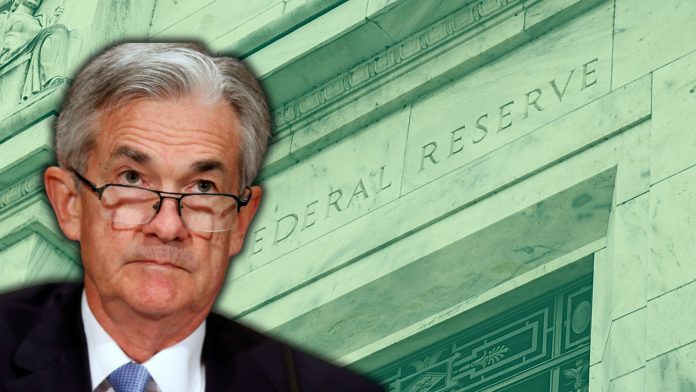

Dealers and consumers will have to wait for relief from higher interest rates as Federal Reserve leaders opted to leave the Fed benchmark rate unchanged. Following the Federal Open Market Committee’s meeting on June 11 and 12, the central bank’s federal funds rate target remains between 5.25% and 5.5%—where it has stood since July 2023. Despite improving inflation data, the Fed is considering only one rate cut in 2024.

The next Fed rate meeting will be held on July 30 and 31, with subsequent meetings scheduled for September, November, and December. Cox Automotive Chief Economist Jonathan Smoke expressed skepticism about further rate increases this year. The Fed’s decisions have significant implications for consumers taking out auto loans, as interest rates directly affect the rates they receive.

High vehicle prices and interest rates are impacting the auto finance market in 2024. According to Experian data, the average new-vehicle loan interest rate in the first quarter was 6.73%, up from 6.61% a year earlier. The average used-vehicle loan interest rate increased to 11.91% from 11.4% over the same period. In the first quarter of 2023, the federal funds rate target was 4.25% to 4.5%, raised to 4.5% to 4.75% in February.

Interest rates are a significant concern for franchised and independent dealers. Cox Automotive Dealer Sentiment Index polling of 550 franchised and 476 independent retailers from April 23 to May 7 revealed that 68% of franchised dealers and 60% of independents see interest rates as a problem. The economy was the only other issue cited by more than half of both groups, with 53% of franchised dealers and 59% of independents calling it a hindrance.

However, only 21% of franchised dealers and 34% of independents cited consumer credit availability as an issue. The Fed’s rate action on June 12 aims to combat inflation, which remains above the 2% target. The Bureau of Economic Analysis reported a 2.7% year-over-year price increase in April, while the Bureau of Labor Statistics‘ consumer price index showed a 3.3% increase in May.

Inflation is also a concern for retailers. Both franchisees and independents reported increased business costs and felt pressure to lower prices. “Everything has had price increases with inflation,” a Midwest Toyota dealer told Cox, mentioning higher employee wages, equipment costs, and other expenses.