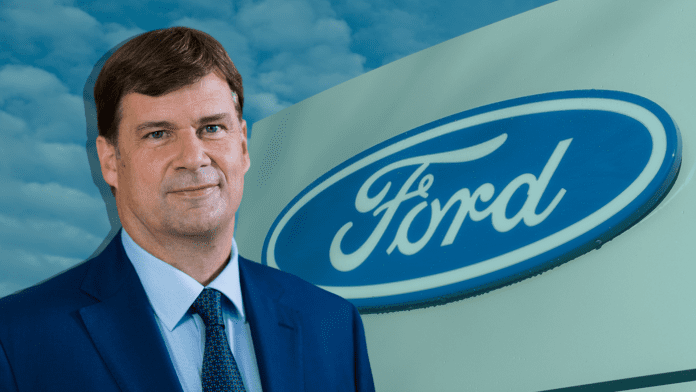

According to Andrew Frick, Ford’s Vice President of Sales, Distribution, and Trucks, new vehicle demand “remains strong” and retail orders are “rapidly expanding.” The company’s quarterly sales outperformed the industry, which analysts expected to be down just under 1% compared with last year.

Last month, Cox Automotive lowered its 2022 new vehicle sales forecast to 13.7 million, a 9% decline from 2021 and the lowest sales volume forecast in the last ten years. Ford has sold more than 1.38 million units year-to-date through September, which represents a decline of 1.2%.

The company said sales of its F-Series pickups were down by 27% in September compared to last year. However, sales of Ford’s Mustang Mach-E crossovers have increased 49% compared to 2021, representing around two-thirds of the company’s 41,200 total EV sales.

The company’s quarterly sales outpaced many others in the industry. In light of the news, Morgan Stanley analyst Adam Jones upgraded the automaker’s stock to overweight from equal weight and held his price target of $14 per share.

Ford shares dropped over 18.5% throughout the month of September after the company said its supplier costs would be $1 billion higher than expected for the third quarter and told investors that roughly 40,000 to 45,000 vehicles hadn’t made it to dealers due to parts shortages.

“3Q profits warning coupled with macro concerns have resulted in a decline in but-side expectations and sharp pull-back in shares,” Jonas wrote. “Ford shares trade at approximately 8x our normalized EPS forecast of $1.50.”

“Potentially favorable idiosyncratic development regarding the company’s restructuring (creation of Ford Blue and Ford Model e) has the potential to better align the growth and capex (capital expenditure) needs of the EV business with a more favorable cost of capital,” Jonas said.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.