The Rise of “Digital Identities”

We live in a world where the majority of our financial transactions happen online. Consumers can transfer and pay bills through banking apps, and stocks and investments can now be handled through online marketplaces. Instead of the hassle of always entering in credit card information, individuals can store data in their computers to easily purchase a new item on Amazon or pay off a loan. Years ago, many were apprehensive about having financial data stored on machines. Now, in exchange for convenience, consumers want one-click purchases. However, financial information is not the only data stored, information such as addresses, places of employment, and even high school alma maters can easily be found on a Facebook or LinkedIn profile. Digital identities create convenience, but they also create a major security concern, especially for consumers looking to purchase a vehicle.

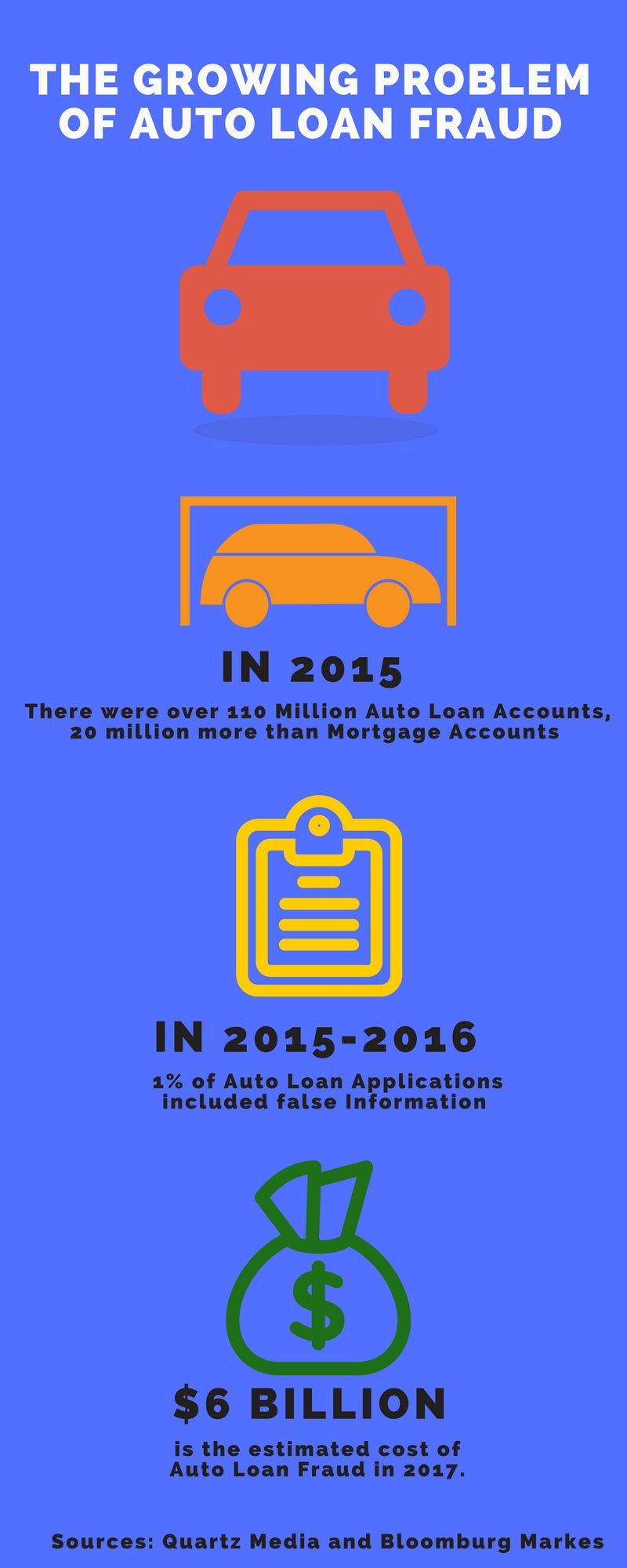

The Alarming Impact of Auto Loan Fraud

Frank McKenna, chief fraud strategist for PointPredictive, a firm that provides fraud solutions for financial institutions, discussed his alarming findings concerning auto fraud. His research from car loan applications and modeling revealed that fraud this year costs the auto industry approximately $4 to $6 billion. This is not counting the fraud that may not be reported by dealers and auto loan companies. Another startling trend is the increase in application fraud. Elizabeth Lasher, director of fraud, cybersecurity, and compliance at FICO discussed the ease of fraudsters to use private information for car applications. Two issues are creating this more favorable environment for identity thieves: their ability to purchase private information, and new online auto loans systems that make security breaches possible.

The Method: Synthetic Identities

A TransUnion article laid out the reasons Synthetic Fraud has almost made it impossible for loan institutions to crack down. Synthetic Fraud is where a person creates a fake identity by taking various personal information details from multiple sources. Fraudsters are utilizing this method in two ways in regards to auto lending. As stated above, they can apply to a lender using their false identities, and the lender was none the wiser. They can also apply for an installment, and then transfer the money to a pre-paid card registered under the false identity. Because the information stolen from a person may be small, it may take a long time before they realize the fraud has occurred. For dealerships and lending organizations, this fraud is so new; there has not been a precedent for how to deal with it.

What Can Dealers Do To Protect Themselves?

The sad truth about this situation is the two groups that are negatively impacted: the consumer victims of the fraud and the lenders and dealerships that discover they have been tricked into selling a vehicle to one of these fraudsters. It is a precarious situation to be in, but what options do these groups have? What can dealers do to protect themselves? Frank McKenna’s experience with this new type of fraud has given him insight into the ways dealers can combat this. Below are three tips dealers can implement in their day-to-day dealings with consumers.

- Stay Educated on Various Types of Fraud – Criminals are creative, and they are always innovating on ways to steal information. However, the information may not always be identity-related. Fraud can happen about income, employment, documents provided, and many other ways. It is important for dealers to educate themselves and their staff on what to look for with these fraud methods.

- Check For Any Employment Discrepancies – Confirm the validity of their pay stubs. McKenna advises that fake pay stubs will often have inconsistencies that do not make sense. Check them against bank statements or verify their income with the IRS with a 4506T signed by the customer.

- Does The Income Make Sense? – Check to see if what they borrowed makes sense for their income. Also, if they are trading in a less luxurious car to help purchase a top-of-the-line vehicle, it might make sense to run an extra check on their income report.

McKenna has a couple of other valuable tips for dealers to prepare themselves to deal with synthetic identities. This is a problem that will become more sophisticated as time advances. The most valuable weapon for dealers and lenders is to become educated on as many fraud techniques as possible.