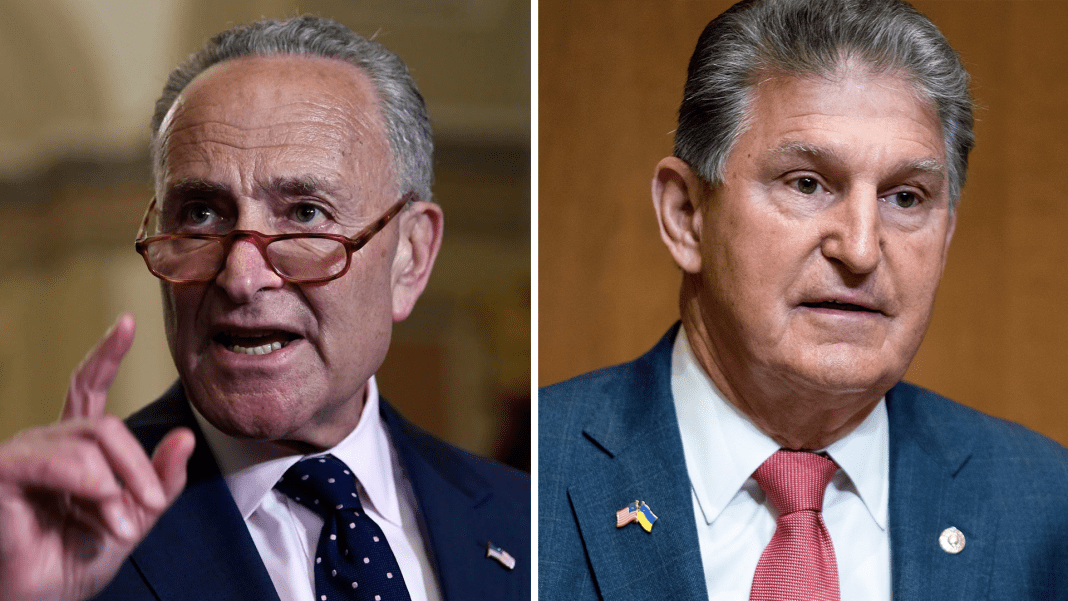

In a surprise turn of events, Senate Majority Leader Chuck Schumer and Senator Joe Manchin announced a deal that includes $369 billion for energy and climate action initiatives with the goal of reducing carbon emissions by 40% by 2030. The bill would maintain the $7,500 federal tax credit currently available for the purchase of “clean vehicles.” Additionally, it would eliminate the current 200,000 car cap for tax credits, which is a significant win for automakers.

For used clean vehicles, there is another incentive. Users who buy a used electric car qualify for a $4,000 tax credit. This is perfect for low to middle-income earners that cannot afford the hefty prices of a new electric vehicle. Instead of only purchasing from American producers, the bill now references ‘North America’ to include Canada.

There are some limitations to using the new tax incentive. It only covers clean cars under $55,000 and pickup trucks, SUVs, and vans under $80,000. If buyers make over $150,000 in one year, they also do not qualify for the tax incentive. For tax filers filing as married and together, the cap is set to $300,000.

Batteries from vehicles that “were extracted, processed, or recycled by a foreign entity of concern,” designated as a state sponsor of terrorism or nations barred by the Treasury Department’s Office of Foreign Asset Control, are ineligible for tax credits.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.