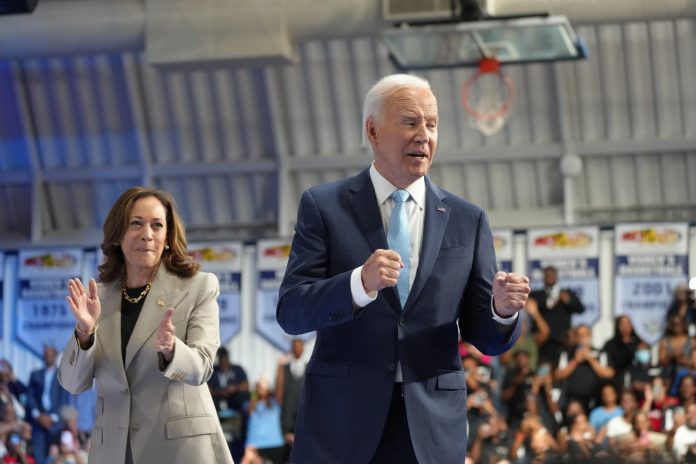

The Biden-Harris administration is expected to finalize steep tariff increases on certain Chinese imports this week. However, various U.S. manufacturers, from electric vehicle makers to utility equipment producers, urge the administration to soften, delay, or abandon many of these planned duties. The administration’s decision is particularly significant as it will be its first major trade action since Vice President Kamala Harris became the Democratic Party’s presidential nominee following President Joe Biden’s decision to step aside in late July.

In May, President Biden announced a significant escalation in tariffs on Chinese goods, including a quadrupling of tariffs on Chinese electric vehicles to 100%, a doubling of duties on semiconductors and solar cells to 50%, and new 25% tariffs on lithium-ion batteries and strategic goods like steel. These measures are designed to protect U.S. industries from Chinese overproduction. The tariffs were initially set to take effect on August 1 but were delayed until September as the U.S. Trade Representative’s office reviewed over 1,100 public comments.

The administration’s decision comes as National Security Adviser Jake Sullivan prepares to meet with Chinese Foreign Minister Wang Yi, aiming to manage U.S.-China tensions ahead of the upcoming November election. The decision is politically sensitive, with potential backlash from both Republicans and some Democrats. While dialing back tariffs could invite criticism that Harris is too lenient on China, implementing the hikes could lead to complaints about increased costs.

Foreign Minister Wang Yi has described the measures as “bullying,” and China has vowed to retaliate against the tariff hikes. Additionally, specific industry concerns have arisen, such as the potential strain on resources at U.S. ports due to a new 25% levy on Chinese-made ship-to-shore cranes. Additionally, Ford and other industry groups have called for reductions or delays in tariffs on essential materials like artificial graphite and EV batteries, citing the need to support U.S. production and consumer adoption of electric vehicles.

On the other hand, some companies, such as Finnish stainless steelmaker Outokumpu, advocate for more extensive tariffs on Chinese steel to prevent tariff circumvention and protect the U.S. industry. The administration’s final decision, expected by the end of August, will have far-reaching implications for U.S.-China trade relations and the domestic economy.