In my two recent articles, “From the Fax Machine, to the future: Auto Finance Disruption Time is Here,” and “Digital Finance: Consumer Expectations and Today’s Digital Retail Reality,” I discussed, from the auto dealer’s perspective, the key obstacles to achieving a better digital finance future, especially around inaccurate online payment quotes and the huge gaps between those quotes and fundable contract terms. In this article, I will share more data that highlights the impact those inaccurate payment quotes, exacerbated by the lack of transparency between auto dealers and lenders, is having on the buying experience.

Hint: it is not a good one!

The vast majority of dealers (86%) agree that these bad online quotes are affecting the sales process adversely. This is further evidence that our much-touted dealership ‘digital retailing’ age has yet to live up to its promise – so is it any wonder that consumers still hate the car-buying process? We already know the FTC is not too happy with it, with the inaccurate payment quote fiasco having the potential to explode even further when the final version of the FTC’s new CARS Rules (Combatting Auto Retail Scams) becomes law.

It is an issue that needs to be solved now.

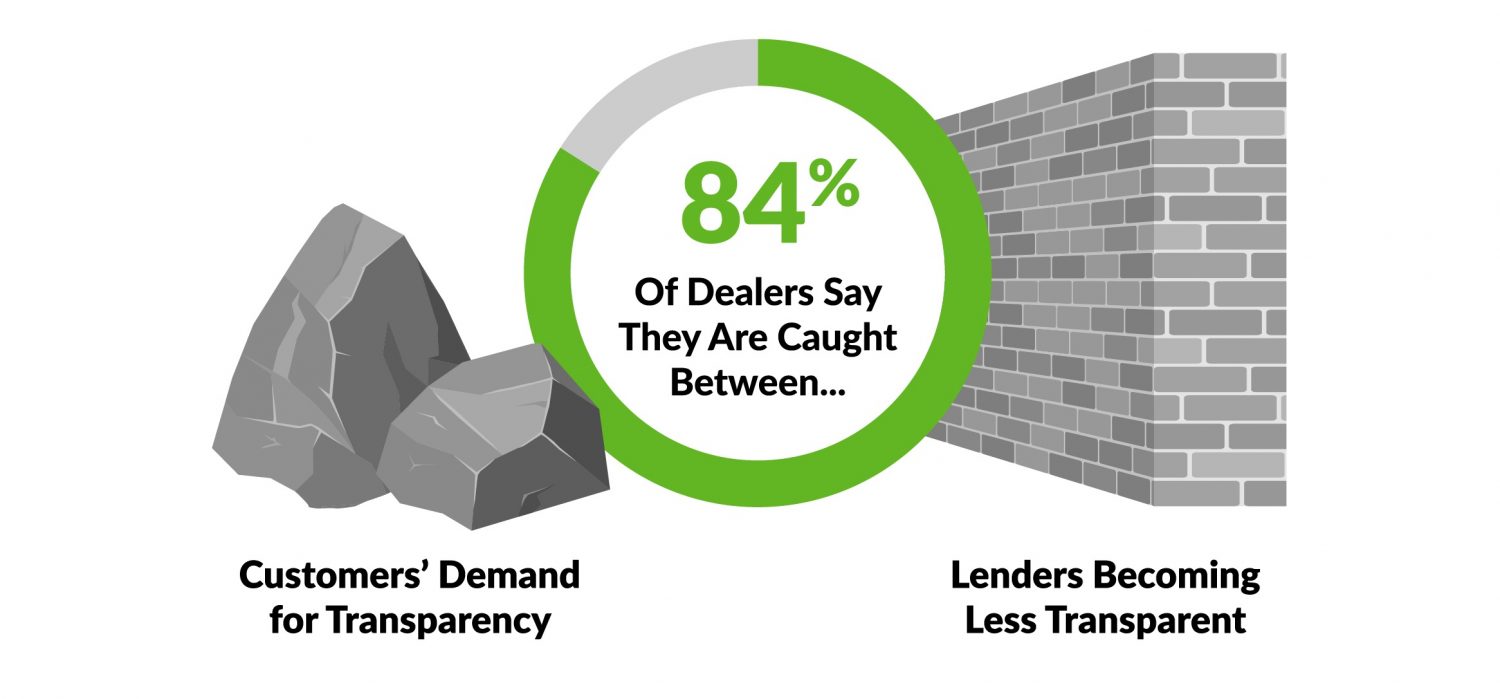

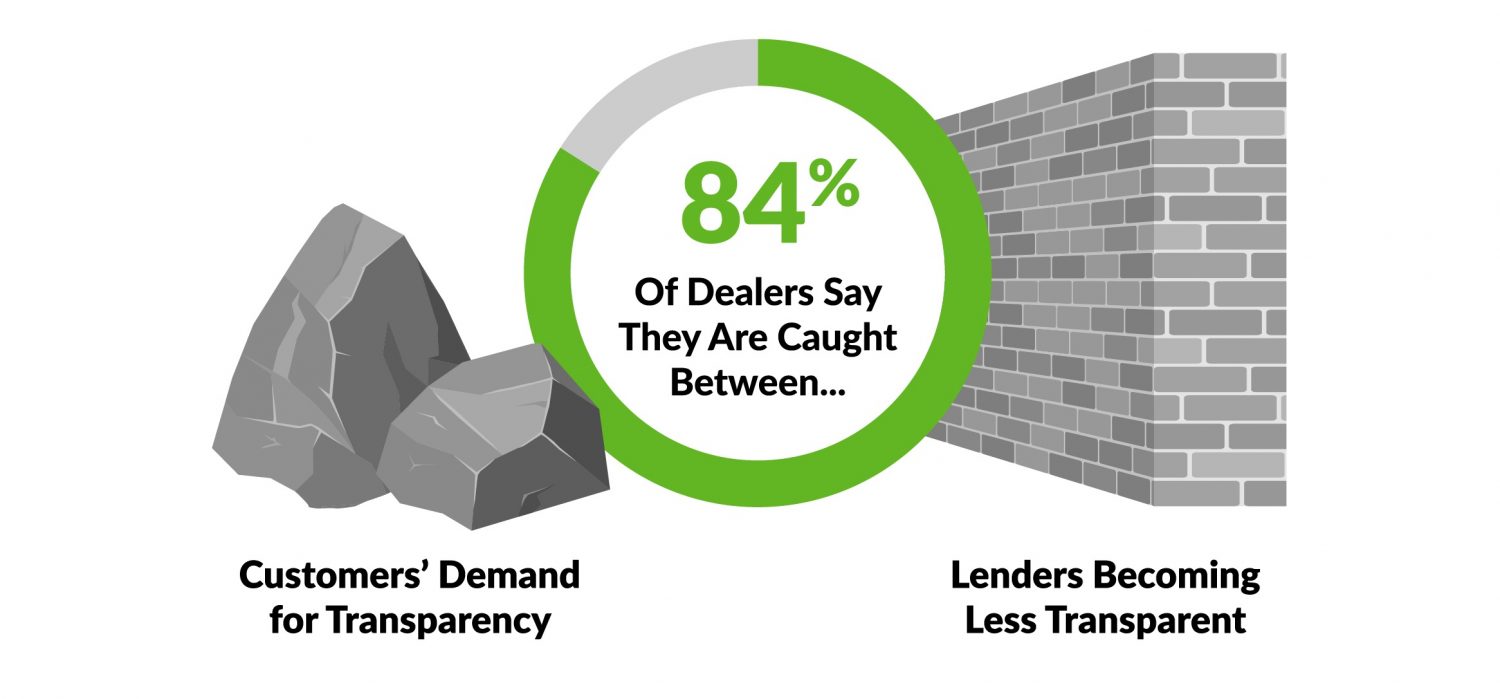

But, unfortunately, technology, and its new shiny object, AI, rather than increasing lender transparency, has sent it on the decline with the majority of dealers reporting a reduction in lenders providing rate-sheet pricing bulletins – the very thing that dealers rely on to estimate the customer’s payment. So, it is hardly surprising that 84% dealers are finding themselves caught between the hard place of diminishing lender transparency and the rock of customers’ demand for deal transparency.

Nevertheless, dealers have to move forward with the information they have because, with the affordability crisis, today’s customer is payment-focused and wants to know how that car payment will impact their monthly nut, up front. So, operating with one hand tied behind their backs, dealers have little choice but to give their customers what they want, and quote payments before receiving final lender loan decisions.

And this isn’t just an online issue, it is the same in the store – another symptom of the legacy disease of putting sales and finance into silos for a ‘sales first, finance last’ process.

So, what is the end result? Well, if a deal is negotiated based on a faulty online payment quote, that deal must be rewound – which doesn’t do wonders for your CSI. After all, your customer has made their numbers work, excited to step into that shiny new car of their dreams, only to discover that your dealership’s numbers are wrong and things have to be re-calculated – and usually not to the customer’s benefit.

Sadly, this is not an occasional glitch: a whopping 94% of dealers report a quarter – one in four! – of their digital retail-initiated deals have to be re-worked because they don’t have the information needed to match the quote to the customer’s credit profile, final deal structure and lender approvals. And, astonishingly, over one third report 50% or more of their deals have to be reworked.

That makes for a lot of unhappy customers.

But don’t stop there, it gets worse.

How easy do you think it is going to be to sell other F&I products in the face of all this confusion and disappointment? That customer is not going to blame technology for the rewind, they will blame the dealership. All that good will and trust that got them into your dealership in the first place has been lost, not to mention they now probably have a higher monthly payment than planned, which means they will be even less likely to add on products. All of which can dramatically decrease the profitability of your F&I product sales.

And let’s not forget the impact all this confusion has on one of your, and your customer’s, most valuable resources: time. The extra minutes (sometimes hours) added to the F&I process to rewind a deal will further infuriate your customers, while potentially impacting your labor costs and productivity. In fact, over half of dealers say that quoting qualified payment terms prior to the F&I handoff could save 15 to 30 minutes, with 32% saying it could save 30 to 45 minutes or more. Each minute is worth more than its weight in gold.

Granted, today’s customer does not necessarily expect retail automotive to deliver an Amazon type experience – after all, Amazon does not let you trade in your old toaster for a new one and financing is not available – but they do expect technology to have improved the process a little bit. And they certainly don’t expect their dealership experience – to use an age-old, but sometimes too true, cliché – to be as painful as going to the dentist.

Unfortunately, as demonstrated, inaccurate online payment quotes and lender transparency gaps are gumming up the works, preventing the fulfillment of a streamlined modern automotive retailing process, while continuing to breed distrust at a point in history where customer expectations are higher than ever. This needs to be solved now – and, fortunately, with the right kind of industry collaboration, a solution is within sight.

Join me next month on CBT News, for a deep dive into the quest to bridge the gap between the sales and finance processes and the API roadmap between dealer and lender platforms. One that can, at last, fix the anti-transparency AI finance debacle. See you then!