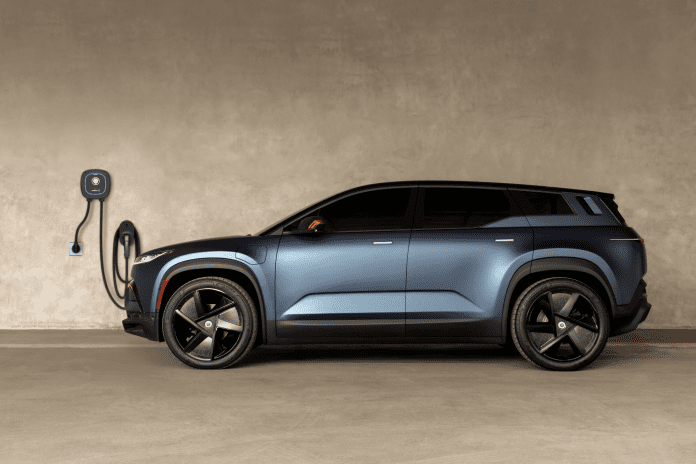

Fisker Inc., the electric vehicle startup, has taken a significant step in its ongoing bankruptcy proceedings by seeking approval from a bankruptcy judge to sell over 3,000 of its Ocean electric SUVs.

The company has proposed selling these vehicles at a significantly reduced price of $14,000 each to American Lease, a vehicle-leasing company based in New York City.

American Lease had initially agreed to purchase 2,100 Ocean EVs on May 30, just two weeks before Fisker filed for Chapter 11 bankruptcy protection. Subsequently, American Lease increased its offer to encompass all 3,321 Ocean SUVs that were ready for sale, demonstrating confidence in these vehicles’ potential within the New York City market.

Pending the judge’s approval, Fisker plans to sell all 3,321 electric vehicles to American Lease for a combined total of $46.25 million. This sale is a critical component of Fisker’s efforts to offload inventory, raise capital, and meet debt obligations during its Chapter 11 bankruptcy protection proceedings.

This move is part of Fisker’s broader strategy to address financial challenges and streamline operations.

Targeted Deployment in New York City

All Fisker Oceans will be utilized for ride-share and vehicle rental services within the New York City market.

This targeted deployment aligns with the growing demand for electric vehicles (EVs) in urban transportation networks, driven by environmental considerations and consumer preferences for sustainable mobility options.

Challenges and Strategic Shifts

Fisker’s journey to this point has been marked by a series of financial and logistical challenges.

Last month, the company filed for bankruptcy protection following significant cash burn and logistical issues that hampered the sale of its Ocean electric SUVs. Initially aiming to sell vehicles directly to consumers, logistical setbacks and financial pressures forced the company to pivot to a dealer-partner model earlier this year.

Fisker’s financial difficulties have been exacerbated by the need to significantly reduce the prices of its vehicles to generate sales and liquidate inventory. Some variants of the Ocean SUV were originally priced at around $70,000, but as the company descended into bankruptcy, the most affordable variant was slashed to approximately $25,000.

This aggressive pricing strategy reflects Fisker’s urgent need to raise capital and stabilize its financial situation.

Future Implications and Industry Impact

Utilization of Fisker Oceans for ride-share and rental services in New York City aligns with broader market trends.

Adoption of electric vehicles for such services is gaining traction due to lower operating costs, environmental benefits, and compliance with increasingly stringent emissions regulations. For American Lease, acquiring a large fleet of electric SUVs offers an opportunity to expand offerings and cater to the growing demand for eco-friendly transportation options.

While awaiting the judge’s decision, the automotive industry will closely watch the outcome. If approved, the sale could set a precedent for how electric vehicle startups navigate financial distress and leverage strategic partnerships to sustain operations. It also highlights the evolving dynamics of the urban mobility market, where electric vehicles are increasingly becoming integral to ride-share and rental services.