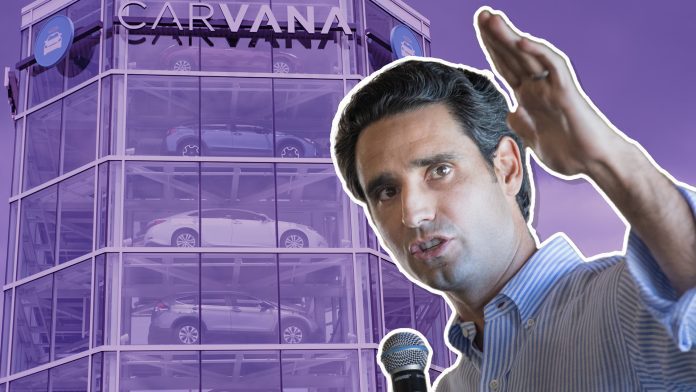

On Wednesday, Carvana released an early loss estimate with its first quarter guidance, and shared a new debt plan which would significantly reduce its overall burden.

According to the guidance updates, the used car retailer now expects to lose $50 million to $100 million by the end of the quarter. This number is much improved over last year’s net losses, which ranged from $806 million in Q4 and $348 million in Q1. The brand is also operating with less revenue than it had in early 2022, highlighting the aggressiveness with which it has tightened budgets.

In a separate action, Carvana also revised its debt plan to more efficiently tackle its $9 billion total. Noteholders now have the option to turn in their unsecured notes for secured replacements traded at current market rates. Since the notes are backed by collateral, not only will the move give lenders more protection in the event of a default, it will also reduce the business’s interest expenses. Financial Times estimates that if all bondholders agree to make the switch, the company could reduce its debt by $1.3 billion and interest payments by $100 million.

The day the news arrived, Carvana’s $8.04 stock price shot up nearly 21% to $10.15 before stabilizing at $8.70. After peaking at $360.98 in August of 2021, the company’s shares quickly collapsed as it struggled to navigate fluctuations in used car values after automakers ramped up post-COVID production. Due to a shortage of new vehicles during the pandemic, the retailer swiftly became a preferred alternative for customers, but this support faded just as fast once inventory began to improve. Much of Carvana’s $9 billion debt originated from its decision to buy a surplus of preowned stock just before demand vanished, leaving the brand with little choice but to sell its vehicles at a loss.

The company is also facing a mounting number of legal threats towards it storefronts. The brand has been forced to restructure its operations in multiple regions after state agencies suspended or restricted its business operations for allegedly violating title and registration rules. Another problem could be developing in North Carolina, where a report claims that Carvana sold a stolen 2021 Maserati SUV worth $68,000 to an army veteran. Although the company has said it was not aware of the vehicle’s history, and has since attempted to refund the money, the victim is seeking recuperation for damages worth $1 million.