Auto lending is a process that is becoming more automated, and dealership finance teams are generally in favor of using new technologies like AI to determine the loan allocation process. However, there is no alternative to a successful face-to-face sales encounter when developing commercial partnerships. According to the J.D. Power 2023 U.S. Dealer Financing Satisfaction Study, issued on August 11, 77% of dealership F&I teams believe in-person interactions with sales staff are critical to increasing business with lenders.

While some dealership F&I teams are adopting new technology, dealers are very clear about their desire for direct interactions in the sales process. Patrick Rosenberg, senior director of automotive finance intelligence at J.D. Power, says, “When it comes to the introduction of AI and machine learning in the loan adjudication and approval process, 30% of dealership finance teams say they are comfortable with the process.” However, the issue today lies that lender representatives miss the mark on delivering a highly effective sales meeting nearly 40% of the time.

U.S. Dealer Financing Satisfaction Study

The 2023 U.S. Dealer Financing Satisfaction Study comprises 3,552 car dealer financial experts’ responses. The survey, conducted in April and May 2023, assesses the satisfaction of auto dealers concerning five different types of lenders: captive premium-prime, captive mass market-prime, non-captive national-prime, non-captive regional-prime, and non-captive sub-prime.

Study Rankings

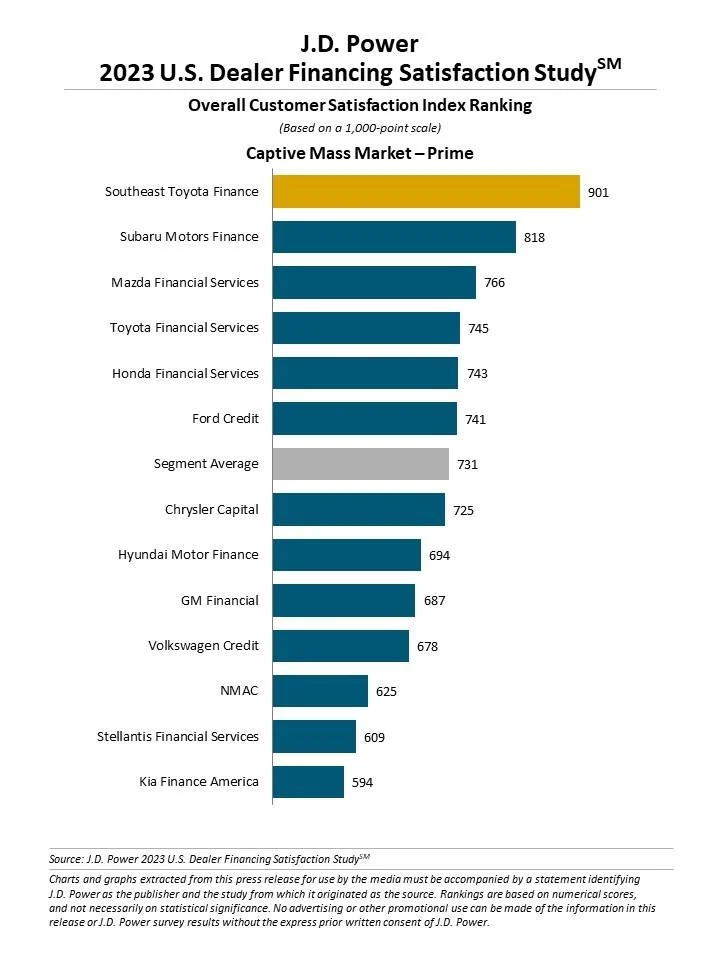

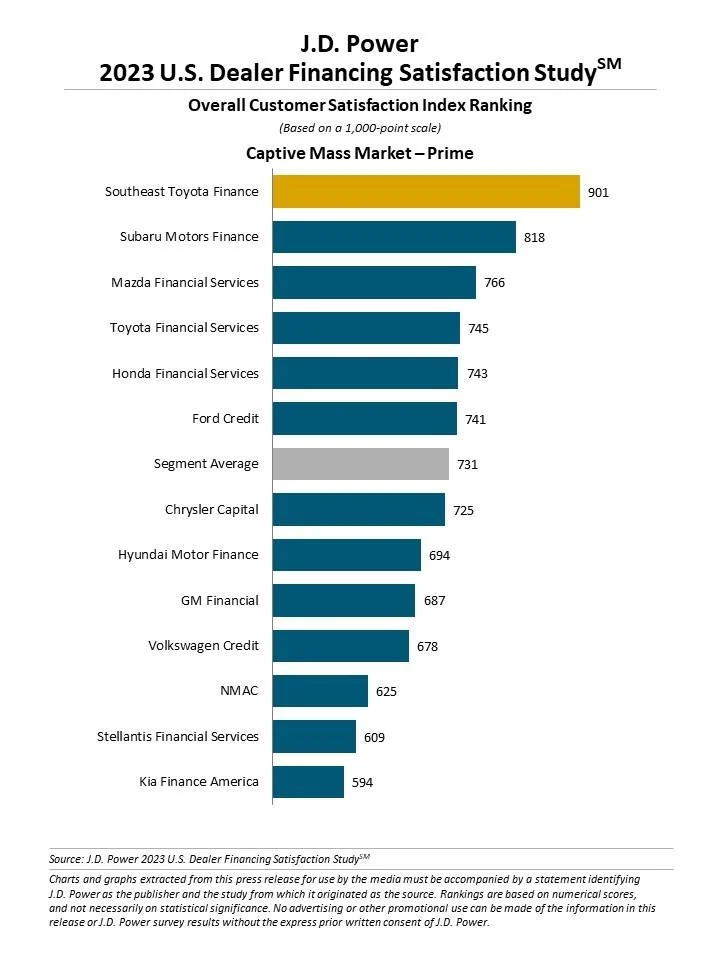

- Captive Mass Market—Prime

- Southeast Toyota Finance ranks highest in overall dealer satisfaction with a score of 901, followed by Subaru Motors Finance with 819, and Mazda Financial Services scoring 766.

- Non-Captive National—Prime

- TD Auto Finance ranks highest in overall dealer satisfaction for a fourth consecutive year, scoring 878. Ally Financial ranks second with an 854 score, and Wells Fargo Auto ranks third scoring 778.

- Non-Captive Regional—Prime

- Huntington National Bank ranks highest in overall dealer satisfaction with a score of 753. Santander Auto Finance (746) ranks second, and Fifth Third Bank (703) ranks third.

- Non-Captive—Sub-Prime

- Ally Financial ranks highest in overall dealer satisfaction for a third consecutive year, scoring 852. Chase Automotive Finance (762) ranks second, and Wells Fargo Auto (718) ranks third.