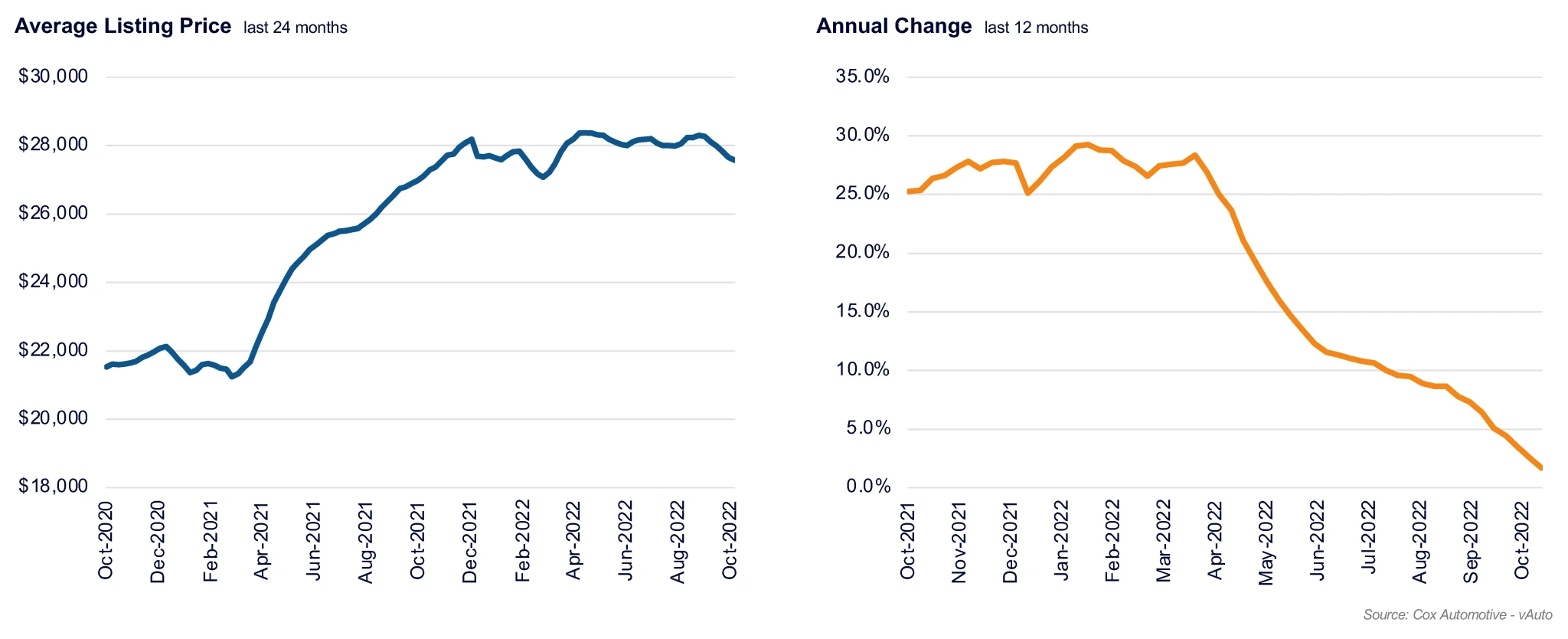

According to Charlie Chesbrough, senior economist at Cox Automotive, asking prices for vehicles are now reflecting decreased wholesale prices. By Thanksgiving, he continues, “the pricing disparity between 2022 and 2021, which is currently at 2%, will probably be gone.” With new autos, the inventory is more limited the lower the price.

At the end of October, there were 2.44 million unsold used cars on dealer lots, including independent and franchised dealers. This is roughly where it has been for the previous three months, although it is 10% higher than in October 2021 and very nearly back to pre-pandemic 2019 levels.

Cox Automotive forecasts that used retail sales for the entire month of October increased marginally month over month and decreased 13% from a year ago. Certified pre-owned sales improved from 3% in September but were down 4% from a year ago.

Cox Automotive forecasts that used retail sales for the entire month of October increased marginally month over month and decreased 13% from a year ago. Certified pre-owned sales improved from 3% in September but were down 4% from a year ago.

On the low end of the spectrum, Cox Automotive’s days’ supply for cars under $10,000 is 33, while on the high end, it is 68 for cars above $35,000. In this situation, the supply is determined using the daily sales rate for the most recent 30-day period that ended on October 31.1.43 million vehicles were sold during that time, up from the revised 1.40 million sold during the same 30-day period in September.

While the rate of price growth is currently decreasing, trends indicate that it will hit zero before Thanksgiving. Honda, Hyundai, Lexus, Mazda, Toyota, and Volkswagen have the lowest days’ supply of used cars according to Cox Automotive reports.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.