EV tax credit eligibility was expanded last week in response to complaints from Ford, General Motors and Tesla over the Inflation Reduction Act’s SUV classification system.

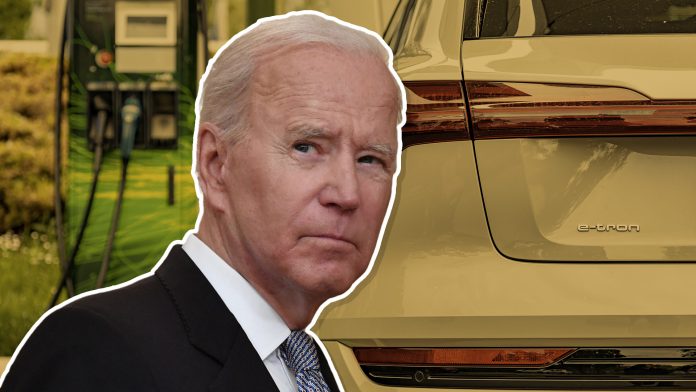

The tax incentives provide a $7,500 rebate on purchases of qualifying battery-powered vehicles. According to the IRA’s original rules, electric SUVs were allowed a maximum price point of $80,000 while smaller vehicles, such as sedans, would only qualify if they were below $55,000. However, although other government agencies use different classification rules, the Tesla Model Y, Ford Mustang Mach-E and Cadillac Lyriq fell beneath the weight requirements for SUVs in Biden’s EV tax credit eligibility guidelines, which lowered their maximum price to $55,000. The new rule change, which was announced last Friday, reduces the minimum SUV weight, expanding the number of vehicles which can now qualify.

After frustrated comments from Tesla CEO Elon Musk decrying the inconsistent government classification systems, the automaker cut the price of its Model Y by 20% in January. Now that the EV tax credit eligibility rules have been updated, the automaker swiftly adjusted the SUV’s price tag, raising it by $500. Ford had also dropped the price for its Mach-E earlier this year, but has so far refused to act in response to the change in regulation.

EVs remain a divisive topic in the car business, fueled by controversies over sustainability, infrastructure preparedness and high prices. Whatever personal feelings dealers and manufacturers may harbor, the demand for all-electric models has undeniably grown since the COVID pandemic, with many automakers reporting considerable year-over-year sales growth. With a recession on the horizon, EV tax credit eligibility may prove vital to stopping the loss of customers, who are fatigued by high prices, high insurance premiums and high auto loan payments.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.