Welcome to the Kerrigan Advisors Market Update with Bridget Fitzpatrick and Erin Kerrigan, managing director for Kerrigan Advisors. April’s Kerrigan Report tackles higher valuations for public companies, new vehicle sales, floor plan expenses, and better management of inventories.

Bridget Fitzpatrick: Hello, everyone. I’m Bridget Fitzpatrick, welcoming to the Kerrigan Advisors Update. Today, we’re joined by Erin Kerrigan, managing director for Kerrigan Advisors. Thanks so much for joining us today, Erin.

Erin Kerrigan: Thanks, Bridget, for having me.

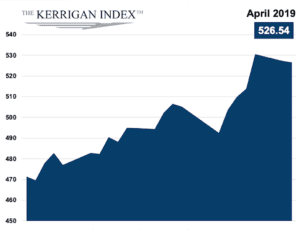

Bridget Fitzpatrick:: How did the Kerrigan Index perform for the month of April?

Erin Kerrigan: April was a really great month for the index. It was up 11%, far surpassing the rise in the S&P during that same period. Actually, year-to-date it’s up 22%. In fact, the index is now at 526. The last time we hit that level was last year, last September, so we’re really pleased to see our industry really reflect higher valuations for the public companies. We’re seeing some of the same things in the private market, which I’m happy to talk about.

Erin Kerrigan: April was a really great month for the index. It was up 11%, far surpassing the rise in the S&P during that same period. Actually, year-to-date it’s up 22%. In fact, the index is now at 526. The last time we hit that level was last year, last September, so we’re really pleased to see our industry really reflect higher valuations for the public companies. We’re seeing some of the same things in the private market, which I’m happy to talk about.

Bridget Fitzpatrick:: What came out of their earnings release last month?

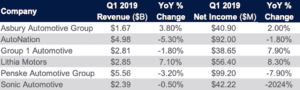

Erin Kerrigan: The publics did quite well as a group. While revenue was down 1% of the entire group, earnings were up 13% for the group. Now, this was largely Sonic that saw a big swing of over 40 million in earnings.

Bridget Fitzpatrick:: What other trends are you seeing in the marketplace?

Erin Kerrigan: Well, we’re also seeing a real focus on the floor plan expense and better management of inventories in reaction to that. It’s pretty interesting to see how big a swing it has been. In 2015, the average dealer made about $100,000 in floor plan. This year, we’re tracking to an expense of $140,000. That’s actually more than double the average expense of 2018, so that is definitely a significant rise in expense. We are seeing dealers really focus in on how they’re managing inventories, and that really is putting a highlight on just the entire focus on expense reduction.

We pointed out in the Blue Sky report last quarter that expense reductions are a pretty interesting part of this business because our industry has a very high variable expense structure, which means it can be cut when things get more difficult, or when sales slow. We are seeing that with both private dealers and public dealers. They are reducing their expenses and finding ways to be more efficient retailers, which is certainly the name of the game in today’s overall retail market.

Bridget Fitzpatrick:: How is the buy-sell market today?

Erin Kerrigan: Buy-sell market continues to be very active. We’re very busy here at Kerrigan Advisors. Certainly, more sellers coming to market, mostly because they don’t have a cessation plan that might be viable, and they’re deciding that if I can get the valuations that I’m seeing in the marketplace today, I’d like to do so.

But the good news is we’re also seeing a growing buyer pool, and that pool of buyers is backed by, in many cases, high-net worth investors, family offices, new capital coming to our industry. In fact, our database of investors that are interested in auto retail has grown to over 300 different investors that have contacted us to say, “We really want to be in auto retail. We really would like to have an investment in dealership.” So, it’s an exciting time for both sellers and, I would say, growing dealership groups that want to tap into that private capital to help them to grow their group.

Bridget Fitzpatrick:: Are certain franchises in more demand than others?

Erin Kerrigan: We are seeing a flight to quality. I will say that buyers are becoming much choosier when it comes to which franchises they’ll acquire.

In 2015, everyone was growing, every franchise really was of quite a bit of interest to most buyers. However, today, we are seeing that it’s the top franchises that are in high demand, and we’re seeing much less demand for some of the franchises that have more difficult business models.

An example of this is we’ve been tracking, for instance, Toyota, Subaru and Honda’s market share in the buy-sell market, and we’ve actually seen that grow from about 12% in 2016, to nearly 15% in 2018. That is a trend we expect to continue to see as buyers really seek those top brands, especially as we could go into a period of slower or no growth in the new vehicle market and in revenues.

Bridget Fitzpatrick:: How do the financial markets play into valuation?

Erin Kerrigan: During the financial markets, we still see lenders willing and able to finance acquisitions, and that’s a really key part of getting transactions done. Usually, most buyers do tap into the debt markets when they are acquiring a dealership, whether that’s for a mortgage or a cap loan on the Blue Sky.

What we’re seeing is, interestingly, as real estate becomes a larger portion of transactions, the financial markets are playing a really critical role in keeping the buy-sell market going. Because lenders will lend more on real estate, generally, than they will on Blue Sky and so the equity required for a transaction is actually not increased, though we have seen an increase in the overall transaction size, prices and values when you include the real estate. So, real estate and the financial markets are a key part of why we continue to see a very active buy-sell market.

Bridget Fitzpatrick:: All right. Thank you so much for joining us, Erin. We really appreciate it, and we look forward to talking with you again next month.

Erin Kerrigan: No problem. Thank you, again, for having me.

This has been a JBF Business Media Production.