Dealers want to be sure they are making the right investments for their business, which is why on this episode of CBT Now anchor Jim Fitzpatrick with frequent CBT News contributor, and author of “The Future of Automotive Retail,” Steve Greenfield. Greenfield is the Founder and CEO of Automotive Ventures, and through his years of experience in auto tech as a corporate leader and entrepreneur, he has accrued insights into the decisions driving acquisitions in the vehicle space.

Valuations fluctuated throughout 2022, making many investors hesitant going into the new year. Although the first quarter saw strong performance in the used car market, subsequent quarterly performance fell drastically as a result of increased new vehicle production. The whiplash caused many would-be investors to dial back their spending. Although this did not slow down the pace of dealership buyouts in the private market, Greenfield notes that some of the publicly-traded dealer groups, such as AutoNation and Lithia Motors, focused their resources on stock buybacks rather than acquisitions, giving the market time to normalize before expanding.

That time seems to be approaching as valuations have already started to settle. Although the volatility is still high, the economy has remained fairly resilient, as evidenced by higher-than-expected retail spending in January, even in the face of interest rate hikes and a possible recession. While larger companies, such as Cox Automotive, may continue using a cautious approach throughout 2023, Greenfield expects to see an increase in opportunistic buying among other investment groups who hope to claim an early stake in technology or startups with a promising future.

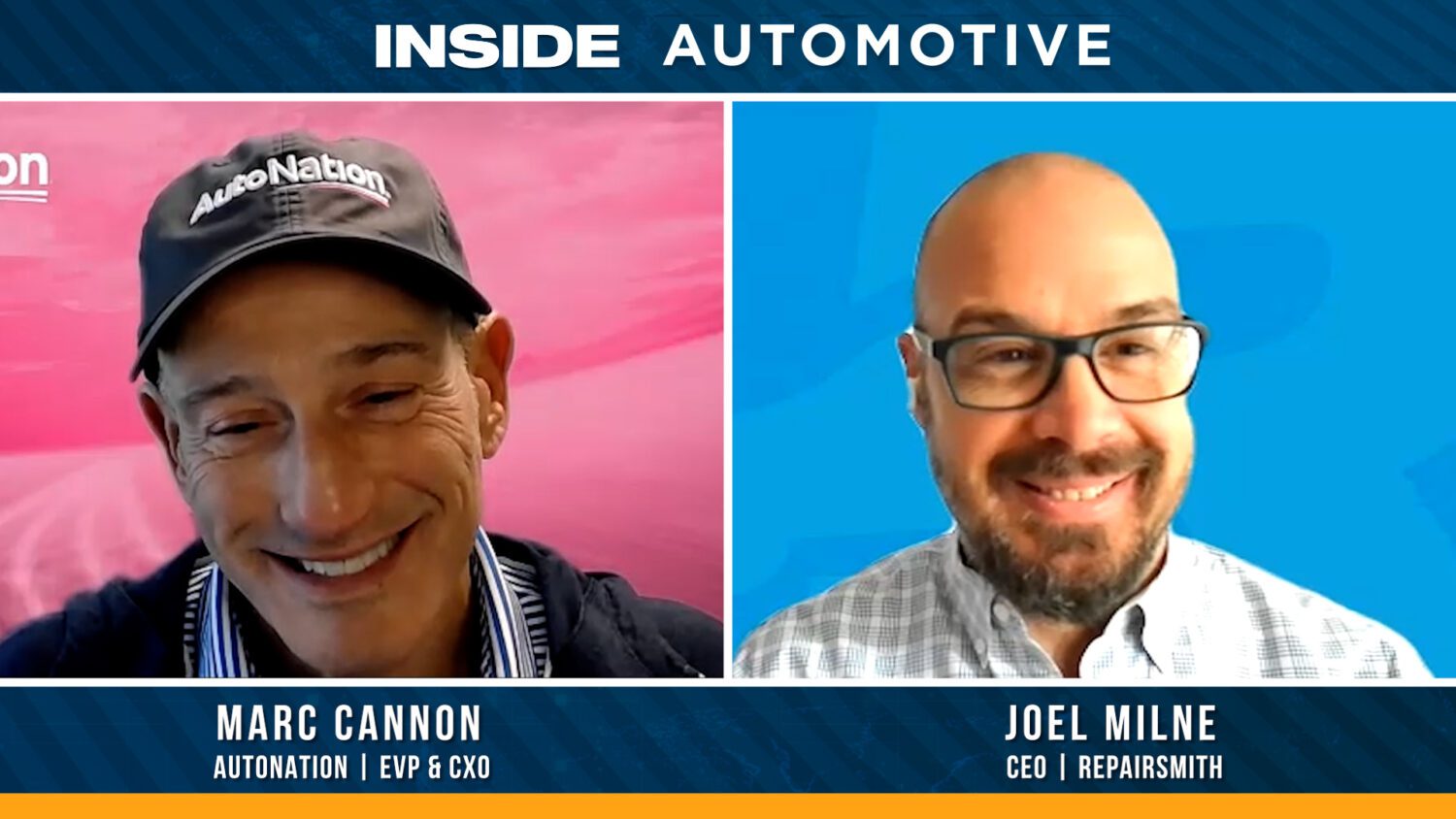

Perhaps the biggest opportunity for investors, digitalization and other technological innovations have become a major driving force in auto acquisitions. Although many derided eCommerce brands such as Carvana, overwhelmingly positive consumer response has led the industry to rethink its stance. According to Cox Automotive, as much as 87% of dealers and 81% of consumers believe that digital retail improved the car buying experience in 2022. Greenfield notes that this shift in demand has led some companies to replicate Carvana’s business model with successful results. Larger dealer groups have responded by making investments into digital platforms, such as AutoNation, which acquired car listing service TrueCar last November, and mobile maintenance provider RepairSmith in January.

Although dealers are anxious for the market to return to normal, it is unlikely that the market of the past will return in the future. But this is far from bad news. Rather, it means that new opportunities to grow businesses and provide better customer service will appear in place of outdated methods.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.