As analysts struggle to predict the future of the auto-retailer, Citigroup has labeled Carvana’s stock as “neutral.”

The brand saw massive profits in 2021 as a result of economic shifts after the COVID pandemic. Automakers fell far behind on production as a result of labor and material shortages, causing inventories across the country to dwindle. Discovering new cars were scarce, consumers were temporarily forced into the pre-owned market instead, a change which dealers such as Carvana misinterpreted as permanent. The auto-retailer purchased a surplus of used-cars at high-prices to prepare for what they thought would be another successful year.

|

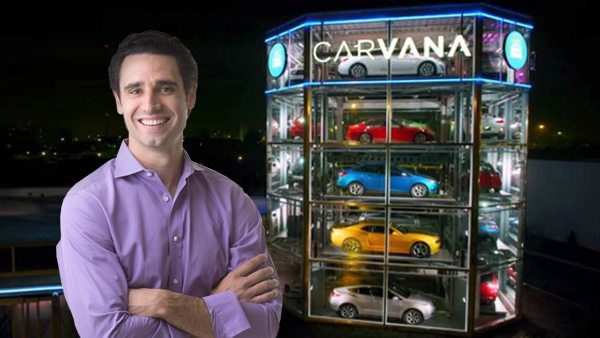

However the end of 2021 saw another shift in the industry dynamic: as the supply chain recovered, manufacturers were able to increase output, resulting in a swarm of new cars. With a different option available, consumers abandoned the used-vehicle market, leaving the auto-retailer with massive inventories but no way to pay its debts. Over the course of 2022, the brand became increasingly desperate as stocks went into freefall. CEO Ernest Garcia struggled to quell investor fears as analysts began to question how long the brand could afford to lose money.

While investment firms are unable to agree on the company’s future, some seem to believe there is still a chance. In a CNBC report, Citigroup explained that if markets were to return to “normal,” Carvana would likely recover its former status as a used-vehicle giant. The issue seems to be whether or not the auto-retailer will last long enough for pandemic-related market imbalances to recover. While industry insiders remain worried about the coming year, 2023 may be the make-or-break point for the used-car seller.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.