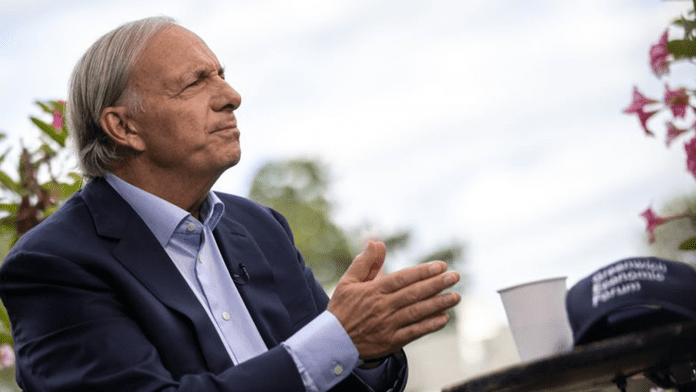

Ray Dalio, a prominent investor, and Bridgewater Associates founder, shared his opinion about inflation, falling stock prices, and future interest rate increases on social media this week. According to Dalio, interest rates will likely top 4 or 5% over the next few months to years, and inflation will continue to affect stock prices.

“My guesstimate is that it will be around 4.5 to 5% long term,” Dalio wrote about inflation on LinkedIn. He also said price increases could be “significantly higher” if economic crises in Europe and Asia or environmental disasters like droughts or floods create more turmoil in the market.

This week, the Consumer Price Index showed an increase of 0.6% in the core CPI for August and a 7.4% increase year-over-year. Dalio suggested inflation may ease over the next several months, spurred mainly by improvements in the energy and gasoline index, but said higher inflation in the medium term should be expected.

Dalio guessed that the Federal Reserve will raise interest rates around 2.5% today and expects rates to increase to between 4.5% and 6% soon.

As for the effects of rising inflation and interest rate hikes, Dalio said that disposable incomes would be at risk, and asset prices are likely to fall as a reflection of lower returns versus bonds and savings accounts. “I estimate that a rise in rates from where they are to about 4.5% will produce about a 20% negative impact on equity prices,” he said.

The investor expects a significant recession to remain on the horizon but said it could be a while before Americans burn through their cash and wealth until they are forced to cut back on spending.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.