The Federal Reserve left interest rates unchanged after its policy hearing on Wednesday, marking the central bank’s sixth consecutive meeting without making any adjustments to its disinflationary strategy.

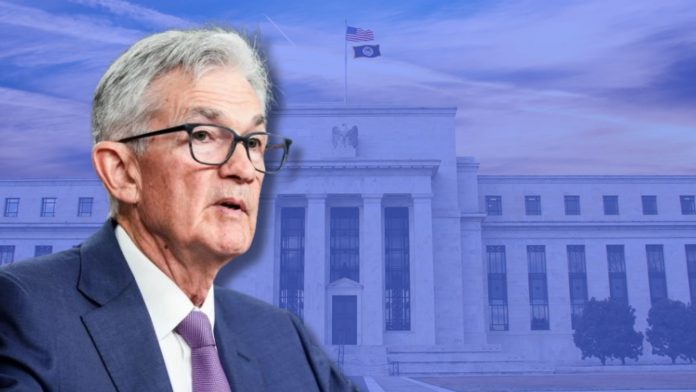

Fed Chair Jerome Powell attributed the decision, or lack thereof, to disconcerting shifts in inflation trends since January. While consumer prices showed signs of cooling in the second half of last year, the first quarter of 2024 saw the costs of goods and services accelerate, rising at a pace of 2.7% in March.

After the COVID-19 pandemic saw consumer prices soar, the government implemented periodical rate hikes throughout 2022 and 2023 in an effort to slow down the economy and force inflation back to the target pace of 2%. Although some worried that this strategy would result in a recession, the Federal Reserve last year appeared poised to have averted a so-called “hard landing” as inflation growth began to cool without making an observable impact on employment.

Encouraged by this, the Federal Reserve indicated that consumer prices would allow for the introduction of interest rate cuts as early as this summer. However, following the central bank’s meeting this week, Powell stressed that the bank is no longer confident in its original schedule and may be forced to wait an extended period of time before making a decision. “Inflation is still too high,” the Fed Chair commented. “Further progress in bringing it down is not assured, and the path forward is uncertain.”

Nevertheless, the Federal Reserve still believes that inflation will decline before the end of the year. Powell concluded that whether interest rate cuts will follow will “depend on the data.”