With June just about done, many are releasing their mid-year reports, giving a sort of “State of the Union” for automotive sales. Earlier this week Cox Automotive released their June Industry Report, which included both information on how the car industry has been doing this year and projected how they see the remainder of the year playing out.

Similar to other mid-year car industry reports, the Cox Automotive report notes that new-vehicle sales have been up and strong this first half of the year, mainly in part to a growing economy, increasing consumer confidence and record low levels of unemployment. Unemployment in 2018 reached the lowest it’s been in fifty years.

Although these would all seem to be indicators for optimism, the report cautions readers to get ready for a peak and fall after June. This will be due primarily to wage increases not keeping pace with the unemployment drop, higher levels of inflation and higher interest rates. Additionally, possible tariffs placed on imported cars could also put a dent in sales during the second half of this year. Finally, elevated gas prices are also cutting into new-car sales as consumers consider travel alternatives with less regular expenses.

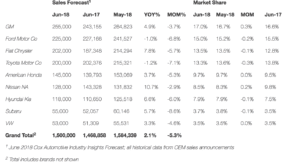

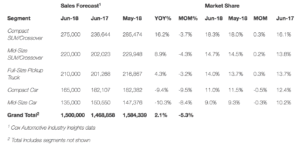

June itself will seem like a strong month, but that appearance will be deceptive, according to the Cox Automotive report. Compared to last year’s June sales, this year there’s expected to be 2.1% increase. This would make June 2018’s seasonal adjusted annual rate (SAAR) to 16.9 million. Last June’s SAAR was 16.6 million, and this year’s May only made it to 16.8 million. 16.9 is still under the June record set in 2005, before the recession. That year the June SAAR was 18.0 million.

Some of that increase can be attributed to the changes in the economy mentioned above, as well as to aggressive incentives. However, Charlie Chesbrough, a senior economist employed by Cox Automotive, is quick to point out that there is one other advantage that this June has over last year’s June, and it’s not necessarily an indicator of better sales. “Monthly sales volume in June is expected to rise over last year, but June has one additional selling day this year – 27 instead of 26, and the pace is not expected to rise very much. June sales volume is expected to reach 1.5 million, an increase of nearly 30,000 units over last year, but a decrease of nearly 85,000 units (down 5.3 percent) from May.”

While there is an expected decrease in sales over the next few months, the report doesn’t herald a bust. Instead, the expectation is for things to slow down a bit, but then remain stable. The most influential factor in keeping new car sales up is ultimately the expected 2018 tax reform. This reform should create a whole sector of consumers who are now able to afford–and who want–new cars over used or leased.