Erin Kerrigan, Managing Director of Kerrigan Advisors, joins CBT News to discuss July’s Kerrigan Index and the marketplace’s reaction.

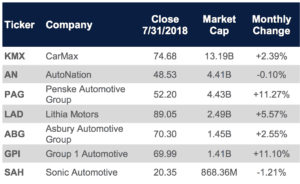

The Kerrigan Index™ is composed of the seven publicly traded auto retail companies with operations focused on the US market, including CarMax, AutoNation, Penske Automotive Group, Lithia Motors, Group 1 Automotive, Asbury Automotive Group, Sonic Automotive.

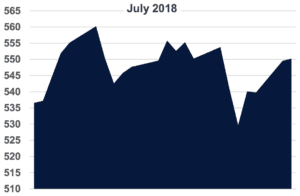

The Kerrigan Index did well through the month of July and was up over 3.8 percent. These results keep steadily in line with the S&P and is up over 5% for the year. Even though there has been much talk about disruption to the industry due to different contributing factors, we are not seeing that. Leading companies within the industry continue to rise.

Erin explains that these results could be due to Wall Street’s efforts to consolidate. She says, “We think this is Wall Street’s way of saying there is clearly more consolidation in auto retail and that the largest companies in our industry will disproportionately benefit from consolidation, both through economy of scale and of course through economy of scope.”

Dealerships have found various ways to maintain success through disruption by changing their business models and adjusting as needed. Many are doing so by developing and investing in technology. This allows a dealer to continue to grow earnings amidst selling lows.

It was a successful month for a few of the leading companies in automotive during the month of July. On average, earnings were up 28%. Much of that number was not driven by new vehicle sales. Instead, there has been a strong showing among used car sales and service. It was reported this month that service picked up and had a leading hand in the July’s success with F&I gross per vehicle improving as well.