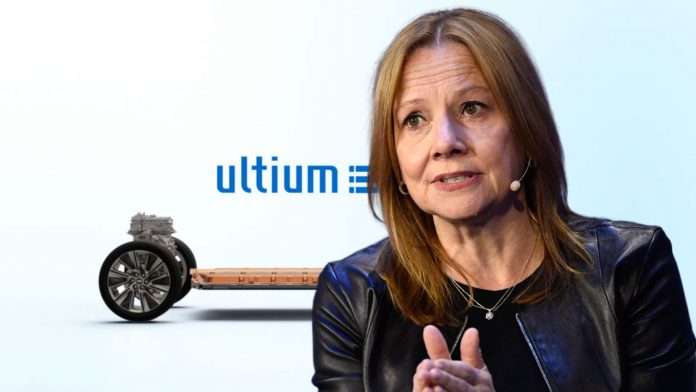

General Motors (GM) is set to abandon the Ultium brand name for its electric vehicle (EV) batteries and technologies, signaling a significant shift in its battery strategy. This decision, announced by Kurt Kelty, GM’s vice president of battery cell and pack, during the annual Investor Day presentation, aims to enhance the automaker’s approach to battery production amidst challenges in scaling up the Ultium platform. While GM retains the underlying technology, it recognizes the need to move from a one-size-fits-all model to program-specific battery solutions.

The transition comes after four years of pursuing a common architecture for all future models, which was intended to allow GM to produce batteries at scale and drive profitability in its EV lineup. Currently, the Ultium battery packs power various models, ranging from the $35,000 Chevy Equinox EV to the $100,000 GMC Hummer EV, with different sizes but similar technology. Moving forward, GM plans to diversify its battery chemistries and cell shapes to tailor solutions for specific vehicle models, incorporating high-nickel, mid-nickel, and lithium-iron-phosphate (LFP) cathodes.

GM’s leading battery partner, LG Energy Solution, has been critical to its battery production, which currently utilizes nickel-cobalt-manganese-aluminum cells. However, GM is now in talks with Japan’s TDK Corp to produce LFP batteries in the U.S. using licensed technology from CATL. The next-generation Chevy Bolt EV, which will still utilize the Ultium platform, will be equipped with LFP batteries to help reduce production costs and improve thermal performance.

Kelty highlighted that LFP batteries are less energy-dense but more cost-effective and offer better thermal performance, making them ideal for entry-level models. He noted that GM’s truck platform has sufficient space to integrate low-cost LFP batteries while achieving a range of over 350 miles with clever engineering.

To support this new direction, GM is enhancing its research and development capabilities at the Wallace Battery Cell Innovation Center in Warren, Michigan, and a newly announced Battery Cell Development Center, expected to be operational by 2027. These facilities will streamline the development of new battery packs, allowing GM to prepare them for production within 18 months. Kelty expressed confidence that GM has overcome its manufacturing challenges in late 2022, noting a tenfold increase in battery module production compared to the previous year.

GM’s joint venture with LG Energy Solution in Ohio is on track to produce 100 million battery cells by the end of this year. The company is also investing $3.5 billion in a new battery plant in Indiana, in partnership with Samsung SDI, to develop nickel-rich prismatic cells. These strategic moves aim to significantly reduce battery weight, drive down costs, and simplify manufacturing processes, positioning GM for greater mass production of EVs.

Despite revising its sales goals and previously abandoning its target of 400,000 EVs by mid-2024, GM anticipates producing and delivering approximately 200,000 EVs this year. With ongoing software improvements and a robust battery strategy, GM is poised to solidify its position as the second-largest electric automaker in America, trailing only Tesla.