Here’s a question nobody ever thought to ask: What would happen if the decision makers at one of America’s big three automaker’s announced one day they had decided not to make cars anymore?

Such a hypothetical question might have been considered delusional until very recently. And even now Ford’s decision to stop making almost their entire line up of fleet cars has a vaguely surreal quality to it.

In terms of perspective, the decision for Ford to stop making cars is on the order of Coca Cola deciding to stop bottling soda or Apple deciding to stop making iPhones, because personal computers are more profitable on an individual basis.

As a testament to Ford’s public relations skills, the news that Ford would stop making almost every passenger car in its portfolio – continuing only with the ever popular Mustang and a car they don’t even make yet, the Focus Active – has trickled into public awareness over the past five months. In fact, some major business publications announced the decision as far back as early January, while others did not catch on until late April. Are they really going to do this or not?

They are. Gone are the Fusion, the Fiesta, the Taurus. Gone is the Ford Focus, except for the aforementioned Focus Active, which will be the wagon-oriented version of the Focus.

As one Ford official put it, the company is “dealing decisively with the parts that destroy value,” the word parts referring wholesale to mainstream brands that have carried the Ford name in recent years.

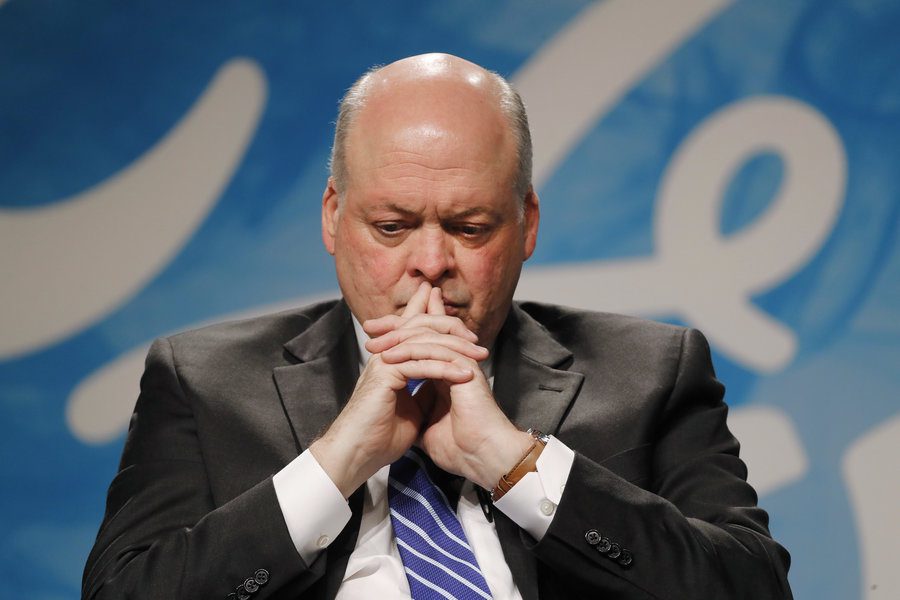

Ford President and Chief Executive Jim Hackett – on the job for 11 months – said the company was “eliminating every non-luxury car,” which meant it would keep the Mustang, a performance car, and the Ford Active, when it appears – perhaps as a token placeholder. Meanwhile, it will continue with its full range of pickup trucks, SUVs and crossovers.

However, in a News Wheel report, Ford’s Chief Financial Officer Bob Shanks also noted that “most Lincoln products” were among the company’s loss leaders, which matches with unofficial reports that say the Continental is on it’s way out, as well.

Besides cutting out the money it loses on small cars, the company said in October it would save $14 billion annually by dropping the operational costs associated with the fleet cars. By January, the company had increased that estimate to $22.5 billion.

It is not clear if those figures include losses on the cars themselves, but UBS analyst Colin Langan has been frequently cited as estimating Ford’s losses on smalls cars stands at about $800 million per year, In contrast, For make about $3 billion in truck, SUV and crossover sales in the first quarter of the year alone.

That’s a lot of incentive, but dealership owners quickly trounced the decision as short sighted. In the slump that preceded, accompanied and lasted beyond the Great Recession, it was clear that small cars were the wave of the future. A rebate policy put in place by the Obama Administration, at one point, allowed for credits to truck owners who traded for a vehicle with better mileage. The push was not only for improved efficiency, but even to move to electric or hybrid vehicles. Everyone wanted a Prius back then. Then SUVs and trucks started a comeback as the economy picked up, putting the writing on the wall.

Still, no car company has embraced a market turn with such determination before, making the shock value unprecedented. “Something for Everyone,” says Ford on its website’s home page. Suddenly, that isn’t ringing true, anymore.

Ford, meanwhile, is spinning the news to deflect the shock and embrace the brave new future. The company’s head of Global Markets, Jim Farley, has been telling the press that the company had plans to “expand our passenger car line up in the U.S.” and that “affordable price points” were still in the company’s mandate. He checked those statements, however, saying, that dealerships would have “just as many opportunities to grow,” as always, “just with a different portfolio.”

The other major fallout in Ford’s decision is the possibility that environmentalists will accuse the company of turning its back on climate control initiatives. Ford appears to be gearing up to meet that accusation with an expanded offering of battery electric and hybrid vehicles to answer those who will claim that the company is willing to give up its commitment to efficiency if it means making more money.