With growing digitization in the auto industry, consumers are looking for more transparency in the car buying process, and dealers who wish to stay competitive are encouraged to meet this demand. This is where the 2022 Capital One Car Buying Outlook (CBO) comes in, which highlights dealers and consumers perceptions of the car buying process. Key findings from the research are included below.

Dealers and Consumers Perceptions of Transparency

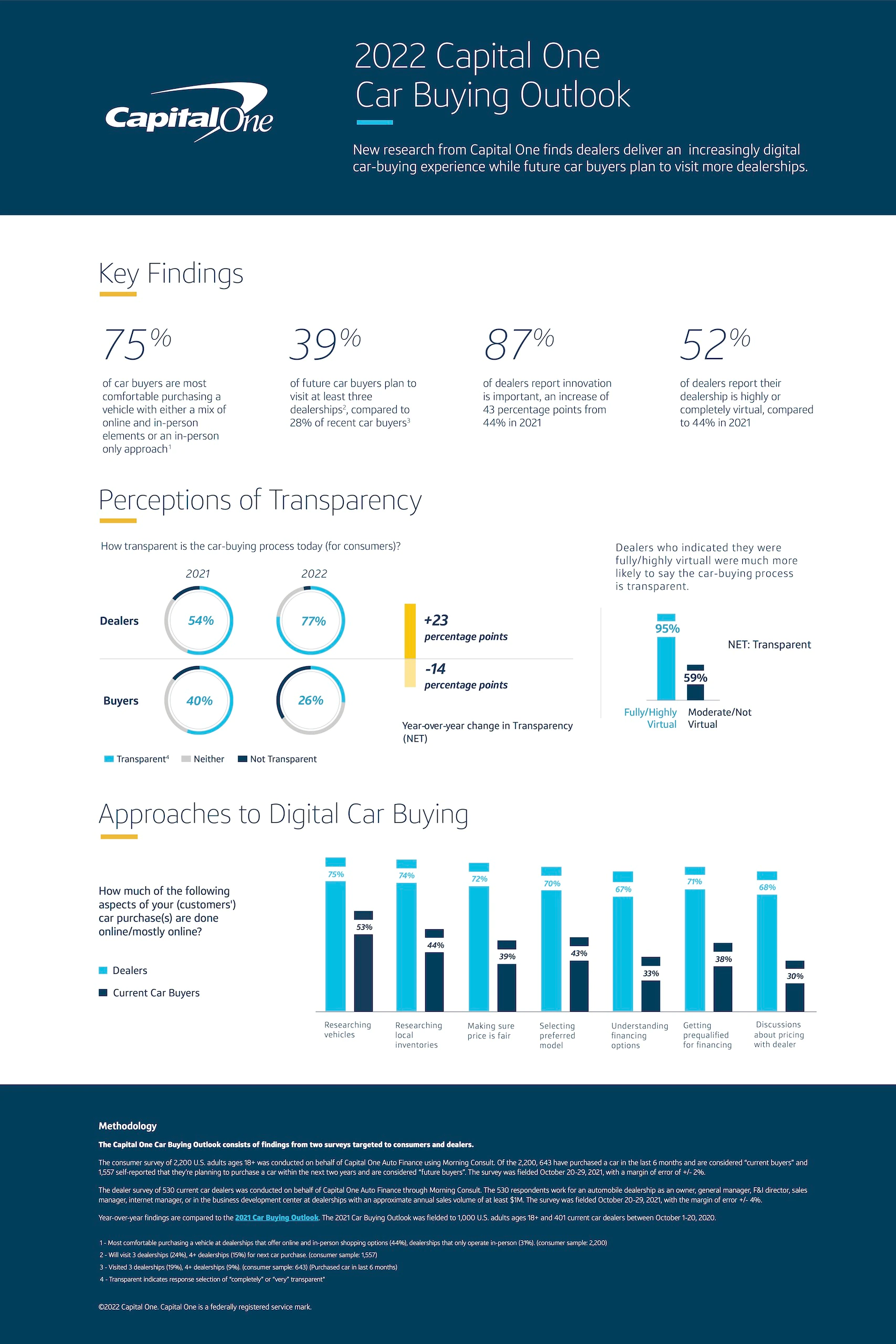

Insights from the 2022 CBO, derived from the survey of 2,200 current and future car buyers and 530 auto dealers, revealed that dealers and consumers’ perceptions of transparency in the car buying process trended in different directions. To illustrate, 77% of dealers report that the car buying process is transparent, a 23% percentage point increase from 2021.

However, only 26% of car buyers share this same perspective, a decrease from the 40% of car buyers who saw the car buying process as transparent in 2021.

Digital Adoption: Enabling Transparency in Car Buying

83% of dealers say digital tools are a necessary component of maintaining a competitive edge in the auto market. Consequently, digitizing the dealership can help dealers offer increased value while closing even more deals.

Vice President of National Sales of Capital One Auto, Steve Baldwin, implored auto retail professionals to join the long digital haul and focus on meeting the dealership demands of consumers by adopting innovative digital tools. Ultimately, this adoption will further help dealers achieve increased customer satisfaction (CSAT) in their deals.

Furthermore, the 2022 CBO revealed that 52% of dealers reported they are highly or completely virtual. As a result, the issue is not whether car buyers will resort to a digital car buying approach. Instead, it is a question of how well-prepared the dealers are to leverage consumers’ online research knowing that every customer is unique and at a different stage of digital adoption, as well as in the car buying process.

So, with dealers being dynamic and flexible in their response to digital adoption of the car buying process, they can meet their consumers where they are, or even halfway.

Moreover, findings from the 2022 CBO show that 44% of car buyers are most comfortable with the hybrid mix of online and in-person interactions. 39% of future car buyers also plan on visiting at least three dealerships for their next car purchase. So, one might say that although customers’ exposure to digital car buying may begin on the internet through online research, it does not end there.

The Importance of a Transparent Process

The transparency split can be understood in the context of the current economic challenges and supply chain shortage. After all, the 2022 CBO reports that 66% of future car buyers say the part shortage has affected their car buying plans.

A transparent car buying process includes selecting the car model, price, local inventories, or financial options such as pre-qualification and monthly payment.

This single realization offers immense benefits to dealers in forging more robust transparency in the car buying process with their customers. When they feel ready to step into the dealership, customers can physically see, touch, and test-drive car options.

In fact, 34% of car buyers want to be pre-qualified for financing before going to the dealership, and with Capital One Auto Navigator, buyers can get pre-qualified without any impact to their credit score, before walking into the dealership.

Knowing the available automotive finance options in advance helps put customers in the driver’s seat and can eventually help in contributing to the overall transparency of the car buying process. In other words, digital tools and resources can close the gap in transparency in car buying.

That being said, dealers can take advantage of the research consumers have done prior to stepping into the dealership and offer speedy deals whenever possible.

Capital One: Creating a Win-Win Situation for Buyers and Dealers

According to Baldwin, leveraging tech in a powerful manner that empowers the consumers is not achieved at the dealers’ expense, but instead can allow for a better car buying process for both parties.

As one of the nation’s leading auto finance institutions, Capital One is confident its auto finance digital tools can help buyers find the right car and receive personalized financing options. This, according to National Sales Vice President, Tim Mullins, can help align the right tools to the right problems both parties are trying to solve.

The financing stage is perhaps the most significant step in the car buying process. Customers may pace through pre-finance transactions relatively easily, however, many still want to take their time when it comes to discussing financing terms with their dealer. The 2022 CBO showed that car buyers particularly prefer discussing aspects of the car buying process, like pricing and financing, in-person.

As a result, dealers should offer innovative digital solutions that empower customers to buy cars on their own terms and prepare for in-person pricing and financing conversations when customers walk into the dealership.

Capital One Auto Navigator: Digitizing Modern Retail

Capital One Auto Navigator, an industry-leading digital product that can show potential car buyers their real rates, is designed to promote transparency and create a win-win situation for car buyers and dealers alike. This innovative product can enable car buyers to feel more empowered and more involved than ever before, when conducting the search for their vehicle of choice.

Capital One Auto Navigator allows customers to conduct research on their preferred vehicles and pre-qualify for financing – dealers can leverage their customers’ legwork to close deals faster and in a more efficient manner for both parties. Car buyers can save time at the dealership when they pre-qualify for auto financing with Auto Navigator

Capital One Auto Navigator is available on the web and as an App through Apple App Store and Google Play app.

For more insights into the car buying process, check out the 2022 Capital One Car Buying Outlook.

Methodology

The Capital One Car Buying Outlook consists of findings from two surveys targeted to dealers and consumers.

The consumer survey of 2,200 U.S. adults ages 18+ was conducted on behalf of Capital One Auto Finance using Morning Consult. Of the 2,200, 643 have purchased a car in the last 6 months and are considered “current buyers” and 1,557 self-reported that they’re planning to purchase a car within the next two years and are considered “future buyers”. The survey was fielded October 20-29, 2021, with a margin of error of +/- 2%.

The dealer survey of 530 current auto dealers was conducted on behalf of Capital One Auto Finance through Morning Consult. The 530 respondents work for an automobile dealership as an owner, general manager, F&I director, sales manager, internet manager, or in the business development center at dealerships with an approximate annual sales volume of at least $1M. The survey was fielded October 20-29, 2021, with the margin of error +/- 4%.

Year-over-year findings are compared to the 2021 Car Buying Outlook. The 2021 Car Buying Outlook was fielded to 1,000 U.S. adults ages 18+ and 401 current auto dealers between October 1-20, 2020.

Did you enjoy this article from CBT News? Read other articles on CBT News here. Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.