The Cox Automotive Dealer Sentiment Index for the third quarter of 2022 shows that auto dealers have a mostly pessimistic view of the market, likely fueled by increasing inflation, high costs, and low inventory levels.

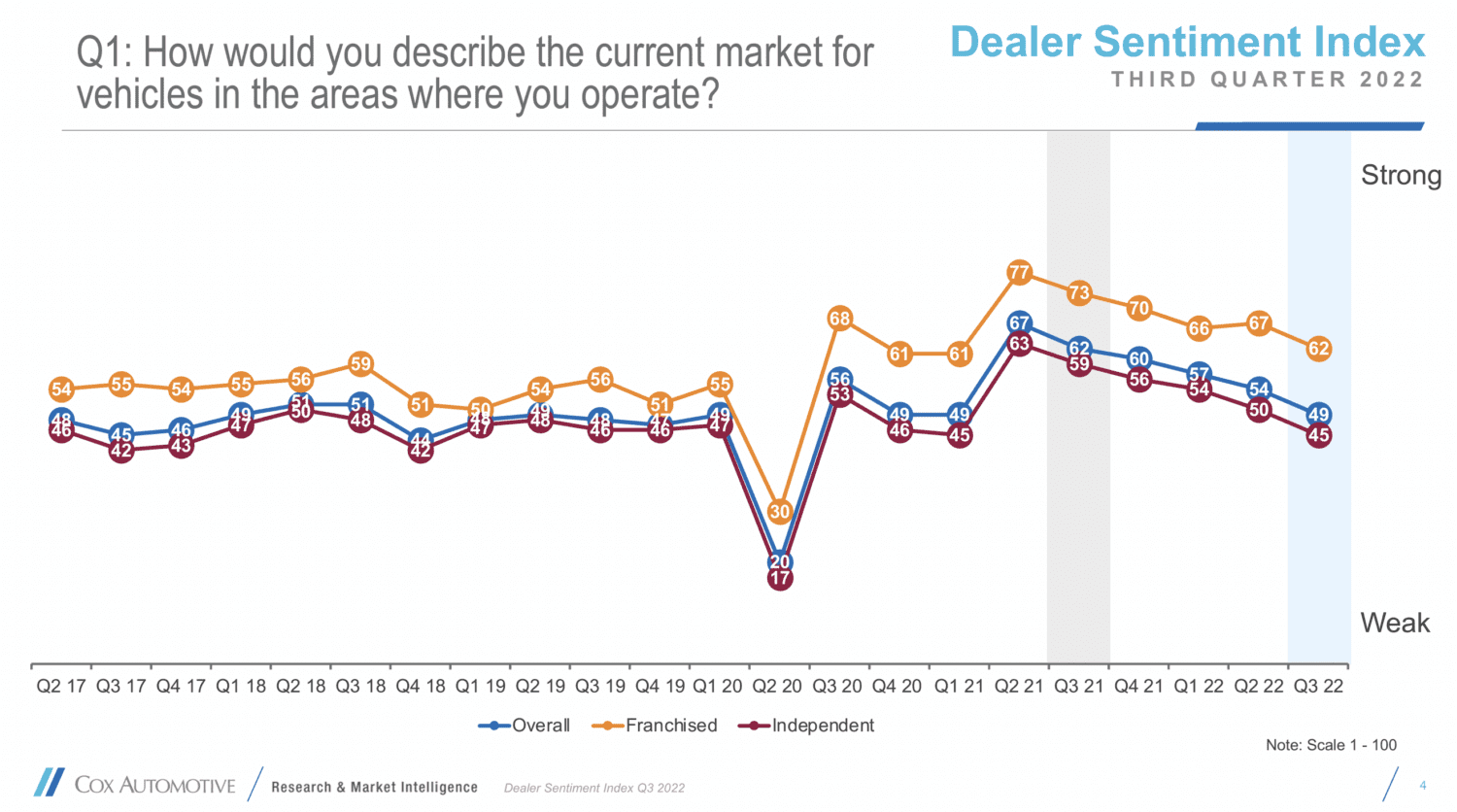

The current market index came in at 49, just below the positive threshold of 50. This marks the fifth quarter-over-quarter decline in market sentiment and the first time the index fell below 50 since the first quarter of 2021. The index is down five points from the second quarter of 2022 and 13 points year-over-year.

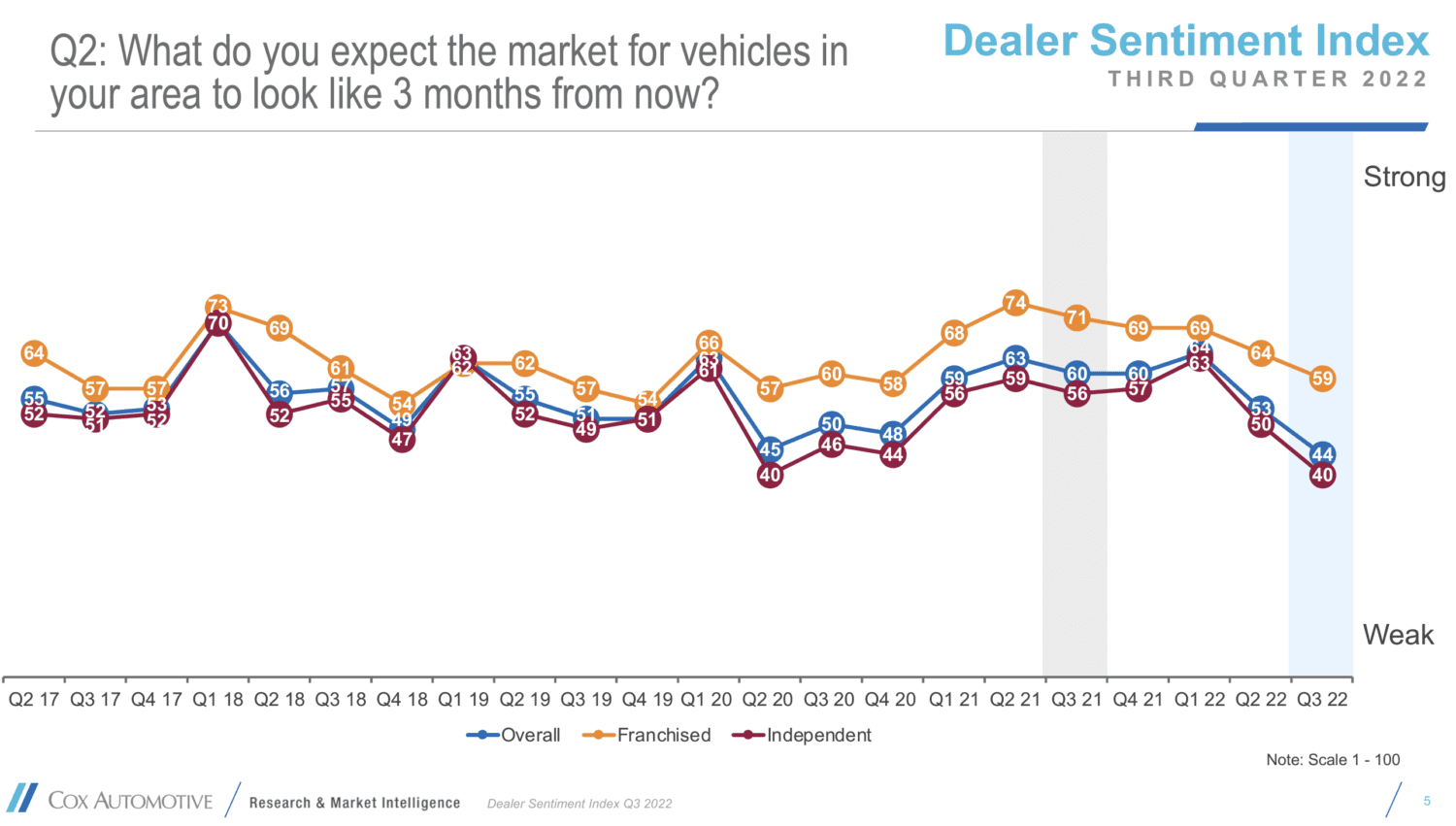

The three-month, forward-looking market outlook also dropped, coming in at only 44. That’s a record low for the index and a level that hasn’t been seen since the onset of the pandemic in 2020. The third quarter of 2021 had the index at a much higher 60.

The economy index also decreased from 50 to 45. That puts dealers below the positive threshold and means they view the overall economy as weak instead of strong.

The cost index fell from an all-time high of 75 in the second quarter of 2022, but only by one point. This puts it nine points higher than a year ago. The price pressure index increased from 41 to 48 but remained much lower than pre-pandemic levels. This means dealers see the cost of operating a dealership as relatively high and aren’t inclined to lower prices.

New vehicle inventory and sales sentiment mostly remained steady, as did the new-vehicle incentives and sales indexes. However, the limited stock remains the top struggle for dealers. Rising interest rates are also stalling improvements in dealer sentiment.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.